India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 6, 2017

Sensex Trades in the Green; All Eyes on Quarterly Results and RBI Monetary Policy Ahead Mon, 6 Feb 01:30 pm

After opening the day on a positive note, the Indian share markets continue to trade above the dotted line. Sectoral indices are trading on a positive note with stocks in the realty sector and healthcare sector witnessing maximum buying interest.

The BSE Sensex is trading up 200 points (up 0.7%) and the NSE Nifty is trading up 60 points (up 0.7%). The BSE Mid Cap index is trading up by 0.9%, while the BSE Small Cap index is trading up by 1.1%. The rupee is trading at 67.20 to the US$.

As many as 120 BSE-listed companies are set to declare their December quarter results today. The list includes Gujarat Gas, Shakti Pumps, Tube Investments, Titagarh Wagons, Aarti Industries etc. among others.

The effect of above result announcements would be seen on Indian markets today as well as during the trading week ahead.

You see, estimates and even the actual corporate earnings every quarter tends to have a major influence on investor sentiments. The company's under or outperformance is immediately reflected in market movements. If the company beats street expectations, the stock takes off like a rocket. On the other hand, if the company miss analyst's forecasts by even a small amount, the stock is trashed.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

In all, these announcements put market participants and stock markets into a frenzy.

So the question then comes as: What can one do in order to sail safe during such times?

We think the best way to counter this volatility is to follow a long term value investing approach.

It's also important to have a set process in place. Many of you have already tasted the fruits of one of Rahul's processes with his Microcap Millionaires service.

Now, at the Equitymaster Conference 2017, Rahul asked attendees to mark 10 February 2017 on their calendars. The reason? He will send out his first Profit Velocity report to subscribers.

As you may have guessed, Profit Velocity is a system-based strategy.

With Profit Velocity, Rahul believes that the system he has worked upon and developed could help subscribers potentially fetch gains several times those of the benchmark index. To know more about Profit Velocity, you can attend the live event which is scheduled at 5pm today.

Apart from the results announcements, participants in the Indian share markets are keeping tabs on the RBI monetary policy review scheduled on 8th February.

This bi-monthly monetary policy is RBI's second policy after November's note ban. It comes at a time when banks are flushed with funds post the demonetisation exercise. Owing to this, many expect that the Reserve Bank of India (RBI) will keep the key interest rates unchanged in its monetary policy review.

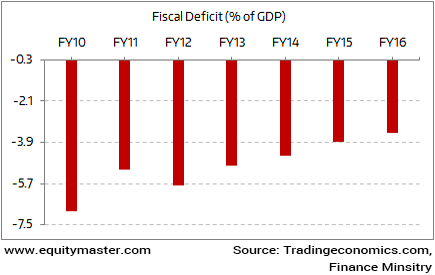

However, there are also arguments contrary to the above expectations. With the government pegging fiscal deficit target for FY18 at 3.2% of GDP, there are hopes that the RBI can be accommodative and slash the policy rate.

Fiscal Deficit target of 3% of GDP

Now, as you know, rate hikes and cuts never really disappoint or enthuse us. For in no way do they impact our long term views on stocks.

The shortage in money supply due to demonetisation has led to a slowdown in consumption impacting India Inc. This in turn has put a question mark on the GDP growth.

The economy will not gain momentum from the rate cut alone. To set the paralyzed demand into motion, there needs to be more action beyond cuts in interest rates.

So irrespective of the market reaction to the RBI's decision, just test the safety of your stocks and seek the comfort of the safest ones.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in the Green; All Eyes on Quarterly Results and RBI Monetary Policy Ahead". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!