India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 6, 2017

Sensex Ends Up 199 Points; ACC & Ambuja Cement Zooms on Merger Buzz Mon, 6 Feb Closing

Share markets in India finished the day on a strong note on hopes of an interest rate cut ahead of RBI's monetary policy. At the closing bell, the BSE Sensex closed higher by 199 points, whereas the NSE Nifty finished higher by 60 points. The S&P BSE Midcap and the S&P BSE Small Cap both finished up by 1.1% & 0.9% respectively. Barring metal stocks, all sectoral indices ended the day in green. Realty and FMCG stocks were among the top gainers on BSE.

ACC Ltd share price and Ambuja Cements share price rallied 4% & 5% respectively today as LafargeHolcim is mulling merger of the two companies. LafargeHolcim holds a 63% stake in Ambuja Cements and 50% stake in ACC. The merger had been on cards since 2013.

Asian markets finished higher today with shares in Hong Kong leading the region. The Hang Seng is up 0.95% while China's Shanghai Composite is up 0.55% and Japan's Nikkei 225 is up 0.31%. European markets are higher today with shares in London leading the region. The FTSE 100 is up 0.22% while France's CAC 40 is up 0.27% and Germany's DAX is up 0.1%.

The rupee was trading at Rs 67.21 against the US$ in the afternoon session. Oil prices were trading at US$ 53.89 at the time of writing.

Pharma stocks finished the day up by 1.3% with Sun Pharma being the most active stock (up 4.2%) on BSE. According to an article in a leading financial daily, Sun Pharma is recalling over 2.7 lakh bottles of bupropion hydrochloride extended-release tablets in the US due to failed dissolution specifications. The tablets are used for treatment of major depressive disorder.

As per the US Food and Drug Administration (USFDA), Sun Pharma has recalled bottles of bupropion hydrochloride extended-release tablets, USP (SR) in the strengths of 150 mg and 200 mg. The tablets have been manufactured by Sun Pharma at its Halol plant in India.

The recall is classified as class-III, which means the products are unlikely to cause any adverse health reactions, but violate FDA labelling or manufacturing rules. Earlier Sun Pharma had recalled several thousands of bottles of the same drug in 100, 150 and 500 mg dosage forms manufactured at Halol facility. The Halol facility of Sun Pharma is under USFDA scanner for some time.

Considering the pharma's regulatory distresses, are Indian pharma companies now adapting to the scrutiny by the USFDA? Bhavita Nagrani, our pharma sector analyst, shares her insights in one of our premium editions of The 5 Minute Wrap Up (Subscription required).

In the meanwhile, Dr Reddy's Laboratories slipped 1.5% after the company reported a consolidated net profit of Rs 4.7 billion in the December quarter, registering a 19% decline from Rs 5.8 billion in the same period a year ago. The company's revenues for the quarter under review were down 7% to Rs 37.1 billion from Rs 39.7 billion in the corresponding quarter previous year.

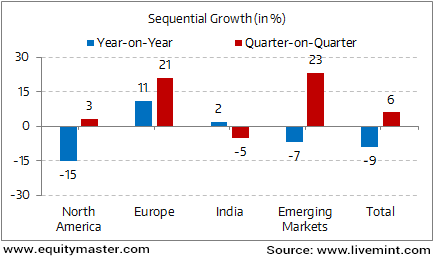

Sales Growth in Europe & Emerging Markets Aided Sequential Growth

In the December quarter, consolidated sales, under the new Ind-AS accounting standards, declined by 6.6% over a year ago, but rose by 3.5% sequentially. Sequential growth was driven by a higher growth of 21% in Europe and 23% in emerging markets, while that in North America was slower at 3%.

To know more about the company's financial performance, subscribers can access to Dr Reddy's latest result analysis (subscription required) and Dr Reddy stock analysis on our website.

Moving on to the news from

While all the 10 identified areas of installation would be within the municipal limits of Surat; 1 MW of energy will be required for Surat Smart City. This is the single largest order for a rooftop PV system won by BHEL and will be an important step in establishing BHEL as one of the leaders in the Rooftop PV system segment also, the reports noted.

Considering engineering stocks, 2016 has been a mixed year. Despite these near-term headwinds, companies from this sector are expected to start doing well once the recovery in the Indian economy becomes more meaningful. In our recent edition of The 5 Minute WrapUp, we wrote about the performance of the stocks in this space. We have also highlighted the difficulties faced by BHEL (Subscription Required) and cited probable reasons for the same. Here's an excerpt:

- "BHEL has lost around 25% so far in 2016. The reason is the subdued set of numbers the company has been announcing for the past several quarters now. For instance, in FY16, the company saw its revenues fall by 15% YoY and reported a net loss of Rs 9 billion. A lot of BHEL's current problems are to do with state of the power sector today."

BHEL share price ended the day up by 0.9%.

At the Equitymaster Conference 2017, Rahul Shah, Co-head of Research had asked attendees to mark 10 February 2017 on their calendars. The reason? He will send out his first Profit Velocity report to subscribers. As you may have guessed, Profit Velocity is a system-based investing approach.

With Profit Velocity, Rahul believes that the system could help subscribers fetch gains several times those of the benchmark index. To know more about Profit Velocity, you can attend the live event which is scheduled at 5pm today. In this live session, Rahul Shah will give you a sneak peek into his first report of Profit Velocity.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Up 199 Points; ACC & Ambuja Cement Zooms on Merger Buzz". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!