India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 3, 2017

Dull End to the Week; BSE Makes a Stellar Debut on NSE Fri, 3 Feb Closing

Share markets in India finished the day on a flat note. At the closing bell, the BSE Sensex closed higher by 14 points, whereas the NSE Nifty finished higher by 7 points. The S&P BSE Midcap and the S&P BSE Small Cap both finished up by 0.6% & 1.1% respectively. Sectoral indices ended the day on a mixed note. Auto and consumer durables stocks were among the top losers on BSE. While, healthcare and

Asian markets finished mixed as of the most recent closing prices. The Nikkei 225 gained 0.02%, while the Shanghai Composite led the Hang Seng lower. They fell 0.60% and 0.24% respectively. Markets in Europe were higher ahead of the publication of the latest nonfarm payrolls in the US and a European summit, where leaders are likely to discuss the new US administration.. The CAC 40 is up 0.83% while London's FTSE 100 is up 0.39% and Germany's DAX is up 0.13%.

The rupee was trading at Rs 67.38 against the US$ in the afternoon session. Oil prices were trading at US$ 53.77 at the time of writing.

According to an article in a leading financial daily, Asia's oldest stock exchange BSE Limited made a strong debut today, with the scrip listing at Rs 1085, a 35% premium over the issue price of Rs 806 on the National Stock Exchange (NSE). The stock hit high of Rs 1200, up 49% against its issue price within minutes of listing.

BSE Ltd's Rs 12.4 billion issue saw 51 times more demand than the shares on offer. The institutional investor portion was subscribed 49 times, the high net worth individual portion nearly 159 times and the retail investor portion by 6.5 times, the exchange data shows.

The existing shareholders of the exchange sold 15.42 million shares through an offer for sale. The issue represented 28.3% of BSE's pre-share sale capital. The price band was fixed at Rs 805-806. BSE's initial share sale was also the first this year after 26 companies together garnered Rs 260 billion through IPOs in 2016.

Interestingly, an article on Business Standard lists the historical performance of the global exchanges. Most of them have fared poorly on growth and margins to say the least. The average growth of last five years for most of the indices have been disappointing. For instance, Nasdaq profits have grown by 6.9% while for Australian exchange the same was up by 2.7%, in the last five years. There are others like Deutsche Boerse AG that have shown decline in profits growth.

After successful listing of BSE, the investors of NSE are cheering. NSE has already applied for an IPO and filed DRHP with SEBI, the reports noted.

During the offer for sale, we had alerted subscribers about our view regarding the BSE Limited IPO in one of the premium editions of The 5 Minute WrapUp. You can read about our view on the BSE IPO here (Subscription Required).

BSE share price closed the day at Rs 1070.55 on the National Stock Exchange (NSE), which is nearly 33% higher than the issue price of Rs 806.

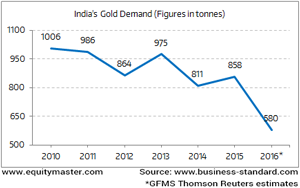

In another development, as per an article in a leading financial daily, gold demand in India witnessed a significant decline of 21% in 2016 at 675.5 tonne. The gold demand for 2015 stood at 857.2 tonne, while it was 675.5 tonne in 2016, as per the World Gold Council's (WGC) data.

Backed by challenges like jewellers strike, PAN card requirement and demonetisation move, India's gold demand for 2016 fell sharply. Jewellery demand in India also witnessed a sharp decline of 22.4% in 2016. Indian demand averaged at 845 tonnes over the last 10 years.

Gold Demand is Losing Appetite

According to WGC, there are some interesting short-run dynamics too. Gold demand is spurred by inflation, rises with a good monsoon, and is dampened by higher import taxes and other restrictive measures. By 2020, the Indian gold demand is expected to average 850-950 tonnes.

Moreover, consumption will likely be between 650 and 750 tonnes in 2017, with appetite also hit by the introduction of the nationwide Goods and Services Tax (GST).

Meanwhile, Rahul Shah, Co-head of Research has spoken about the yellow metal's performance over the years. He has also offered insights on gold's wealth-creation potential in our recent edition of The 5 Minute WrapUp. Here's an excerpt:

- "You see, the value investing legends are evaluating gold as an investment asset. And from that vantage point, gold does lose some of its luster. But real beauty of gold is that, through the millennia, it has held its value better than any other monetary asset. No fiat currency in history has outlast gold."

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Dull End to the Week; BSE Makes a Stellar Debut on NSE". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!