India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 6, 2017

Sensex Opens Strong, Bank Stocks Rally Mon, 6 Feb 09:30 am

Asian markets are higher today taking cues from Wall Street. The Shanghai Composite is up 0.47% while the Hang Seng is up 0.67%. The Nikkei 225 is trading up by 0.3%. Stock markets in US and Europe closed their previous session in green.

Meanwhile, Indian share markets too have opened the day on a strong note. BSE Sensex is trading higher by 161 points and NSE Nifty is trading higher by 49 points. Meanwhile, S&P BSE Mid Cap and S&P BSE Small Cap are trading higher by 0.9% and 0.7% respectively. Gains are largely seen in oil & gas, banking and power stocks.

The rupee is trading at 67.38 against the US$.

As per an article in a leading financial daily, Tata Motors is revamping its product strategy for the passenger car segment to safeguard itself from competition. In this regard, Tata Motors has created a new sub-brand called Tamo.

Tamo is a new vertical within Tata Motors which will work as a start-up. It will be collaborating with technology companies across the world and bring out sports luxury vehicles.

Reportedly, the company plans to launch two modular platforms and gradually phase out six existing platforms. The new modular platforms are aimed at launching more products across various segments to bring down the capital expenditure as customers are changing cars more frequently.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Moreover, introduction of Tamo will help the company co-design India's automotive footprint by taking new technologies and mobility concepts as a new ecosystem, the company stated. Additionally, the company is also looking to build two vehicle platforms that'll be used to build all Tata cars which use a common underlying design and components for all vehicles. Thereby reducing procurement costs and time-to-market.

The first car under the Tamo brand will be launched at the Geneva Motor show in March. As part of the strategy, Tata Motors will deliver seven-to-eight product variants from two platforms, for greater coverage and economies of scale. Further, with large auto makers already investing in these emerging technologies, it is clear that Tata Motors needs to make the move quickly to avoid losing out the race particularly when also technologically assisted driving can soon become a reality.

To know more about the company's financial performance, subscribers can access to Tata Motors' latest result analysis and Tata Motors stock analysis on our website.

Tata Motors share price began the trading day up by 0.4% on the BSE.

According to an article in The Financial Express, the Reserve Bank may refrain from lowering benchmark interest rate at its policy review meet this week. However, with services sector contracting for the third straight month in January, there are hopes that the central bank will be accommodative in its monetary policy.

Banks are flush with low cost deposits on account of demonetisation of high value currency notes of Rs 500 and 1,000, as a result of which their lending rates fell by up to 1% last month.

Although banks and industry have been pitching for cut in benchmark repo rate (short-term lending rate), the six-member Monetary Policy Committee (MPC) headed by RBI Governor Urjit Patel may adopt a cautious approach on February 8, especially in view of spike in crude oil prices and growing protectionist sentiment with Donald Trump taking charge as the US President.

The MPC has been mandated to maintain retail inflation at 4% (with plus/minus 2 per cent range) till 2021.

Rising for the fifth straight month, retail inflation or CPI quickened to 5.61% in December, mainly on costlier vegetables and cereals, limiting the headroom for the RBI to lower rates.

Some bankers, however, expect RBI to cut benchmark lending rate by 0.25% as macroeconomic indicators are favorable for an easy monetary policy stance.

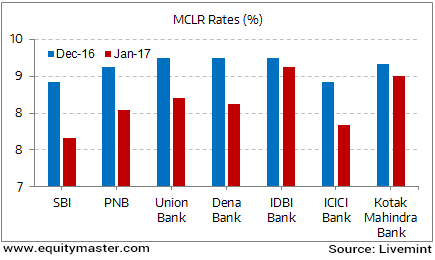

A consensus among everyone is that Interest rates are headed lower this year. Some banks have announced a significant cut in their MCLR rates.

Interest Rates Finally Headed Down South?

Essentially the banks are now aggressive on the rates cut in the hope of riding on some credit growth.

The Reserve Bank of India data suggest a slowdown in India's credit growth. This is languishing at 5.8% YoY. Flush with bucket loads of cash in the system which has helped in reducing cost of funds for the banks, some of the banks have in turn reduced their lending rates.

Bank stocks began the trading week on a strong note with Axis Bank and ICICI Bank leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Strong, Bank Stocks Rally". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!