India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 31, 2023

SGX Nifty Up 79 Points | Laurus Labs Q3 Results | Update on Adani-Hindenburg Saga | Top Buzzing Stocks Today Tue, 31 Jan Pre-Open

On Monday, Indian share markets witnessed a volatile trading session and fell sharply in afternoon hours.

However, most of the losses were erased in the second half and indices managed to close on the positive zone.

Benchmark indices ended a volatile session in green ahead of the Union budget 2023 as Adani Group stocks extended a decline after the Hindenburg report last week triggered a sell-off.

At the closing bell on Monday, the BSE Sensex stood higher by 170 points (up 0.3%).

Meanwhile, the NSE Nifty closed higher by 45 points (up 0.3%).

Adani Enterprises, Bajaj Finance, and HCL Tech were among the top gainers.

Power Grid Corporation, JSW Steel, and Bajaj Auto, on the other hand, were among the top losers.

Broader markets settled on a negative note. The BSE Midcap ended 0.2% lower while the BSE SmallCap index fell 0.1%.

Sectoral indices ended on a mixed note with stocks in the telecom sector, and IT sector witnessing buying.

While stocks in power sector, oil & gas sector and FMCG sector witnessed selling.

Shares of Jindal Saw, and Sun Pharma hit their 52-week high on Monday.

The rupee was trading at 81.48 against the US$.

Gold prices for the latest contract on MCX were trading lower by 0.1% at Rs 57,233 per 10 grams at the time of Indian market closing hours on Monday.

At 8:00 AM today, the SGX Nifty was trading up by 79 points or 0.5% higher at 17,790 levels.

Indian share markets are headed for a positive opening today following the trend on SGX Nifty.

Speaking of stock markets, research analyst Aditya Vora talks about a smarter way to ride the rally in steel sector, in his latest video.

He focuses on industry tailwinds which makes this proxy sector a better play than the underlying steel sector.

Tune in to the below video to find out more.

Top Buzzing Stocks Today

Sun Pharma will be among the top buzzing stocks today.

Sun Pharma, on Monday, acquired Disperzyme, Disperzyme -CD, and Phlogam, from Mumbai-based Aksigen Hospital Care.

Aksigen is a Mumbai-based research-driven healthcare entity with more than two decades of experience in the healthcare field.

GAIL will also be in focus today.

Gas Authority of India (GAIL), on Monday, posted a 92% year-on-year (YoY) decline in standalone profit at Rs 2.5 bn for December 2022 quarter, hit by lower gas sales due to supply disruptions.

New developments on Adani-Hindenburg

Most Adani group shares extended their sharp falls to Monday, with losses now rising to US$65 billion over three days.

Amid this sharp selloff in Adani group stocks, India's Life Insurance Corporation (LIC) on Monday revealed that they are reviewing Adani Group's over 400-page response to allegations raised by Hindenburg Research. Also, LIC plans to hold talks with the conglomerate's management within days.

According to reports, LIC spent Rs 3 billion (bn) as an anchor investor in the FPO of Adani Enterprises. The investment would add to its current holding of 4.23%.

LIC is an investor in five Adani companies, with stakes ranging from 1% to 9%, worth Rs 722.7 bn.

Meanwhile, the group has clarified that no Ambuja Cement shares have been pledged under SEBI's strict rules stake.

It remains to be seen how the above developments pan out.

In the meantime, check out Equitymaster's Indian Stock Screener, where you can view the fundamentals of companies within a business group.

It also includes the Adani Group. These screens would help you get a better grip on fundamentals, business group-wise.

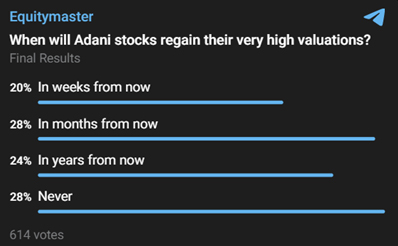

To understand what our readers are thinking about this stock crashes in Adani group stocks, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 750 participants till afternoon session yesterday, the answer is right in front of you. Most investors do not think that the crash in Adani Group stocks would end the Indian bull run.

Welspun India inks partnership with Disney

Welspun India on Monday signed a brand licensing agreement with The Walt Disney Company for the Europe, Middle East, and Africa (EMEA) region.

The license will give Welspun the rights to design, develop, manufacture and distribute a complete range of home textiles products leveraging Disney's vast franchises and characters across Disney, Pixar, Marvel and Lucas brands.

The collaboration with Disney will enable the company to further enhance consumer living spaces with market-leading solutions and experiences for all retail channels and consumers across EMEA.

Welspun is a global leader in home textiles. The company has been a strategic partner to global retailers for over 35 years with its farm-to-shelf capabilities and innovative solutions.

Welspun India is one of the largest home textile manufacturers in the world. The company offers a large spectrum of home & technical textile products and flooring solutions.

Since textile stocks interests you, check out our editorial: why textile sector will make a strong comeback in 2023.

Key quarterly results

Laurus Labs: The pharma company, Laurus Labs on Monday reported a 32% year-on-year (YoY) rise in profit to Rs 2 bn for December 2022 quarter.

The company reported a net profit of Rs 1.5 bn in the same quarter last year.

Profit growth was supported by the anticipated recovery in the ARV FDF segment.

The company's consolidated revenue from operations came in at about Rs 15.4 bn, up 50.2% YoY.

The total expense stood at Rs 12.7 bn, recording an increase of 52.7% YoY. The company also spent Rs 1.5 bn on R&D in April- December 2022 period.

Its API revenue rose 49% YoY to Rs 6.3 bn during the quarter following a ramp-up in the new contract supplies.

However, FDF revenues for the quarter declined 33% YoY to Rs 2.5 bn. FDF revenue growth was impacted by lower demand and adverse prices in the ARV formulations.

Laurus lab is a multibagger midcap gainer over past 3 years with a CAGR return of 98% in the last 3 years and 34% in the past 5 years

Punjab National Bank: The banking giant, Punjab National Bank on Monday reported a massive 44% YoY fall in profit to Rs 6.3 bn. The bottom line was dragged by a sharp rise in provisions from a year ago.

The provision for December 2022 quarter rose by 40% to Rs 47.1 bn from Rs 33.5 bn a year ago.

Gross non-performing assets (GNPAs) were at 9.8% of the total loan book, down from 12.9% in the year-ago period.

The net NPA ratio fell to 3.3% from 4.9%.

The bank's net interest income grew 17.6% to Rs 91,8 bn.

NII growth was driven by a healthy 11.8% domestic loan growth and a sequential surge in net interest margin to 3.3%.

With a 5-year-average gross NPA ratio of 14.95 and a 5-year-average net NPA ratio of 7.42, it India's worst performing banks on this all important ratios.

To know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "SGX Nifty Up 79 Points | Laurus Labs Q3 Results | Update on Adani-Hindenburg Saga | Top Buzzing Stocks Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!