India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 31, 2023

Sensex Today Falls 350 Points | Adani Group Stocks Trade Mixed | BPCL Gains 4% Tue, 31 Jan 10:30 am

Asian share markets started cautiously today as investors await central banks meetings and the US jobs data and wage data.

The Nikkei is trading 0.2% lower while the Hang Seng is trading lower by 1.3%. The Shanghai Composite is down 0.4%.

The S&P 500 fell 1.3% on Monday ahead of the Fed meeting on Wednesday.

The Dow Jones ended lower by 0.8% while the tech heavy Nasdaq Composite ended lower by 1.9%.

Here's a table showing how US stocks performed yesterday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 97.95 | -2.74 | -2.76 | 99.41 | 97.52 | 152.1 | 83.45 |

| Apple | 143 | -2.01 | -2.93 | 145.55 | 142.85 | 179.61 | 124.17 |

| Meta | 147.06 | -3.08 | -4.68 | 151.12 | 146.95 | 328 | 88.09 |

| Tesla | 166.66 | -6.32 | -11.24 | 179.77 | 166.5 | 384.29 | 101.81 |

| Netflix | 353.11 | -2.12 | -7.66 | 360.95 | 352.86 | 458.48 | 162.71 |

| Amazon | 100.55 | -1.65 | -1.69 | 101.74 | 99.01 | 170.83 | 81.43 |

| Microsoft | 242.71 | -2.2 | -5.45 | 245.6 | 242.2 | 315.95 | 213.43 |

| Dow Jones | 33,717.10 | -261 | -0.77% | 34,055.29 | 33,695.18 | 35,824.28 | 28,660.94 |

| Nasdaq | 11,393.80 | -227.9 | -1.96% | 11,553.30 | 11,388.50 | 15,265.42 | 10,440.64 |

Back home, Indian share markets are trading on a negative note, as investors look forward to pre-budget survey and the movement in Adani group stocks.

At present, the BSE Sensex is trading lower by 292 points. Meanwhile, the NSE Nifty is trading lower by 92 points.

BPCL, UPL, and, JSW Steel are among the top gainers today.

Tech Mahindra, Britannia, and Apollo Hospital are among the top losers today.

Broader markets are trading on a positive note. The BSE Mid Cap index is trading flat, while the BSE Small Cap index is up 0.4%.

Sectoral indices are trading on a mixed note. Stocks in power sector, IT sector and FMCG sector witness selling.

While stocks in telecom sector, metal sector and auto sector witness buying.

Shares of Jindal Saw, and Carborundum Universal hit their 52 week high today.

The rupee is trading at Rs 81.68 against the US dollar.

In the commodity markets, gold prices trade lower by 0.1% at Rs 57,000 per 10 grams.

Meanwhile, silver prices are trading lower by 0.1% at Rs 68,510 per 1 kg.

Speaking of stock markets, research analyst Aditya Vora talks about a smarter way to ride the rally in steel sector, in his latest video.

He focuses on industry tailwinds which makes this proxy sector a better play than the underlying steel sector.

Tune in to the below video to find out more.

Adani Enterprises FPO to receive investment from IHC

In a boost to the Rs 200 bn follow-on offering of Adani Enterprises, Abu Dhabi's International Holding Company (IHC) would invest US$ 400 million (m) in the FPO via its subsidiary Green Transmission Investment Holding RSC.

IHC was an investor in the offering's anchor book as well.

This will be the second investment deal IHC has completed with Adani Group after last year's US$2 billion (bn) investment in three green-focused companies of the Adani Group, including Adani Green Energy, Adani Transmission, and Adani Enterprises.

The FPO by Adani Enterprises has managed to garner bids for 1.39 m shares against its offer size of 45.5 m shares, representing a 3% subscription so far on 30 January 2023, the second day of the sale.

The offer will close today, 31 January 2023.

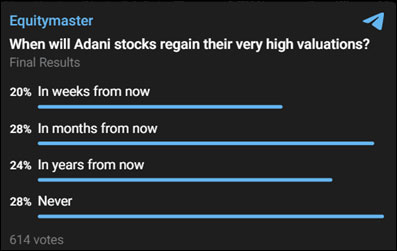

To understand what our readers are thinking about the wild movement in Adani group stocks, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With over 600 responses from the participants till today morning, the answer is right in front of you. There is a tie as some think the stocks would regain their valuations in a month.

While some think the Adani stocks will never gain their high valuation, this can be due to investors' doubt about the group following the Hindenburg report.

L&T Q3 profit rises 24%

Engineering and infrastructure conglomerate Larsen & Toubro (L&T) yesterday posted a 17% YoY rise in revenue to Rs 463.9 bn from Rs 395.6 bn a year ago.

The net profit for the quarter rose 24% YoY at Rs 25.5 bn for December 2022 quarter. The strong performance was aided by improved execution in the infrastructure projects segment and continued growth momentum in the information technology and technology services (IT&TS) portfolio.

The international revenue jumped 37% YoY to Rs 173.2 bn.

At the group level, L&T received orders worth Rs 607.1 bn during the quarter, registering a growth of 21% YoY. The consolidated order book stood at Rs 3.8 tn at the end of the December 2022 quarter.

Larsen & Toubro is an Indian multinational engaged in EPC projects, hi-tech manufacturing and services. It operates in over 50 countries worldwide.

The company has rewarded investors with 10 bonuses over the last 7 decades and the CAGR over the last 20 years stands at an impressive 25.6%.

L&T has been an investor's favorite stock for a long time and also a stock that makes it to the top 5 infrastructure stocks.

Tech Mahindra Q3 results

Yesterday, one of the best IT stocks in India - Tech Mahindra announced its earnings for the December 2022 quarter.

The revenue rose 19.9% YoY to Rs 137.4 bn from Rs 114.5 bn a year back.

While the net profit for the December 2022 quarter saw a degrowth of 5.3% YoY to Rs 12.9 bn compared to Rs 13.7 bn a year back.

This moderation in growth was due to the challenging macroeconomic environment.

The total headcount at the end of the quarter declined by 4.2% from the previous quarter. Attrition came down to 17% from 20% in the previous quarter and 24% in the corresponding period a year ago.

2021 was a noteworthy year for Tech Mahindra. In 2021, Tech Mahindra's share price saw a 83% jump. But with the onset of 2022 all IT stocks have been bleeding.

Most IT stocks experienced a brutal sell-off in 2022, eroding over 30% marketcap from Tech Mahindra.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Falls 350 Points | Adani Group Stocks Trade Mixed | BPCL Gains 4%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!