India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 30, 2023

Sensex Today Rebounds 800 Points from Day's Low, Ends 170 Points Higher | IT Stocks Witness Buying | Nykaa Jumps 5% Mon, 30 Jan Closing

It was indeed a volatile trading session on Dalal Street today. After opening the day on a negative note, Indian share markets fell sharply in afternoon hours.

However, most of the losses were erased in the second half and indices managed to close on the positive zone.

Benchmark indices ended a volatile session in green ahead of the Union budget 2023 as Adani Group stocks extended a decline after the Hindenburg report last week triggered a sell-off.

At the closing bell, the BSE Sensex stood higher by 170 points (up 0.3%).

Meanwhile, the NSE Nifty closed higher by 45 points (up 0.3%).

Adani Enterprises, Bajaj Finance, and HCL Tech were among the top gainers today.

Power Grid Corporation, JSW Steel, and Bajaj Auto on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,705, up by 16 points, at the time of writing.

Broader markets settled on a negative note. The BSE Midcap ended 0.2% lower while the BSE SmallCap index fell 0.1%.

Sectoral indices ended on a mixed note with stocks in the telecom sector, and IT sector witnessing buying.

While stocks in power sector, oil & gas sector and FMCG sector witnessed selling.

Shares of Jindal Saw, and Sun Pharma hit their 52-week highs today.

If you're interested in knowing which shares to trade, read our guide on the best intraday stocks for today.

Asian share markets ended the day on a mixed note.

The Hang Seng fell by 2.7%, while the Shanghai Composite index ended 0.1% higher. The Nikkei edged 0.2% higher.

US stock futures are trading on a negative note. Dow futures are trading lower by 0.6% while Nasdaq futures are trading down by 1.2%.

The rupee is trading at 81.48 against the US$.

Gold prices for the latest contract on MCX are trading lower by 0.1% at Rs 57,233 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading up by 0.5% at Rs 68,640 per kg.

Speaking of stock markets, research analyst Aditya Vora talks about a smarter way to ride the rally in steel sector, in his latest video.

He focuses on industry tailwinds which makes this proxy sector a better play than the underlying steel sector.

Tune in to the below video to find out more.

Adani rout crosses US$ 65 billion

Most Adani group shares extended their sharp falls to Monday as a detailed rebuttal of a US short-seller's criticisms by the Indian conglomerate failed to pacify investors whose market losses have now risen to US$65 billion (bn) over three days.

Flagship Adani Enterprises, which is facing a crucial test this week with a follow-on share offering, rose 3% but was off initial gains of as much as 10%.

Adani Transmission and Adani Total Gas plunged 20% each on Monday, while Adani Green Energy was down 16%.

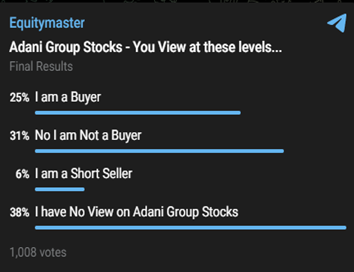

To understand what our readers are thinking about this ongoing battle between Hindenburg and Adani, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 1,000 participants, majority of investors have no view on Adani group stocks.

This view could be due to the ongoing dilemma in the Indian market about the Hindenburg report as the group has issued a 400-page detailed report for the questions of Hindenburg research.

It remains to be seen how the Adani vs Hindenburg battel pans out.

Sun Pharma acquires three brands

In news from the pharma sector, shares of Sun Pharma rallied 1% today.

Sun Pharma, on Monday, acquired Disperzyme, Disperzyme -CD, and Phlogam, from Mumbai-based Aksigen Hospital Care.

Aksigen is a Mumbai-based research-driven healthcare entity with more than two decades of experience in the healthcare field.

The acquisition was done to strengthen Sun Pharma's anti-inflammatory drug portfolio.

All the brands are approved by the Drugs Controller General of India (DCGI) for post-operative inflammation in patients undergoing minor surgery and dental procedures.

{inineads3}Disperzyme and Phlogam are fixed-dose combinations of proteolytic enzymes. The overall market of proteolytic enzymes for healing, pain and oedema in India is around Rs 5 bn.

Sun Pharma is India's largest pharma company by revenue and is the world's fourth-largest specialty generic pharmaceutical company.

It is one of the leading players in the chronic therapies segment in India. In the past five years, the stock has gained 84.7%, and is a strong candidate among the 4 pharma stocks to watch out for potential multibagger return.

Increasing demand for chronic conditions and ailments will be the growth driver for Sun Pharma in the future.

If you want to bank on specialty pharma story, Sun Pharma is your best bet.

GAIL Q3 net profit dips 92%

Moving on to the news from the energy sector, shares of GAIL fell 4.2% today.

Gas Authority of India (GAIL), on Monday, posted a 92% year-on-year (YoY) decline in standalone profit at Rs 2.5 bn for December 2022 quarter, hit by lower gas sales due to supply disruptions.

Revenue from operations increased 37.2% YoY to Rs 353.8 bn.

The company posted losses in some business segments.

Natural Gas Marketing posted a loss before interest and tax of Rs 860 m, petrochemicals posted a loss of Rs 3.5 bn, and LPG & Liquid Hydrocarbons posted a loss of Rs 290 m at the EBIT level.

It is reeling from the impact of Russia-owned Gazprom Marketing and Trading's failure to deliver some liquefied natural gas (LNG) cargoes following western sanctions on Moscow over its invasion of Ukraine last year.

GAIL signed a 20-year deal with Gazprom Marketing and Trading Singapore (GMTS) in 2012 for annual purchases of an average of 2.5 m tonnes of LPG.

With ambitious plans with respect to green hydrogen, it is amongst 5 Indian companies that are leading green hydrogen revolution.

To know what's moving the Indian stock markets today, check out the most recent share market updates here

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Rebounds 800 Points from Day's Low, Ends 170 Points Higher | IT Stocks Witness Buying | Nykaa Jumps 5%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!