India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 31, 2023

Sensex Today Rebounds 400 Points from Day's Low | PSU Bank Stocks Rise Ahead of Union Budget 2023 | SBI Jumps 3% Tue, 31 Jan Closing

After opening the day on a positive note, Indian share markets swung between gains and losses to trade on a volatile session throughout the day.

However, most of the losses were erased in the second half and indices managed to close in green with marginal gains.

Benchmark indices displayed high volatility today but ended flat as Adani group stocks and IT stocks dropped ahead of the Federal Reserve's policy decision, with investors also cautious ahead of the Union budget 2023.

A fag-end buying helped domestic markets stage turnaround in trade, after the economic survey 2022-23 projected 6.5% GDP growth in FY24.

At the closing bell, the BSE Sensex stood higher by 50 points (up 0.1%).

Meanwhile, the NSE Nifty closed higher by 13 points (up 0.1%).

M&M, SBI, and Adani Enterprises were among the top gainers today.

Bajaj Finance, TCS, and Tech Mahindra on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,752, up by 47 points, at the time of writing.

Broader markets settled on a firm note. The BSE Midcap ended 1.5% higher while the BSE SmallCap index rose 2.2%.

Sectoral indices ended on a mixed note with stocks in the telecom sector, auto sector and metal sector witnessing buying.

While stocks in IT sector, and energy sector witnessed selling.

Shares of M&M, Jindal Saw, and Indian Bank hit their 52-week highs today..

Asian share markets ended the day on a negative note.

The Hang Seng fell by 1%, while the Shanghai Composite index ended 0.4% lower. The Nikkei edged 0.4% higher.

US stock futures are trading on a negative note. Dow futures are trading lower by 0.3% while Nasdaq futures are trading down by 0.5%.

The rupee is trading at 81.9 against the US$.

Gold prices for the latest contract on MCX are trading lower by 0.4% at Rs 56,799 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading down by 0.9% at Rs 67,945per kg.

Speaking of stock markets, research analyst Aditya Vora talks about a smarter way to ride the rally in steel sector, in his latest video.

He focuses on industry tailwinds which makes this proxy sector a better play than the underlying steel sector.

Tune in to the below video to find out more.

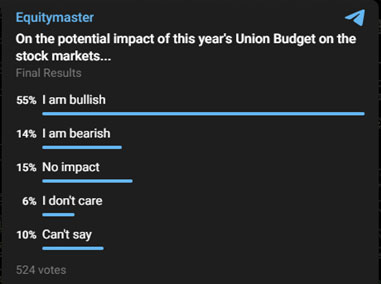

Also, to understand what our readers are thinking about the upcoming union budget and its impact on stock market, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 500 participants, majority of investors are bullish on the union budget 2023.

Adani group denies buyback plan

Adani Group on Tuesday, denied reports that it is considering a share buyback in group companies Ambuja Cements and Adani Ports.

Replying to the clarification sought by exchanges, both Adani group companies clarified that there is no such plan and are in no position to comment on the veracity of the media report.

On 30th January 2023, a leading business website reported that Adani group is mulling the buyback of shares in group firms Ambuja Cements and Adani Ports and Special Economic Zone, and the buyback of shares would be to the tune of Rs 300 bn.

The report further talks regarding the buyback of shares were in an advanced stage, and an announcement in this regard may come by next week.

This attracted the attention of the Indian exchanges, and they sought clarification from the Adani group.

The shares of Ambuja Cements and Adani Ports rallied following the news of the buyback after a steep fall last week due to the Hindenburg allegation.

Shares of Adani Ports declined 23% last week and 16.3% on Friday alone, its lowest close in almost two years.

On the other hand, shares of Ambuja Cement plunged 25% on Friday, its steepest intra-day fall since 2006.

It remains to see how the Adani vs Hindenburg battle pans out.

Sun Pharma declared an interim dividend

Moving on to news from the pharma sector, shares of Sun Pharma were in focus today.

Drug major Sun Pharmaceutical Industries on Tuesday reported a 15% YoY rise in revenue to Rs 112.4 bn. The growth was driven by an increase in sales of specialty drugs.

The company reported a 5% YoY rise in profit to Rs 21.7 bn.

Earnings before interest, depreciation, tax and amortization (EBITDA) came in at Rs 30 bn, higher 15% YoY from Rs 26 bn reported last year.

The company's India formulations sales stood at Rs 33.9 bn, up by 7% YoY and accounted for 31% of total consolidated sales.

The company's external sales of Active Pharmaceutical Ingredients (API) came in at 9% YoY, higher to Rs 5.2 bn.

Consolidated R&D (Research and development) investment was at Rs 6.7 bn, up 23% YoY.

The company's board announced an interim dividend of Rs 7.5 for the financial year ending on 31 March 2023.

Sun Pharma is India's largest pharma company by revenue and is the world's fourth-largest specialty generic pharmaceutical company.

It is one of the leading players in the chronic therapies segment in India. In the past five years, the stock has gained 84.7%, and is a strong candidate among the 4 pharma stocks to watch out for potential multibagger return.

Increasing demand for chronic conditions and ailments will be the growth driver for Sun Pharma in the future.

If you want to bank on specialty pharma story, Sun Pharma is your best bet.

Godrej Consumer Q3 revenue rises 9%

Moving on the news from FMCG sector, shares of Godrej Consumer gained 1.2% today.

The company on Tuesday reported a 3.6% rise in profits to Rs 5.5 bn. The company posted a consolidated profit of Rs 5.3 bn a year back.

The revenue for the quarter rose to Rs 35.9 bn against Rs 33 bn a year back. This was due to an uplift in underlying volume growth.

The company had broad-based growth across geographies with India delivering double-digit sales growth of 11%.

Africa, USA and Middle East business continued its strong growth trajectory, growing at 14% in rupee terms and 23% in constant currency terms.

Godrej Consumer is one of the leading FMCG companies in India. The company has five product segments namely household insecticides, soaps, hair colors, liquid detergents, and air fresheners.

With the CAGR growth of 5.8% in past five year, it is among the top 5 FMCG companies in India by growth.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Rebounds 400 Points from Day's Low | PSU Bank Stocks Rise Ahead of Union Budget 2023 | SBI Jumps 3%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!