India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 28, 2017

Sensex Trades in Red; Metal Stocks Witness Buying Fri, 28 Apr 01:30 pm

After opening the day on a negative note, share markets in India have continued the downtrend and are trading below the dotted line. Sectoral indices are trading on a mixed note with stocks in the metal sector and stocks in the auto sector trading in green, while stocks in the realty sector are leading the losses.

The BSE Sensex is trading down by 130 points (down 0.4%), and the NSE Nifty is trading down by 45 points (down 0.5%). Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.4% The rupee is trading at 64.26 to the US$.

In news from stocks in the banking sector. Private sector lender Kotak Mahindra Bank's (KMB) share price is in focus today after it announced that it is buying out British partner Old Mutual's entire 26% stake in its life insurance arm for Rs 12.9 billion.

The bank aims to expand and deepen its financial services in the country by consolidating its partner's stake in the insurance business.

The buyout is subject to regulatory and other approvals, and will result in the Kotak Mahindra Group holding 100% equity in Kotak Life.

The life insurance joint venture was formed in 2001 with Kotak owning 74% and the rest being with Old Mutual.

Over the time, there has been a liberalisation in foreign holding caps in the insurance sector to 49% and many foreign entities have increased their holdings.

The announcement comes within a month of the bank announcing a plan to raise up to Rs 5, billion through a share sale, amid a string speculations that it may be in the market looking for acquisition opportunities in the banking space.

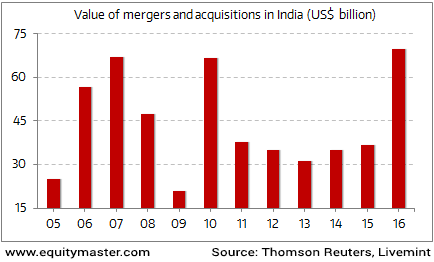

Indian M&A activity at an All Time High

Merger and acquisition activity in India is on a high. The value of M&As that have taken place last year - at US$ 69.8 billion - are the highest on record for the country. This even beats the previous record of US$ 66.9 billion set in 2007.

KMB's executive vice chairman and managing director Uday Kotak had confirmed their interest in inorganic growth opportunities and said that they will also look to deploy the capital in the stressed assets management space.

The KMB board had approved a proposal to raise equity capital by issuing up to 62 million shares of Rs 5 each, through a rights issue, public issue, private placement, including a qualified institutional placement, or any other permissible mode. The capital raising will also help bring down the promoter family's holding in the bank to 31.1%. The RBI had mandated to get it down to 30%.

At the time of writing, Kotak Mahindra Bank share price was trading down by 1.2%.

Moving on to news from stocks in the oil and gas sector. State-owned Oil and Natural Gas Corp (ONGC) made 23 oil and gas discoveries in the fiscal year ended March 31 as a record number of wells drilled helped it uncover new reserves.

While the International Energy Agency (IEA) stated that global oil discoveries fell to a record low in 2016 as companies continued to cut spending and conventional oil projects sanctioned were at the lowest level in more than 70 years, ONGC stepped up its exploratory efforts to augment new production.

Its exploratory efforts yielded 23 new discoveries, a 35% jump over 17 finds made in 2015-16 fiscal. Of the 23 new discoveries, 12 are new prospects -- a potential trap which may contain hydrocarbons, while 11 are new pools -- a geological term for subsurface hydrocarbon accumulation.

As many as 13 new discoveries were made in onland and 10 in offshore wells.

A total of 100 exploratory wells were drilled which is higher by 9% as compared to 92 wells drilled in the previous year 2015-16. Of these, 37 wells proved hydrocarbon bearing registering success ratio of 37%.

IEA in a report said oil discoveries declined to 2.4 billion barrels in 2016, compared with an average of 9 billion barrels per year over the past 15 years.

Also, the number of projects that received a final investment decision dropped to the lowest level since the 1940s.

However, ONGC continued to spend more to help achieve Prime Minister Narendra Modi's target of reducing import dependence by 10% by 2022.

ONGC is currently working on early monetisation of new discoveries. Nine onland discoveries made during the year have been monetised and put on production with average oil rate of 445 cubic meters per day and gas rate of 220,000 cubic meters a day.

The discoveries have cumulatively produced 38,809 tons of oil and 23.78 million standard cubic meters of gas during the year.

Recently, ONGC received environmental clearance for its proposal for phase III development of Jharia Coal Bed Methane (CBM) block in Jharkhand.

As part of its phase III development programme, ONGC plans to drill 77 additional wells, install five gas collecting stations and lay interconnecting and transportation pipeline network for CBM gas production, collect, transport and sell.

ONGC has already completed the phase-I (exploration) and phase II (pilot assessment, market survey and commitment) of the project.

At the time of writing, ONGC share price was trading up by 1.9%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in Red; Metal Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!