India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 27, 2017

Sensex Finishes Lower; Metal & FMCG Stocks Drag Thu, 27 Apr Closing

Share markets in India finished on a weak note as investors continued to book profits ahead of the April F&O expiry. At the closing bell, the BSE Sensex closed lower by 104 points, whereas the NSE Nifty finished lower by 10 points. The S&P BSE Midcap finished up by 0.1% while the S&P BSE Small Cap Index ended flat.

Among the BSE sectoral indices, metal sector and FMCG sector witnessed the selling pressure. Gains were largely seen in stocks from realty sector and information technology sector.

Asian equity markets finished mixed as of the most recent closing prices. The Hang Seng gained 0.49% and the Shanghai Composite rose 0.36%. The Nikkei 225 lost 0.19%. European markets are lower today with shares in London off the most. The FTSE 100 is down 0.58% while France's CAC 40 is off 0.33% and Germany's DAX is lower by 0.24%.

The rupee was trading at Rs 64.11 against the US$ in the afternoon session. Oil prices were trading at US$ 49.17 at the time of writing.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Lupin share price fell by 2.5% after the US health regulator issued Form 483 with three observations to its Goa plant. The US Food and Drug Administration (USFDA) inspected this plant between March 27 and 7 April 2017.

Reportedly, Goa plant contributed close to 50% of the US sales (around 25% of consolidated revenue) and accounted for 30 outstanding ANDAs.

Bank stocks finished the day on a mixed note with IDFC Bank & Yes Bank leading the gains. Axis bank share price declined over 2.2% after the private lender reported a 43.13% drop in net profit for the quarter ended 31 March 2017 to Rs 12.25 billion from Rs 21.54 billion reported for the same quarter of 2015-16.

The bank's net interest income however rose 3.87% to Rs 47.29 billion. The ratio of gross NPAs to gross advances stood at 5.04% as on 31 March 2017 as against 5.22% as on 31 December 2016 and 1.67% as on 31 March 2016.

Net NPAs were 2.11% of the net advances during the quarter, as against 0.70%. Consequently, provisioning more than doubled to Rs 25.81 billion for bad loans and contingencies from Rs 11.68 billion in the same quarter a year ago.

In the meanwhile, Kotak Mahindra bank share price rose 1.6% after it reported 33% year-on-year rise in consolidated net profit at Rs 14.04 billion for the quarter ended 31 March 2017 against Rs 10.55 billion in the corresponding quarter last year on the back of higher net interest income and other income.

As a percentage of total loans, gross NPAs were 2.59% at the end of the March quarter compared with 2.42% in the previous quarter and 2.36% a year ago. Further, Net interest income rose 16.37% to Rs 21.61 billion in the March quarter from Rs 18.57 billion last year.

On a separate note, the Reserve Bank of India (RBI) has imposed a monetary penalty on Kotak Mahindra Bank and Hong Kong & Shanghai Banking Corp. Ltd for violation of instructions on reporting requirements of the Foreign Exchange Management Act (FEMA), 1999.

The central bank slapped a fine of Rs 70,000 on HSBC and Rs 10,000 on Kotak Mahindra Bank in exercise of the powers in RBI under the provisions of section 11(3) of the FEMA Act.

Moving on to news from economic sector. According to a report by ICRA, FII inflows into Indian debt market in 2017-18 are expected to be limited to US$5-10 billion.

Domestic debt markets are witnessing huge foreign inflows. So far in April, foreign institutional investors (FIIs) have pumped in close to US$3 billion into Indian debt. Earlier, between October 2016 and February 2017, FIIs invested more than US$10 billion in the debt market. However, this pace of inflows may not continue.

Factors such as a likely compression of spreads, geopolitical tensions, and sharp appreciation of the rupee would temper the attractiveness of purchasing Indian debt. This was also aided by factors such as a widening of the spreads between 10-year US and domestic G-secs yields, the receding impact of the note ban on economic activity and investor sentiment, as well as policy reforms including the passage of all the GST laws.

Further, a likely hike in interest rate by RBI could also dent investor sentiment towards the debt market. Therefore, funds brought in by FIIs into Indian debt markets during FY18 are likely to be primarily long term in nature, searching for higher yield rather than short-term capital gains, the reports noted.

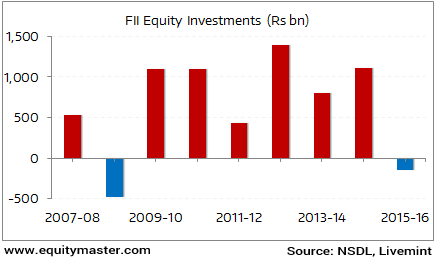

Notably, FY16 was not a very good year for stocks. Below average monsoons, global economy slowdown, US tightening interest rates, poor earnings... Nothing was in India's favour.

FIIs Turn Net Sellers After Six Years

No wonder foreign investors lost patience. As per an article in Livemint, FIIs pulled out net US$ 2.2 billion from stocks in the year, the highest outflow since 2007-08- the year of global financial meltdown.

However, domestic institutional investors (DIIs) are singing a different tune. After being net sellers for six years, they have turned net buyers in FY 16.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes Lower; Metal & FMCG Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!