India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 28, 2017

Sensex Opens Lower; Realty Stocks Drag Fri, 28 Apr 09:30 am

Asian equity markets are lower today as Chinese and Hong Kong shares fall. The Shanghai Composite is off 0.35%, while the Hang Seng is down 0.39%. The Nikkei 225 is trading down by 0.20%. The European markets ended Thursday's session in the red as market participants were disappointed after the European Central Bank (ECB) again made no changes to its monetary policy.

Meanwhile, share markets in India have opened the day on a negative note tracking weakness in Asian peers on concerns over US-South Korea free trade pact. The BSE Sensex is trading down by 78 points while the NSE Nifty is trading down by 33 points. The BSE Mid Cap index opened down by 0.1%, while BSE Small Cap index has opened the day up by 0.2%.

Sectoral indices have opened the day on a mixed note with stocks from PSU sector and power sector leading the gains. While stocks from FMCG sector and realty sector are witnessing selling pressure. The rupee is trading at 64.11 to the US$.

ITC share price fell by 1.8% after it was reported that the Bombay High Court ordered Union finance ministry and others to be made parties to a plea against LIC's investments in business conglomerate ITC Ltd, which earns 80% of its revenue from the sale of tobacco.

Real estate stocks opened the day mixed with PVP Ventures and Era Infra Engineering trading in the red. As per an article in a leading financial daily, Indian real estate sector is expected to witness an investment of US$7 billion this year on likely revival in the sector.

The impact of demonetisation was expected to be catastrophic for the Indian economy. However, the reality on the ground is quite encouraging, indicative of the fact that the economy is already on its way to fully absorb the impact of the policy, the reports noted.

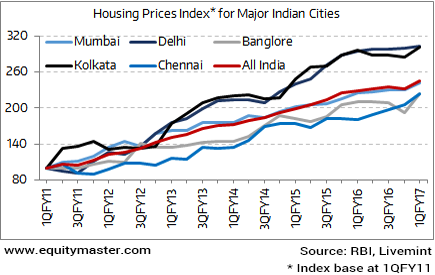

Demonetisation Effect on Growth in House Prices

India residential supply has jumped by 70% quarter on quarter. Compared to only 18,000 units introduced in the October to December quarter, we have seen more than 30,000 units introduced in the January to March quarter. The biggest jump was in Chennai, Hyderabad, Kolkata and Bengaluru.

Further, during the March quarter housing sales also jumped by 70%. Compared to 14000 units sold in the October to December quarter, more than 23,000 units were sold in the January to March quarter.

In the meanwhile, it was reported that the Maharashtra Real Estate Regulatory Act, 2016 (MahaRera) will bring transparency and discipline in the real estate sector. After May 1, when the Real Estate Regulatory Act (RERA) is in place, the realty sector will likely see an uptrend with a slight price correction.

This is likely as genuine buyers may pitch in on the back of an improved consumer climate and lower home loan rates, the reports noted. Also, Vivek Kaul in his Diary has written about why real estate prices are going down at a slow pace. Here's a snippet of what he wrote:

- "This has essentially led to a situation where real estate transactions have crashed across many markets in the country but the prices haven't. This isn't good for the real estate market because unless homes that have already been built are sold to buyers who want to live in them (and not invest), the huge inventory of built up homes with no one living in them, won't clear."

Moving on to the news from stocks in pharma sector. As per an article in a leading financial daily, Dr Reddy's Laboratories has launched generic Ezetimibe and Simvastatin tablets, used for reducing cholesterol, in the US market.

The product is a generic version of MSD International GmbH's Vytorin tablets. The company launched the tablets in the strengths of 10 mg/10 mg, 10 mg/20 mg, 10 mg/40 mg and 10 mg/80 mg in the US market.

According to IMS Health, Vytorin brand had the US sales of approximately US$678 million MAT for the most recent 12 months ended February 2017.

In the meanwhile, Zydus Cadila has also received approval from the USFDA to market an anti-cholesterol drug, Cholestyramine. Cholestyramine will be produced at the group's formulations manufacturing facility at Baddi. The group now has more than 110 approvals and has so far filed over 300 ANDAs since the commencement of the filing process in FY 2003-04.

Notably, the US is the world's largest drug market and approvals to sell generic medicines there provide companies opportunities to increase their revenue.

Dr Reddy's Lab share price opened up by 0.5% & Cadila Healthcare share price opened the day down by 0.6%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Lower; Realty Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!