India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 1, 2023

Sensex Today Rallies 500 Points ahead of Union Budget | Adani Group Stocks Extend Fall | ICICI Bank & Tata Steel Top Gainers Wed, 1 Feb 10:30 am

Asian share markets advanced today following a rally overnight in US shares on signs of cooling inflation. This encouraged risk appetite ahead of the Federal Reserve's meeting.

The Nikkei is trading 0.1% higher while the Hang Seng is up 0.3%. The Shanghai Composite is up 0.1%.

Major Wall Street indices closed over 1% higher on Tuesday as labour cost data encouraged investors about the Federal Reserve's aggressive approach to taming inflation a day ahead of the central bank's critical policy decision.

The Dow Jones ended higher by 1.1% while the tech heavy Nasdaq Composite ended higher by 1.7%.

Here's a table showing how US stocks performed yesterday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 99.87 | 1.92 | 1.96% | 99.91 | 97.79 | 152.1 | 83.45 |

| Apple | 144.29 | 1.29 | 0.90% | 144.34 | 142.28 | 179.61 | 124.17 |

| Meta | 148.97 | 1.91 | 1.30% | 149.88 | 147.52 | 328 | 88.09 |

| Tesla | 173.22 | 6.56 | 3.94% | 174.3 | 162.78 | 384.29 | 101.81 |

| Netflix | 353.86 | 0.75 | 0.21% | 355.95 | 348.71 | 458.48 | 162.71 |

| Amazon | 103.13 | 2.58 | 2.57% | 103.35 | 101.14 | 170.83 | 81.43 |

| Microsoft | 247.81 | 5.1 | 2.10% | 247.95 | 242.95 | 315.95 | 213.43 |

| Dow Jones | 34,086.04 | 368.95 | 1.09% | 34,095.23 | 33,664.91 | 35,824.28 | 28,660.94 |

| Nasdaq | 12,101.93 | 189.54 | 1.59% | 12,104.13 | 11,915.94 | 15,265.42 | 10,440.64 |

Back home, Indian share markets are trading on a strong note, as investors look forward to the union budget 2023.

At present, the BSE Sensex is trading higher by 540 points. Meanwhile, the NSE Nifty is trading higher by 151 points.

ICICI Bank, Tata Steel, and, Power Grid are among the top gainers today.

Sun Pharma, M&M, and ITC are among the top losers today.

Broader markets are trading on a positive note. The BSE Mid Cap index is trading higher by 1.1%, while the BSE Small Cap index is up 1%.

Sectoral indices are trading on a positive note with the exception of energy sector. Stocks in the finance sector, banking sector and metal sector are witnessing buying.

Shares of Ratnamani Metals and M&M hit their 52 week high today.

The rupee is trading at Rs 81.68 against the US dollar.

In the commodity markets, gold prices trade lower by Rs 142 at Rs 57,100 per 10 grams.

Meanwhile, silver prices are trading flat Rs 68,815 per 1 kg.

Speaking of stock markets, the stock markets have been under pressure after the American short seller Hindenburg Research issued a report on Adani group stocks.

The top Adani group stocks have taken a hit. However, this is not new ...the same thing happened before with Vakrangee.

In January 2018, Co-head of Research at Equitymaster Tanushree Banerjee observed how the market capitalisation of Vakrangee crossed pharma behemoth Lupin's marketcap. A perfect case of an exciting business gaining dominance over a boring one!

Mind you, Vakrangee was already a 1,000 bagger then!

It was not difficult to see why investors were scampering to get a share of the pie. Nothing about Vakrangee seemed to surprise the streets.

What happened next? Watch the below video to know more...

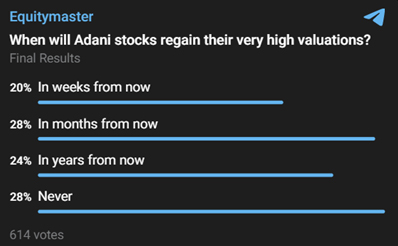

Also speaking of Adani stocks, to understand what our readers are thinking about the fall in Adani group stocks, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

Some think the stocks would regain their valuation in a month.

The FPO of Adani Enterprises was saved yesterday as HNI investors came to rescue.

Adani Enterprises FPO

A healthy competition is always good.

Adani group is a prime example of the above adage. When retail investors showed very little interest in the FPO, the offer was saved by other big business houses of India.

FPO's highest contribution came from the family offices of - Ambani (Reliance), Sajjan Jindal (JSW), Sunil Mittal (Airtel), Sudhir Mehta (Torrent), Pankaj Patel (Zydus).

Also, NIIs put in bids for over three times the 96.2 lakh shares reserved for them. Around 12.8 million (m) shares reserved for qualified institutional buyers, or QIBs, was almost fully subscribed, according to the data on stock exchanges.

Some experts say it made sense for big institutional investors to pick up shares at high quantities from FPO as it is not always possible to procure shares in high quantities from the open market.

The key lesson from the Adani-Hindenburg saga is that keep your relations with your peers & competitors healthy. They'll help you in the darkest hour!

Indian Hotels Company Q3 results

Tata group hospitality firm Indian Hotels Company on Tuesday reported an over four-fold rise in consolidated net profit at Rs 4 bn (about Rs 403.6 crore) December 2022 quarter. This is against a consolidated net profit of Rs 959.6 m in the year-ago period

The consolidated revenue from operations rose by 51.6% to Rs 16.9 bn as against Rs 11.1 bn in the corresponding period of the previous financial year.

The revenue performance supported by scale benefits have enabled strong flow-through and record margins.

Indian Hotels Company rallied over 75% in 2022 on the back of firm demand in the leisure segment and a boost from increased business travel.

Indian Hotels Company was a multibagger stock of 2022. But will it continue the rally this year?

Read our editorial on 5 midcaps that rallied in 2022. How are they set up for 2023 To find out.

Lupin receives tentative approval from USFDA

Global pharma company Lupin on Tuesday announced that it has received tentative approval from the United States Food and Drug Administration (USFDA) for its new drug application for Dolutegravir, Emtricitabine, and Tenofovir Alafenamide (DETAF) tablets that manage HIV infections.

The company said that it has received the tentative nod from the US drug regulator under the US President's Emergency Plan for AIDS Relief (PEPFAR).

Earlier this month, Lupin announced that it had received tentative approval from the USFDA for its abbreviated New Drug Application (ANDA), Dolutegravir and Rilpivirine Tablets, 50 mg/25 mg.

The tablets were the generic equivalents of Juluca Tablets, 50 mg/25 mg of ViiV Healthcare Company, with estimated annual sales of $666 million in the US, according to IQVIA.

Juluca Tablets are used for the treatment of HIV infection in adults. The drug controls the infection and helps to decrease the virus in the body.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Rallies 500 Points ahead of Union Budget | Adani Group Stocks Extend Fall | ICICI Bank & Tata Steel Top Gainers". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!