India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 1, 2023

SGX Nifty Up 78 Points | IOC Q3 Results | Balaji Solutions IPO | Top Buzzing Stocks Today Wed, 1 Feb Pre-Open

On Tuesday, Indian share markets swung between gains and losses to trade on a volatile session throughout the day.

However, most of the losses were erased in the second half and indices managed to close in green with marginal gains.

Benchmark indices displayed high volatility but ended flat as Adani group stocks and IT stocks dropped ahead of the Federal Reserve's policy decision, with investors also cautious ahead of the Union budget 2023.

A fag-end buying helped domestic markets stage turnaround in trade, after the economic survey 2022-23 projected 6.5% GDP growth in FY24.

At the closing bell on Tuesday, the BSE Sensex stood higher by 50 points (up 0.1%)

Meanwhile, the NSE Nifty closed higher by 13 points (up 0.1%).

M&M, SBI, and Adani Enterprises were among the top gainers.

Bajaj Finance, TCS, and Tech Mahindra, on the other hand, were among the top losers.

Broader markets settled on a firm note. The BSE Midcap ended 1.5% higher while the BSE SmallCap index rose 2.2%.

Sectoral indices ended on a mixed note with stocks in the telecom sector, auto sector and metal sector witnessing buying.

While stocks in IT sector, and energy sector witnessed selling.

Shares of M&M, Jindal Saw, and Indian Bank hit their 52-week high on Tuesday.

The rupee was trading at 81.9 against the US$.

Gold prices for the latest contract on MCX were trading lower by 0.4% at Rs 56,799 per 10 grams at the time of Indian market closing hours on Tuesday.

At 8:30 AM today, the SGX Nifty was trading up by 78 points or 0.5% higher at 17,830 levels.

Indian share markets are headed for a positive opening today following the trend on SGX Nifty.

Speaking of stock markets, research analyst Aditya Vora talks about a smarter way to ride the rally in steel sector, in his latest video.

He focuses on industry tailwinds which makes this proxy sector a better play than the underlying steel sector.

Tune in to the below video to find out more.

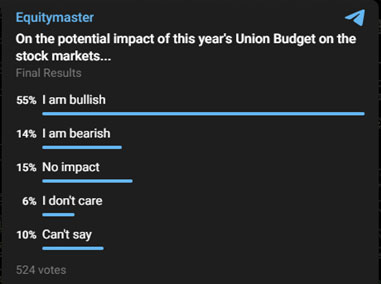

Also, to understand what our readers are thinking about the upcoming union budget and its impact on stock market, we ran a poll on Equitymaster's telegram channel.

This is what we asked our readers:

With a response from over 500 participants, majority of investors are bullish on the union budget 2023.

Top Buzzing Stocks Today

Sun Pharma will be among the top buzzing stocks today.

Drug major Sun Pharmaceutical Industries on Tuesday reported a 15% YoY rise in revenue to Rs 112.4 bn. The growth was driven by an increase in sales of specialty drugs.

Godrej Consumer will also be in focus today.

The company on Tuesday reported a 3.6% rise in profits to Rs 5.5 bn. The company posted a consolidated profit of Rs 5.3 bn a year back.

Adani Enterprises FPO fully subscribed

The Follow-On Public Offering (FPO) of Adani Enterprises got bids for 50.86 million (m) shares against an offer size of 45.5 m shares, representing a 1.12 times subscription on the third and final day of bidding.

Retail investors took a backseat as the stock price slid below the FPO price band, bidding for only 12% of the shares set aside for them.

Qualified institutional buyers (QIB) were at the forefront. They bid for 16.1 m shares of the 12.8 m shares set aside for them. This indicates 1.26 times subscription.

Non-institutional investors have oversubscribed to 332% of the portion set aside for them. They have bid for 31.93 m shares against the 9.6 m reserved. Meanwhile, employees have bid for 54% of the shares reserved for them.

Last week, Adani group shares were hammered after an American short seller, Hindenburg Research, accused the company of using tax havens and flagged debt concerns in a report. In a 413-page rebuttal, Adani group denied all the charges.

It remains to be seen how the Adani vs Hindenburg battle pans out.

Indian Oil Q3 profit slumps 87%

State-run oil marketing major on 31 January 2023 reported a 16.5% YoY rise in revenue to Rs 2.3 tn from Rs 1.9 tn.

However, it reported a 92.4% YoY fall in profits to Rs 4.5 bn down from Rs 58.6 bn a year back. This downfall was due to static pump prices, higher costs and foreign exchange losses.

The marketing under-recovery of oil marketing companies was hurt by retail prices that have remained unchanged since April 2022.

Further, a 40% surge in input costs pushed total expenses up by 20.4% to Rs 2.3 tn.

The company also logged a foreign exchange loss of Rs 17 bn during the quarter.

Indian Oil Corporation is the largest oil refining & petroleum marketing company in India.

With its recent initiative to install EV charging facilities at 10,000 fuel stations in the next three years, it is among the top 5 EV charging infrastructure stocks in India.

Balaji Solutions gets SEBI's nod for IPO

IT hardware and mobile accessories firm Balaji Solutions received capital markets regulator Sebi's go-ahead to raise funds through an initial public offering (IPO).

The company filed their preliminary IPO papers with Sebi in August 2022.

The IPO consists of a fresh issue of equity shares worth up to Rs 1.2 bn and an offer-for-sale (OFS) of up to 0.7 m equity shares by a promoter and a promoter-group entity.

Under the OFS, Rajendra Seksaria and Rajendra Seksaria HUF will offload shares.

The company may consider a pre-IPO placement aggregating up to Rs 240 m. The fresh issue size will be reduced if such placement is done.

Proceeds from its fresh issuance worth Rs 866 m will be utilized for funding incremental working capital and general corporate purposes.

Balaji Solutions is an IT hardware & peripherals and mobile accessories company engaged in manufacturing and branding products under its flagship brand Foxin.

For more details, check out the current IPOs and upcoming IPOs on our website.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "SGX Nifty Up 78 Points | IOC Q3 Results | Balaji Solutions IPO | Top Buzzing Stocks Today". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!