India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 3, 2017

Sensex Remains Flat; Energy Stocks Witness Buying Interest Tue, 3 Jan 11:30 am

After opening the day on a flat note, the Indian share markets registered marginal gains and continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the consumer durables sector and energy sector witnessing maximum buying interest.

The BSE Sensex is trading up 84 points (up 0.3%) and the NSE Nifty is trading up 32 points (up 0.4%). The BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by around 1%. The rupee is trading at 68.05 to the US$.

In a recent move for the demonetisation drive, the government has asked banks to provide information to the Income-Tax (IT) department about savings accounts where deposits have exceeded Rs 2.5 lakh after November 8.

The purpose behind this exercise is to cull out the black money launderers by targeting the accounts that were misused to deposit black money. As per the news, if the deposits are higher than past levels or deviate significantly from what a person's savings are expected to be he could receive a notice from the tax department. We would like to see how this move by the government will pan out in the coming days.

Speaking of black money, it's no secret that political parties are a kind of black hole to black money. Much of these donations to political parties, being below the limit of Rs 20,000, happen in cash and remain unaccountable (one must note that political parties are currently not required to publicly disclose contributions of up to Rs 20,000). So while you and I need to show an identity proof while depositing our old Rs 500 and Rs 1,000 notes into a bank account, political parties can continue to receive donations of up to Rs 20,000 in cash. And they need not declare who gave those donations.

There is a scope that we as citizens of India can put an end to this discrimination. My colleague Vivek Kaul is on a mission to get us EQUAL RIGHTS. Vivek has initiated a petition to the President of India to request him to set things right. Thousands have already signed the petition. He needs 25,000 signatures before 6th of January to kick this off. Already, over 5,000 people have signed.

In case you haven't, it's time to do your bit now. Sign the petition, and become an agent of change.

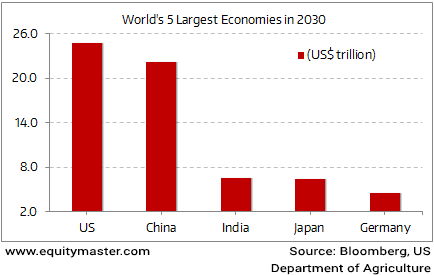

As per a leading financial daily, India is likely to have the biggest jump in the economic pecking order by the time the year 2030 rolls around. Currently ranked seventh, India will go on to become the world's third largest economy by 2030.

The major factor driving the above improvement is India's workforce that is expected to become the world's largest by 2030.

India on Course to Become World's Third Largest Economy by 2030?

So going by the above rationale, a 7% growth in GDP from now till 2030 does indeed look achievable. And the longer we are able to grow at this rate, the more we will be able to close the gap between us and the world's two largest economies, viz. the US and China.

Having said that, we need to ensure that we don't let our demographic dividend turn into a disaster.

Here's our colleague Vivek Kaul quoting Ruchir Sharma on this make or break issue of our demographic dividend.

- The trick is to avoid falling for the fallacy of the "demographic dividend," the idea that population growth pays off automatically in rapid economic growth. It pays off only if political leaders create the economic conditions necessary to attract investment and generate jobs. In the 1960s and '70s, rapid population growth in Africa, China, and India led to famines, high unemployment and civil strife. Rapid population growth is often a precondition for fast economic growth, but it never guarantees fast growth.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; Energy Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!