India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 3, 2017

Sensex Opens Flat; IT Stocks Lead the Losses Tue, 3 Jan 09:30 am

Asian markets are higher today as Chinese and Hong Kong shares show gains. The Shanghai Composite is up 0.78% while the Hang Seng is up 0.53%. Meanwhile, Indian share markets have opened the trading day on a flattish note. The BSE Sensex is trading lower by 47 points while the NSE Nifty is trading lower by 13 points. The BSE Mid Cap index and BSE Small Cap index both have opened the day up by 0.2%. The rupee is trading at 68.02 to the US$.

Sectoral indices have opened the day on a mixed note with consumer durables and power stocks witnessing maximum buying interest. Whereas, banking and IT stocks have opened the day in red.

According to an article in a leading financial daily, Bharti Airtel is in talks with Swedish telecom operator Telenor to acquire the latter's India business unit for US$350 million. Airtel could acquire half of Telenor India's liabilities, while Telenor is expected to hold the remaining half. The deal is likely to be closed by end of January.

Telenor has been allegedly hoping to leave India, having been pushed into a corner on account of its restricted data spectrum holdings and its presence in limited areas. Bigger adversaries like Bharti Airtel, Vodafone India, Idea Cellular and new participant Reliance Jio Infocomm have been greatly extending their 4G administrations.

Reportedly, Telenor India owes close to Rs 19 billion to the government in deferred spectrum payments and about Rs 18 billion to financial institutions as debt.

One must note that, Telenor currently has operations in 6 telecom circles - AP& Telangana, Uttar Pradesh East and West, Bihar, Gujarat and Maharashtra. Telenor also holds 4G spectrum license in seven telecom circles.

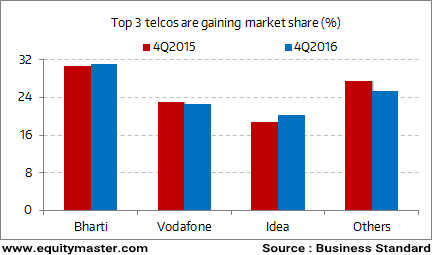

An interesting statistic in the telecom industry shows that <>Bharti Airtel, Vodafone India, and <>Idea Cellular garner about 75% of the industry's revenues.

The chart above shows that all other players have been steadily losing market share. In such a fierce competition, whether the small telcos survive will be the key thing to watch out for going ahead.

Bharti Airtel's share price opened the day down by 0.3%.

Moving on to the news from stocks in engineering sector. According to an article in the Business Standard, Larsen & Toubro (L&T) announced that its wholly-owned subsidiary L&T Hydrocarbon Engineering (LNTHE)-led consortium has bagged two orders from Saudi Aramco.

LTHE in consortium with EMAS CHIYODA Subsea, has won two awards involving Engineering, Procurement, Construction and Installation (EPCI) contracts from Saudi Arabian oil giant, Saudi Aramco. The contract is awarded to supply and install 4 wellhead decks in the Safaniya field and another award to upgrade on 17 platforms in various offshore fields in the Arabian Sea off the coast of Saudi Arabia.

One must note that, the long term agreement awarded by Saudi Aramco to the Consortium in June last year had been very successful. Moreover, the consortium is poised to remain a substantial service provider to Aramco and participate in the development of capabilities in Kingdom over the long term, the reports noted.

Separately, in a major development L&T has been identified as the implementation partner by the government to convert Pune into a smart city. In this regard, the letter of intent for the Pune smart city project was handed over by the Municipal Commissioner of Pune to L&T Construction's Smart World & Communication Business Unit, which will be executing the project.

The scope of work includes enabling Wi-Fi at around 200 strategic locations across Pune, establishing Emergency Call Boxes and Public Address Systems, Environmental Sensors, Variable Messaging Displays, Network Connectivity and Video Analytics Integration.

Diversification continues to help L&T (Subscription Required) negotiate and get better terms and margins for projects. Apparently, this is because it is less desperate to win orders as compared to a company which are present in only a couple of sectors. Its reputation, extensive technical prowess, and large skilled workforce have enabled L&T to command a certain premium from customers and vendors alike. Whether, further addition to these new projects provides a cushion to its profitability will be an interesting thing to watch out for going forward.

L&T's share price opened the day down by 0.2%

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; IT Stocks Lead the Losses". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!