India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 2, 2017

Sensex Ends Dull on First Trading Day of 2017; Realty Index Surges 4.3% Mon, 2 Jan Closing

The Indian share markets started the new year's trading day on a dull note. At the closing bell, the BSE Sensex closed lower by 31 points, whereas the NSE Nifty finished lower by 6 points. The <>S&P BSE Midcap ended up by 0.8% while the S&P BSE Small Cap finished up by 1.2%. Barring banking and IT stocks, all sectoral indices ended the day on a positive note. Realty, and auto stocks witnessed the maximum buying interest.

European markets are higher today as French and German shares show gains. The CAC 40 is up 0.31% while the DAX is up 0.88%.

The rupee was trading at Rs 68.02 against the US$ in the afternoon session. Oil prices were trading at US$ 53.9 at the time of writing.

According to an article in The Economic Times, in a major land deal, realty firm K Raheja Corp and Singapores sovereign wealth fund GIC will jointly purchase a property located at Worli, Mumbai for Rs 6.1 billion from Siemens.

In this regard, Siemens and Whispering Heights Real Estate, a proposed joint venture entity of GIC affiliate Reco Solis and the K Raheja Corp Group, have executed the MoU for the transfer and assignment of leasehold interest in the property located at Worli.

The proposed assignment is subject to receipt of all requisite statutory and regulatory approvals from the concerned authorities and signing of firm agreements between the Company and the Proposed Assignee in this regard. Following the conclusion of the joint bid, Raheja and GIC are planning to develop a 5 lakh sq ft commercial project at the site.

Talking of real estate, we have written about how demonetisation has indeed created a heavy fog of uncertainty on the future of real estate in the country in of the editions of The 5 Minute WrapUp. Richa Agarwal, our research analyst is of the opinion that the banking and real estate sector crisis could lead to a domino effect that topples other sectors and ultimately, the economy.

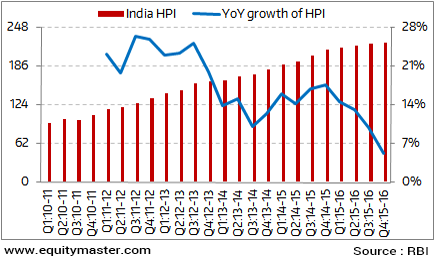

Will Realty Prices Fall Soon?

However, increasing unaffordability and pile up of unsold inventories in metros pose a real threat to the real estate sector. We believe that prices may have run up ahead of themselves and would normalize going forward.

Siemen's share price ended the day up by 0.6%.

Moving on to the news from stocks in pharma sector. As per an article in the Livemint, Natco Pharma has launched a generic Hepatitis C treatment drug in Nepal under the brand name 'Velpanat.' The product is the first generic version of Sofosbuvir 400mg/Velpatasvir 100mg fixed dose combination sold by Gilead Sciences Inc under brand name Epclusa.

In this regard, Natco has signed a non-exclusive licensing agreement with Gilead Sciences Inc, to manufacture and sell generic versions of its chronic hepatitis C medicines in 101 developing countries. The company has priced the medicine at a maximum retail price of Nepalese Rupee 25,000 for a bottle of 28 tablets in Nepal.

As the M&A activity has been heating up globally, the M&A activity in the Indian pharma space has been on the rise in recent times. Rahul Shah has penned an interesting piece in one of the edition of The 5 Minute WrapUp on how generic pharma companies are benefitting from global M&A activity. Here's an excerpt from the article:

"M&A activity among the innovators provides an opportunity for the generics to build a product portfolio by buying the product basket. For small to midsized companies, this is perhaps the quickest way to expand.

Given the high costs and even higher risks in developing a drug, the innovator companies have increasingly turned towards investing resources in the acquisition of existing drugs or promising ones already in the pipeline."

Meanwhile, it was reported that, Lupin Limited has received final approval for its Cevimeline Hydrochloride Capsules, 30 mg from the United States Food and Drug Administration (USFDA) to market a generic version of Daiichi Sankyo Inc's Evoxac Capsules, 30 mg.

The capsules are indicated for treatment of symptoms of dry mouth in patients with Sjögren's syndrome. Further, the company's product is a generic version of Daiichi Sankyo Inc's Evoxac capsules.

Reportedly, the company will commence promoting the product immediately. Evoxac capsules had US sales of US$40.8 million as per IMS MAT September 2016 data. Our pharma sector analyst, Bhavita Nagrani, is of the opinion that Lupin was able to insulate its growth despite rising pressures in the sector. She has recently shared a detailed view on the company and valuations in the recommendation report of The India Letter.

Pharma Stocks ended the day up by 0.6% with Elder Pharma & Ajanta Pharma leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends Dull on First Trading Day of 2017; Realty Index Surges 4.3%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!