- Home

- Todays Market

- Indian Stock Market News March 3, 2023

Sensex Today Skyrockets 900 Points | PSU Banks & Adani Group Stocks Rally | 5 Reasons Why Indian Share Market is Rising Fri, 3 Mar Closing

After opening the day on a strong note, Indian share markets continued their momentum throughout the trading session and had their best day in months.

Benchmark indices bounced back in style after falling in the previous session, as positive global cues coupled with the Rs 154.5 billion (bn) share purchase by GQG Partners in Adani Group stocks boosted investor sentiment.

Adani group shares along with PSU banks and select index heavyweights were the major gainers.

At the closing bell on Friday, the BSE Sensex stood higher by 900 points (up 1.5%).

Meanwhile, the NSE Nifty closed up by 272 points (up 1.6%).

Adani Enterprises, Adani Ports, and SBI were among the top gainers today.

Tech Mahindra, Cipla, and Asian Paints on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,632 up by 277 points, at the time of writing.

Broader markets ended on a positive note with the BSE Midcap index ending 0.5% higher and the BSE SmallCap index ending 0.7% higher.

All sectors ended on a positive note with stocks in the finance sector, power sector and banking sector witnessing most of the buying.

Shares of Procter & Gamble Health and Jindal Stainless hit their 52-week highs today.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

How to Uncover High Potential Small Caps Opportunities

In This Market

Present market sentiment aside, there's an underlying economic force which could cause the Small Cap Index to soar over the next decade...

And with a few well-placed investments today, you could potentially build life changing wealth over the long term.

Explore this opportunity now

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

Asian stock markets ended on a firm note. The Nikkei gained 1.6%, while the Hang Seng was up 0.7%. The Shanghai Composite ended 0.5% higher.

The rupee is trading at 82.98 against the US$.

Gold prices for the latest contract on MCX are trading higher by 0.1% at Rs 55,806 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading higher by 0.7% at Rs 64,449 per kg.

5 Reasons Why Indian Share Markets are Rising

#1 Fed's green signal

The recent hawkish comments from FOMC minutes had sparked fears of a 0.5% rate hike in the next meeting.

But on Thursday, Atlanta Federal Reserve President Raphael Bostic said that he thinks the central bank can keep its interest rate hikes to 0.25% rather than the half-point increase favoured by some other officials.

#2 Upbeat global cues

Following the above comment, the Dow Jones index notched its best day since February 13 and closed over 340 points higher. The S&P 500 rose 0.8% while the Nasdaq climbed 0.7%.

Tracking Wall Street cues, Asian markets also gained in early trade on 3 March 2023. Hong Kong's Hang Seng index rose 0.7%, while the Hang Seng index gained 1.6%.

#3 Dollar takes a back seat

The rupee has been falling for quite some time now and this falling trend reversed today as it appreciated. The rupee appreciated 36 paise to 82.24 against the dollar.

Rupee's appreciation often attracts FIIs as it adds to the return for foreign investors.

#4 China economic data

Another reason behind the rally in the Asian markets was the strong economic activity witnessed in China. The country's services sector saw a jump in activity, according to the Caixin/S&P Global services purchasing manager's index, with a reading of 55 in February from 52.9 in January.

This has spurred buying in Indian metal stocks as well. The Nifty Metal index gained over 5.5% in the last three sessions.

#5 Adani group stocks bounce back in style

Adani Group stocks were the biggest gainers in the Indian markets on Friday with Nifty 50 stocks Adani Enterprises trading over 13% higher. Seven out of 10 stocks in the pack were locked in 5% upper circuit.

Speaking of stock markets, often, retail investors get attracted to stocks trading at low prices.

From a fundamental point of view, the price of the stock by itself doesn't have a lot of importance.

But what about traders? Is there a good trading opportunity in low priced stocks?

In the below video, you will find the answer.

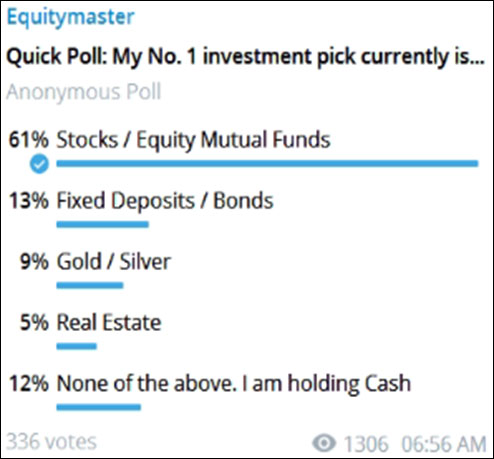

Also, to understand investor sentiment and what our readers are thinking, we ran a poll on Equitymaster's telegram channel

With majority votes, investors are still investing in stocks and mutual funds. It can be that they're looking for bargain buys amid the Adani stocks selloff. Now that the Adani stocks have also started to recover...

Jindal steel to set up steel plant

In news from the steel sector, share price of Jindal Steel and Power jumped 2% on Friday.

Jindal Steel & Power on Friday announced its plan to invest Rs 100 bn for setting up a 3 mn tonne per annum steel plant in Andhra Pradesh.

Make: Your Investing Stress-free with Value for Money Stocks

The group will be signing a MoU with the AP Government for investing in renewable energy across solar, wind and hydro as well expanding the capacity of its existing cement plant.

The group will also be investing in a port and building a slurry pipeline and a MSME park in the state.

Coming to the stock performance, the shares have given a mutltibagger return of 127% return in the last two years.

With over 50% YoY rise in net profit for 2022, it stands among the most profitable midcap stocks of 2022 to watch out for 2023.

Adani Group to set up cement plants

Moving on, the Adani group will set up two new cement manufacturing plants, 15,000 MW of renewable power projects and a data centre in Andhra Pradesh as it looks to double down on its presence in the state.

The group plans to double the capacity of the two seaports it operates at Krishnapatnam and Gangavaram in the state.

The investments will be on top of the Rs 200 bn already invested in the state, which created more than 18,000 direct and 54,000 indirect jobs.

In the next five years, not only the group aims to double this capacity but also transform these ports into industrial port cities.

The group is also developing 15,000 MW of renewable power projects over the next few years across five districts of Anantapur, Kadapa, Kurnool, Visakhapatnam and Vizianagaram.

Also, the group is working on developing a 400 MW of data centre in Visakhapatnam.

For more details, check out Equitymaster's Indian stock screener which shows all the Adani group companies' fundamental analysis on one screen.

Dig deeper into Adani group stocks

NTPC seeks spot local coal as supply worries mount

Moving on, NTPC, India's largest power producer, is making a rare move to buy domestic coal in the spot market, underscoring rising concerns about a potential squeeze on summer energy supply.

The state-owned generator plans to issue a tender for 3 million tons in the next week or so.

India is bracing for another summer of gruelling heat that's likely to push power demand to a record and pressure the country's grid, which relies on coal for about 70% of electricity generation.

Weather officials have already warned there's a higher probability of extreme temperatures in coming months, stoking worries about a repeat of the deadly heat waves last year.

NTPC, which largely relies on contracted volumes from Coal India, also wants to boost competition and encourage its major supplier to improve quality by adding alternative sources among private mines that are entering production.

With this power consumption on the rise, NTPC stands among the top 5 power companies in India by growth.

The company is also setting up its first green hydrogen fuelling station in Leh, making Leh the first city in India to implement a green hydrogen-based mobility project.

--- Advertisement ---

Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Could the Bears Strike During Election Season?

Discover how this Safe Stock Strategy Could Protect Your Wealth & Potentially Lead to Big Long Term Gains

Full details here

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.com

---------------------------------------------------

With its continued expansion in the renewable energy space, NTPC is one of the top 5 renewable energy stocks to watch out for potential multibagger returns.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Skyrockets 900 Points | PSU Banks & Adani Group Stocks Rally | 5 Reasons Why Indian Share Market is Rising". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!