India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

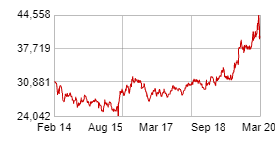

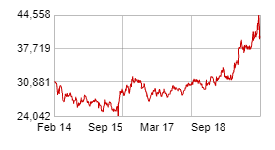

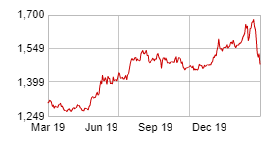

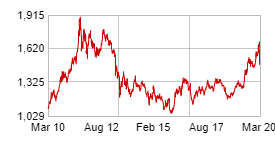

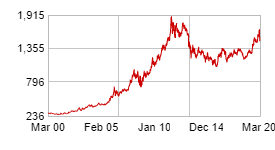

Gold

Gold : Over the fortnight...

|

|

| MOVING AVERAGES | 15 DMA | 30 DMA | 100 DMA | 200 DMA |

| COMPARE WITH | S&P BSE DOLLEX 30 | S&P BSE DOLLEX 100 | S&P BSE DOLLEX 200 | |

| PERIOD | ||||

How to Invest in Gold in India

During the Second World War, there was a popular saying among the rich and powerful in England - 'When you hear the wails of the air raid sirens or the klaxons, buy gold.'

There was wisdom in this argument.

For 3,000 years, mankind has taken shelter in gold. Both as a store of value and as an investment.

Gold is not called "God's own currency" without a reason.

Let's see what happened after a more recent event - the world trade centre attacks on 9/11. Gold traded at sub US$ 275/ounce back then.

Here is what happened to gold prices in the aftermath...

US$ 290 four days later

US$ 277 a quarter later

US$ 324 a year later

US$ 383 two years later

US$ 640 five years later

The London bombings, the government in Cyprus confiscating its citizens money, ISIS entering the global terror scene...

...and now the Coronavirus fallout.

Gold will hold its value in a crisis. Never forget this.

Investing in gold is the cave investors hide in when the mind is overwhelmed with fear and alternate investment ideas run out.

You, as an Indian investing in gold, must contend with the local currency movement as well.

The rupee has a history of depreciating between 3.5% to 5% per annum in the long term.

Every time the rupee falls versus the dollar, gold rises on currency considerations alone. This is why when gold is off its peak in dollar terms it can still be near lifetime highs in INR.

Let's take a look at investing in gold in more detail...

The Emperor of Hard Assets

Gold is so revered that comparisons and idioms like "all that glitters is not gold" are commonly used.

The yellow metal is mined like any other metal and is unfortunately not found in uniform quantities in all countries.

Since time immemorial, gold has been a much sought-after commodity. It has been a yardstick of measuring individual/family and even national wealth.

This precious metal is one of the most favoured hedges against inflation.

Not surprisingly, during times of uncertainties, wars, economic instability especially in financial markets, investors worldwide tend to flock towards gold.

This rush to invest in gold vis-a-vis other assets is also known as "flight to safety" or "safe haven buying."

What Moves the Price of Gold?

Gold tends to move by being influenced by inflation, energy prices, and economic data flow...along with the forces of demand and supply in the market.

It's tends to move inversely to equities, though there have been times when equities and gold have risen together.

The biggest cyclical factor for gold is the festive season demand and the marriage season in this part of the world.

People in Asian countries have a higher attraction towards investing in gold as compared to their western counterparts.

The marriage season in India in April / May and then the second season in October / November. These are typical buying pressure points from Indian investors.

The second season also coincides with Diwali wherein investors consider it auspicious to invest in gold.

Western investors tend to invest in gold towards the Christmas season in December.

This means the last calendar quarter of the year should be a bullish time for this commodity - all other factors being equal.

The Big Reason Why Gold is Rising Now

Ever since the Coronavirus started spreading fast around the world, many people have been surprised that gold prices in the US went up faster than in India.

Why did that happen?

In the month of March, the US Federal Reserve announced the largest ever quantitative easing in the history of America and therefore in the history of financial markets.

The US Fed gave an almost unlimited stimulus to the markets. They said they would stimulate the market as long as it was needed, and therefore bring the US economy back on track.

Now, what it simply means is that the US Federal Reserve started buying bonds and other toxic assets left, right, and center.

They nationalised the losses of the major banks just like in 2008 during the global financial crisis.

What it typically means is that more and more dollars will be printed and that money will flood the markets.

And this is exactly what happened.

What will happen now?

The value of the US dollar will erode. The purchasing power of the US dollar will fall. We have already seen the US dollar fall against global currencies, including the rupee.

This is why, as a hedge against future inflation, people are rushing to invest in gold.

The international markets expect the dollar's purchasing power to erode. They don't seem to fear a similar threat to the rupee in the near future.

This is why, in 2020, gold prices in the US went up faster than in India.

But you shouldn't worry about which gold price is moving faster, dollars or rupees. Considering the money-printing going on around the world, you will make good money by investing in gold, in the long-term.

And you won't be alone!

The Big Money is Betting on Gold

There has been a recent shift in the behaviour of fund managers around the world.

They have started to invest in gold in a significant manner for their clients portfolios. Gold wasn't on their radar before.

The demand and supply in the gold market was usually due to retail investors and traders...not big financial institutions.

But the huge amount of money printing we're seeing around the world, has convinced them to change their minds.

Watch this Fast Profits Daily video, to find out why this is very positive news for the price of gold.

The Best Asset to Preserve Your Wealth

It's a known fact that the key to investment success or even trading success for that matter, is asset allocation. You cannot keep all your eggs in one basket. You must diversify your wealth into different portfolios.

This means you cannot invest all your money in stocks. You must diversity into hard assets too.

Hard assets would mean commodities, not necessarily only gold. You must spread your money across various asset classes.

And yes, you should invest in gold!

It's not only about diversification. There's also the point of the fungibility of gold.

Fungibility is the value of an asset across geographies, across borders.

Gold is a fungible investment which is valued all over the world and is completely divisible. So you split a one kilo of gold into two equal 500 gm bars, both of them will get the same value unlike a diamond.

If you were to split a big diamond in two, the price of these two rocks put together will never be able to give you the price that the big rock would have commanded. So it's equally divisible if it does not diminish its value.

By all means, do allocate a little bit of your assets in gold as a store of value, because when the paper currencies start to lose value, gold will hold its value.

To understand why gold is the best asset to preserve your wealth, we recommend watching this video...

How to Invest in Gold

If you want to invest in gold, you have a choice between physical bars and gold ETFs (Exchange Traded Funds).

We Indians, whille investing in gold, prefer to buy physical gold from their friendly neighbourhood jewellery store.

But it's best to approach a government approved refinery.

It not only works out cheaper, you will also get better sleep at night, knowing the purity of your gold is hallmarked.

In case you choose to buy physical gold, go for standard 99.99% pure hallmarked coins and / or bars only.

Non-hallmarked purchases on verbal assurances of your family jeweller is a risky proposition.

Insist on Hallmarking. Insist on bills. Insist on stamps and clearly purified gold.

When buying physical coins and bars, do note that there will be a 3% difference between the MCX prices and prices at the shop shelf. This is due to 3% GST charged on bullion.

Do not go for delivery via commodity exchanges. The financing costs - cost of carry, rollover, etc - are too high.

If you choose to go with ETFs, take your pick among the many options you have on the BSE/NSE. Their rates are pretty much the same.

An allocation between 5% - 15% of one's total portfolio value can be made to gold.

However, if you're new to the idea of investing in gold, 2% - 3% of the total portfolio is enough to get started.

For my detailed discussion on investing in gold, we recommend this video.

Should You Buy Gold from Your Bank?

The answer is no. It's a bad idea.

While banks will be honest enough to give you gold, which is 99.99% pure, there are three problems here. A problem that many people don't really pay attention to.

As per the banking act, a bank can sell you gold, but it cannot buy back from you. That's problem number one.

Second, banks don't adjust their buying and selling prices frequently. So the price of gold could have come down on the exchanges but they would still be selling at prices a couple of days earlier, which could be higher. This works to your disadvantage.

Third, and most importantly, if you were to buy a gold coin or bar from, say, State Bank of India or Bank of Baroda, they would put their logo there. It would be stamped or embossed on that coin or bar.

Since the bank cannot buy back the bullion from you, you would have to go to your friendly neighbourhood jeweller to sell it. They won't want the SBI or Bank of Baroda logos. They will have to melt it.

Who pays the melting charges? You.

You will always suffer this loss if you buy gold from your bank. This is why you should not consider buying gold from banks.

How to Trade Gold

If you want to trade gold futures, here are the details of the contracts on the MCX.

- Trading unit / contract size - Regular, 1 kg / Mini, 100 gm / Guinea, 8 gm

- Quoted size - Rupees / 10 gm

- Maximum order entry size - 10 kg

- Tick size - Rupee 1 / 10 gm

- Daily price band - 3%, +3%, +3%

- Initial span margin - minimum 5% (20 times leverage)

- Maximum open interest permitted - 5 MT per individual or 5% of overall exposure, whichever is higher

- Contract tenure - Regular lot - 2 months. Mini & Guinea contracts - 1 month

- Number of series available - 4 series open for trade in regular lots, 2 series for a Guinea lot and 3 series for a Mini lot.

As a trader, you should also consider the impact of the gold price on the stock market. Stocks of jewellery companies are immediately impacted. So are gold financing stocks.

Here is a non-exhaustive list -

- Muthoot Finance and Manappuram Finance Ltd - Positive correlation. Higher gold prices lead to an increase in the value of gold pledged with them and increases their safety margins.

- Titan Company Ltd - Positive correlation. Rising gold prices raises the valuation of the inventory stocked by the company at lower prices.

- PC Jeweller - Positive correlation. Rising gold prices raises the valuation of the inventory stocked by the company at lower prices.

Also keep these points in mind when trading gold -

- Monitor global crude oil prices, economic outlook and interest rates.

- Falling USD causes a rally in this precious metal, however limited in magnitude.

- Terror attacks, wars, high inflation, natural disasters, and equity meltdowns are all bullish for Gold.

Even Warren Buffett is Investing in Gold!

A long time gold bear, Warren Buffett, picked up a stake in a gold mining company recently, Barrick Gold.

Gold bulls received a huge boost in terms of market sentiment.

What does this mean for the gold bull market?

If you are a gold bull, you should be very pleased with this news.

Happy Gold Investing!

Helpful Links to Videos About Investing in Gold:

- The Best Asset to Preserve Your Wealth

- The Time to Buy Gold Has Arrived

- Why Large Fund Houses Will Move Gold Prices Higher

- Gold: Bet on God's Own Currency

- The Gold and Silver Bull Market is Not Over

Views On Gold:

After the Sensex Its Time for Gold 40,000

Gold is heading above 40,000 after Sensex. Are you ready to ride this uptrend?

This Could Be the Best Trade of the Year

My short-term views on the two assets, I'm most bullish on.

The Best Asset Class to Invest in 2020

Why I'm most bullish on this asset class above all else in 2020.

Gold is Rising but You Shouldn't Be Happy About It

Gold is rising but it's not a cause for cheer.

Today's Market

![Sensex Today Rallies 1,961 points | Nifty Above 23,900 | 4 Reasons Why Indian Share Market is Rising]() Sensex Today Rallies 1,961 points | Nifty Above 23,900 | 4 Reasons Why Indian Share Market is Rising(Closing)

Sensex Today Rallies 1,961 points | Nifty Above 23,900 | 4 Reasons Why Indian Share Market is Rising(Closing)

After opening the day higher, Indian benchmark indices remained positive as the session progressed and ended the day on firm footing.