India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 30, 2016

Sensex Trades in the Green; FMCG Stocks Witness Buying Interest Fri, 30 Dec 11:30 am

After opening the day flat, the Indian share markets registered gains and are presently trading on a positive note. Sectoral indices are trading in the green with stocks in the FMCG sector and capital goods sector witnessing maximum buying interest.

The BSE Sensex is trading up 260 points (up 1%) and the NSE Nifty is trading up 75 points (up 0.9%). The BSE Mid Cap index is trading up by 1.2%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 67.94 to the US$.

Market participants are keeping tabs on the demonetisation deadline. Prime Minister Narendra Modi's 50-day demonetisation drive ends today and market participants are expecting tax sops from the government to boost the economy.

As per a leading financial daily, the government is expecting a robust fiscal situation led by demonetisation. It is banking on higher tax collections through the income disclosure scheme as also the cancellation of Reserve Bank of India's (RBI) liability in lieu of the demonetised notes.

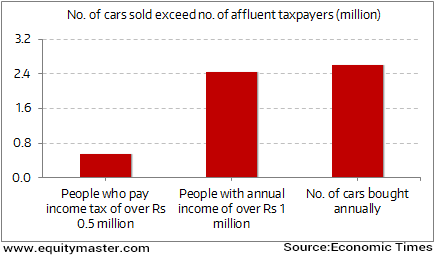

While the above moves will mean a higher tax collection, there's a clear sign that many Indians are not paying up their taxes very dutifully. As is seen in the chart below, the number of cars sold in India is actually higher than the number of people declaring annual income of over Rs 1 million.

India Low on Taxpayers, High on Car Buyers

As we mentioned in our recent edition of The 5 Minute WrapUp:

- Reports suggest that while annual car sales on an average in last three years has been about 2.6 million per year, the number of people in the country who declared an annual income of over Rs 1 million stood at just 2.4 million.

Further, while luxury brands like BMW, Jaguar, Audi, Mercedes, Porsche and Maserati sell almost 35,000 cars a year, an Economic Times report highlights that only about 48,000 persons reported income of over Rs 10 million in a year.

This comes as yet another data point which indicates that many Indians are shying away from paying up their taxes.

Moving on to news from the global financial markets, Japan's core consumer prices slumped for the ninth straight month. The core consumer price index, which includes oil products but excludes volatile fresh food prices, slipped 0.4% in November from a year earlier. Furthermore, core consumer prices in Tokyo, which are available a month before the nationwide data, fell 0.6% in December from a year earlier. This was seen as weak clothing sales forced retailers to cut prices.

The household spending too slumped in November. Data showed that housing spending fell 1.5% in November from a year earlier in price-adjusted real terms. This was against a median market forecast for a 0.2% increase. The data suggested that slow wage growth was keeping consumers in Japan from shopping.

This data suggested that Japan still lacks enough momentum to jump-start inflation towards Bank of Japan's (BOJ) ambitious 2% target. One must note that the BOJ has repeatedly pushed back the timing for achieving its inflation target.

The bank is still pushing the above efforts. It has maintained its negative 0.1% interest rate imposed on banks for some excess reserves. It has also kept the 10-year Japanese government bond (JGB) yield target at around zero and its annual increases in JGB holdings at 80 trillion yen.

However, all of the above efforts by BOJ, including three years of aggressive money printing, have failed to spur inflation. If there's one place on this planet that epitomises all the wrong kinds of growth, it's Japan. Too much money printing...too much debt...too much government intervention...too much stock market manipulation...

So why bother about Japan? Because that's where the rest of the world's central banks appear to be heading.

We don't know about the timing. But the end is going to be ugly. If you want to know what's really happening in the world of man and money, you can claim your free copy of Bill Bonner's latest book, Hormegeddon.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in the Green; FMCG Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!