India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 30, 2016

Sensex Stays Positive; FMCG Stocks Witness Buying Interest Fri, 30 Dec 01:30 pm

After opening the day on a marginally positive note, the Indian share markets have continued to remain positive and are trading in the green. All the sectoral indices are trading above the dotted line, with stocks in the FMCG Sector leading the gains.

The BSE Sensex is trading up 276 points (up 1%) and the NSE Nifty is trading up 78 points (up 1%). Meanwhile, the BSE Mid Cap index is trading up by 1.2%, while the BSE Small Cap index is trading up by 1%. The rupee is trading at 67.94 to the US$.

Shares of GE Power India Limited (GEPIL) surged over 7% in intra-day trading today after the company bagged a contract worth US $40 million from Bharat Heavy Electricals Limited (BHEL) for supply of components and services for two thermal power projects in Tamil Nadu.

In a BSE filing, GEPIL said that the contract is for 2x800 MW coal-based Uppur Thermal Power Project and 1x800MW coal-based North Chennai Supercritical Thermal Power Project Stage-III.

The company added that both the thermal power projects are located in the southern state of Tamil Nadu and the current development is line with the government's focus on upgrading the power infrastructure in the country.

As part of the scope of the contract, GEPIL will partner with BHEL to supply identified pressure parts of the boilers. It will also provide BHEL with technical advisors during the erection and commissioning of the units related to the boilers. Key components for both the projects will be manufactured in GE's state-of-the-art manufacturing facility in Durgapur, West Bengal.

In related news, shares of BHEL witnessed buying interest too after it announced that it had successfully commissioned another 600 MW coal-based thermal power plant in the state of Telangana. The unit has been commissioned at the 2x600 MW Singareni Thermal Power Project (TPP) located in Adilabad district in Telangana. The first unit of the project was earlier commissioned in March, 2016.

At the time of writing the shares of GE Power stood at Rs 476 (up 5.1%) while BHEL's shares were trading at Rs 120 (up 1.4%).

Moving on to news in the telecom/banking sector. Idea Cellular, in a joint venture with HYPERLINK "https://www.equitymaster.com/result.asp?symbol=IRYN&name=ADITYA-BIRLA-NUVO-Stock-Quote-Chart" Aditya Birla Nuvo Ltd (ABNL) is set to launch the Aditya Birla Idea Payments Bank in the first half of 2017.

This follows closely on the heels of rival Bharti Airtel, whose Airtel Payments Bank became the first payments bank to go live in the country with the rollout of its banking services in Rajasthan in November.

Aditya Birla Idea Payments Bank is a 51:49 joint venture between ABNL and telecom major Idea Cellular, respectively.

The payments bank JV will acquire customers online, leveraging on Aditya Birla Group's nearly 45 million digital customers as well as offline riding on the strength of Idea's over 2 million retail distribution channel across 3.9 lakh towns and villages, ABNL said.

It will partner with its 100% financial services arm Aditya Birla Financial Services (ABFS), along with select universal banks to offer a range of banking products. The company will integrate the National Electronic Funds Transfer, Immediate Payment Service and Prepaid Payment Instruments business of Idea with the new Payments Bank to run as single entity.

With the objective of deepening financial inclusion, RBI kicked off an era of differentiated banking by allowing SFBs (small finance banks) and PBs (payments banks) to start services. A total of 21 entities were given in-principle nod last year, including 11 for payments banks. Payments banks can accept deposits from individuals and small businesses up to a maximum of Rs 1 lakh per account.

India's major telecom operators are pushing ahead the government's broad agenda to move towards cashless economy, at a time when demonetisation has crippled cash payments due to inadequate cash in the system.

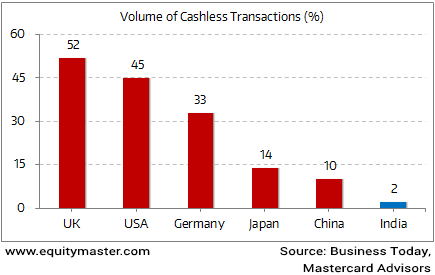

However, this push towards a cashless economy may not have the desired results in a country where nearly 98% of the transactions by volume are undertaken in cash.

Is India Ready to Go Digital?

To go cashless would mean a complete overhaul of how Indians spend their money. Banks and other financial institutions banks will have to be technologically competent to tackle the security issues associated with the shift towards a digital economy.

All these are major changes, and thus beg the question - Is India ready to go digital?

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Stays Positive; FMCG Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!