India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 27, 2016

Sensex Opens Flat, L&T Up 0.6% Tue, 27 Dec 09:30 am

Asian stock markets are mostly higher in thin trading, though gains are muted as the US and European markets were closed overnight for Christmas holidays. The US dollar strengthened, while crude oil futures edged higher in Asian trades. Japanese benchmark Nikkei 225 was up 0.3% in morning trade.

Meanwhile, Indian share markets have opened the day on a flat note. The BSE Sensex is trading higher by 28 points and the NSE Nifty is trading higher by 21 points. Meanwhile, S&P BSE Mid Cap and S&P BSE Small Cap are trading higher by 0.3% respectively. The rupee is trading at 67.83 against the US$. Barring realty sector, all the sectoral indices are trading in green with pharma and consumer durables' stocks leading the gains.

L&T's share price began the trading day on an optimistic note (up 0.6%) after it was reported that the company's construction arm -- L&T Constructions has bagged orders worth Rs 30.39 billion across various business segments. The company received orders worth Rs 14.22 billion under water and effluent treatment segment. The scope includes survey, investigation, design, procurement, construction and installation of pumping systems, rising and gravity / main lines, branch lines, distribution network, control and regulation systems to bring more than 36,000 hectares of land under irrigation.

Under power transmission & distribution business, the company has secured major orders worth Rs 10.36 billion for electrification works under Integrated Power Development Scheme (IPDS) and Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) schemes of the Government of India.

Furthermore, the company's Heavy Civil Infrastructure Business has won an order worth Rs 3.59 billion from the Inland Waterways Authority of India (IWAI) for the engineering, procurement and construction of a new navigational lock at Farakka, West Bengal.

Meanwhile, L&T will continue to hire rapidly and that it is confident of future growth across its businesses. The announcement comes after the company cut about 11% of its workforce across its various businesses in the last six months.

L&T has cut about 14,000 jobs across businesses in the past six months due to factors such as change in technology, use of automation, redundancy, and performance, its management said last month in Mumbai.

Engineering stocks began the trading day on a negative note with Welspun Corporation and Voltamp Transformers leading the losses.

In another development, according to an article in The Financial Express, global merger and acquisition activity has soared to US$ 3.1 trillion. However, the M&A deal tally so far this year registered a 22% decline in value terms and 10% fall in the number of transactions over the last year. Last year, the global deal tally stood at US$ 3.9 trillion.

Sector wise, energy, utility and mining attracted deals worth US$ 582.8 billion by way of 1,351 deals, followed by Industrials and chemicals (USD 498.5 billion, 3,056 deals) and technology (US$ 401.4 billion, 2,115 deals).

The report also noted that Chinese dealmakers engaged in 242 deals worth US$ 171 billion outside of Asia, 3.5 times higher than 2015's previous record value.

The report further noted that going forward "the outlook for 2017 remains uncertain", with Brexit negotiations, the nature of Trump's Presidency as well as the French and German elections, all under question.

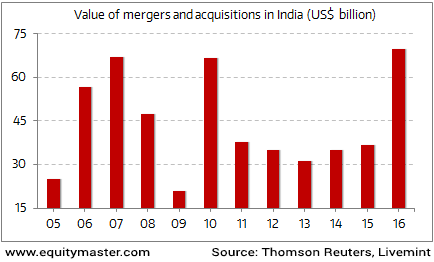

Meanwhile, back home, the value of M&As that have taken place this year stood at US$ 69.75 billion. This even beats the previous record of US$ 66.96 billion set in 2007.

Indian M&A Activity at an All Time High

Indian conglomerates have reportedly used the increase in investor interest to sell assets for deleveraging balance sheets and utilizing cash flows for investments in core businesses, which has been a significant driver of transactions in the infrastructure sector.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat, L&T Up 0.6%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!