India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 26, 2016

Sensex Finishes Weak; Tata Steel Down 2.6% Mon, 26 Dec Closing

The Indian share markets remained negative and headed for a weak close on fears of likely increase in long term capital gains tax. At the closing bell, the BSE Sensex closed lower by 234 points, whereas the NSE Nifty finished lower by 78 points. The <>S&P BSE Midcap ended down by 2.2% while the S&P BSE Small Cap finished down by 2.1%. All sectoral indices ended the day on a negative note. Metal, realty stocks and healthcare stocks witnessed the maximum brunt.

Asian markets finished mixed as of the most recent closing prices. The Shanghai Composite gained 0.40%, while the Hang Seng led the Nikkei 225 lower. They fell 0.28% and 0.16% respectively. European markets finished mixed as of the most recent closing prices. The CAC 40 gained 0.10% and the FTSE 100 rose 0.06%. The DAX lost 0.05%.

The rupee was trading at Rs 67.83 against the US$ in the afternoon session. Oil prices were trading at US$ 53.23 at the time of writing.

According to an article in The Economic Times, Tata Steel has signed an agreement to acquire Odisha-based iron ore pellet manufacturer Brahmani River Pellets Ltd (BRPL) for Rs 9 billion in cash. BRPL owns a 4 million tons per annum capacity pellet plant in Jajpur and a 4.7 million tons' iron ore beneficiation plat in Bardil, Odisha.

BRPL was originally established by the Moorgate Industries Group (MIG). The company has executed definitive agreements to acquire 100% equity shares of BRPL from Aryan Mining and Trading Corpn Private Ltd (AMTC) and other companies in the MIG.

Further, the acquisition provides an upstream integration opportunity to Tata Steel to meet its metallic requirements and improving the feed mix for its Kalinganagar steel plant and Jamshedpur steel plant. Moreover, the company plans to reduce its freight cost by using BRPL's slurry pipeline to transfer iron ore from its captive mine in the Joda and Khondbond region.

Notably, JSW and several other steel majors had been eyeing BRPL's assets, which include a 4-mt pellet plant in Jajpur and a 4.7-mt per annum iron ore beneficiation plant in Barbil connected with a 220-km underground slurry pipeline.

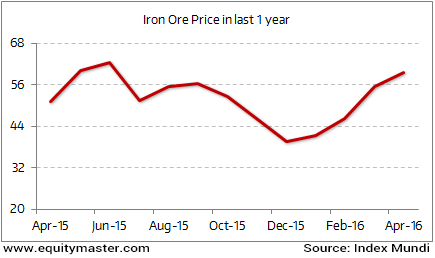

Iron ore has had an eventful start to the year. It's up 50%, making it the best performing globally traded industrial commodity year-to-date. With subdued demand in the domestic market and the rising supply, the situation is not encouraging.

Iron Ore Recovers in 2016

Caught between slowing Chinese demand and relentless production growth, 2016 was supposed to bring more pain for the iron ore industry.

Tata Steel's share price finished down by 2.6%.

Moving on to the news from

ScPharmaceuticals is developing a portfolio of pharmaceutical products for subcutaneous (under the skin) delivery.

This move comes on the back of Sun Pharma's plan of enhancing its portfolio of complex generics and specialty products as the generic drugs business slows in the face of pricing pressure and risen competition in the US, and regulatory issues at its manufacturing plants. This is a small acquisition but is in line with its strategy to build a pipeline of specialty and complex products.

As the M&A activity has been heating up globally, the M&A activity in the Indian pharma space has been on the rise in recent times. Rahul Shah has penned an interesting piece in one of the edition of The 5 Minute WrapUp on how generic pharma companies are benefitting from global M&A activity. Here's an excerpt from the article:

- "M&A activity among the innovators provides an opportunity for the generics to build a product portfolio by buying the product basket. For small to midsized companies, this is perhaps the quickest way to expand.

Given the high costs and even higher risks in developing a drug, the innovator companies have increasingly turned towards investing resources in the acquisition of existing drugs or promising ones already in the pipeline."

Sun Pharma's share price ended the day down by 1.9%.

And here's an update from our friends at Daily Profit Hunter...

Nifty continued its previous weeks losing streak on Monday. It opened 20 points gap down, continued to drag throughout the day and ended today's session at 7908, down by a percent. Nifty closed below its previous low of 7929 from November 21. Adding to the negative sentiment, todays close also printed below the Brexit day's low of 7927. It seems like bulls are slowly losing their grip on the index. 7,900 is a key support level to watch out for. If Nifty is unable to hold these levels during the week then further weakness cannot be ruled out.

Nifty Closes below its previous low of 7916

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes Weak; Tata Steel Down 2.6%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!