India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 26, 2016

Sensex Stays in the Red; Realty Stocks Witness Maximum Selling Pressure Mon, 26 Dec 01:30 pm

After opening the day on a negative note, the Indian share markets have continued to trade below the dotted line. All the sectoral indices are trading on a negative note, with stocks in the Metal Sector and the Realty sector leading the losses.

The BSE Sensex is trading down 212 points (down 0.8%) and the NSE Nifty is trading down 70 points (down 0.9%). Meanwhile, the BSE Mid Cap index is trading down 1.8%, while the BSE Small Cap index is trading down 1.6%. The rupee is trading at 67.82 to the US$.

Shares of Divi's Laboratories tanked 22% last Friday - their biggest single day fall ever - based on reports of strong observations made by the US Food and Drug Administration (USFDA) on the company's facility in Vishakhapatnam. The stock has continued to plunge in today's trade, going down by almost 11% since the markets opened today. It also touched a 52-week low of Rs 745 on the back of heavy volumes.

Divi's manufactures active pharmaceutical ingredients (APIs) and intermediates for generics among others at the Vishakhapatnam facility.

The facility accounts for 70% of the company's overall business and more than 75% of its overall capacity. United States accounts for 32% of overall sales and most of these came from this facility.

USFDA inspected the facility from 29 November to 6 December and issued a Form 483 with five observations.

Form 483 relates to certain critical observations issued to a company at the end of an inspection if there were any violations of the Food Drug and Cosmetic Act and other related acts of the US Government.

Companies that receives its observations must respond in writing with a corrective action plan and implement it quickly. If the company fails to meet the USFDA's expectations, a warning letter may be issued.

Reportedly, the USFDA observations were made on five grounds - lack of proper control over computer system, equipment not maintained to ensure purity and quality strength and identity of APIs, R&D division guides quality and production to commence activities, failure to conduct thorough investigation with respect to complaints received, and documentation not maintained or was inaccurate.

Meanwhile, the stock exchange sought clarifications from Divi's Laboratories on 23 December. The company responded by saying that it will respond to the USFDA observations within the permitted time frame, and also added that the observations have not impacted its operations.

The pharma sector in India has come under regulatory pressure in the recent months, with many of the industry's major players suffering due to lax regulations. Divi's Laboratories being the latest victim.

At the time of writing the shares of Divi's Laboratories were trading at Rs 768 (down 11%)

Moving on to news from the Energy Sector , state run Oil and Natural Gas Corporation (ONGC) approved the plan to acquire the entire 80% participating interest of Gujarat State Petroleum Corporation Ltd.'s (GSPC) block - Deen Dayal West field- in the Krishna-Godavari basin for a consideration of US $ 995.3 million.

ONGC would also pay GSPC $200 million towards future consideration for six discoveries other than Deen Dayal West Field, which will be adjusted against the valuation of these discoveries after the approval of their field development plans.

The block, KG-OSN-2001/3, was allotted to GSPC during the third round of the National Exploration Licensing Policy (NELP), through which awards hydrocarbon assets for exploration and production.

GSPC had announced the gas discovery in the Deen Dayal West field in 2005. Subsequently, the company faced unexpected technical hurdles resulting in a rise in development expenditure, debt and delay in execution. The investments in the block drove up GSPC's debt 180% in four years to Rs 19,700 crore by March 2015.

GSPC has spent US $3 billion to develop the field but hasn't been able to start commercial production.

According to a statement released by ONGC, trial gas production from Deen Dayal West Field has already begun. Upon successful completion of the transaction, it shall endeavour to bring the field on commercial production and use the infrastructure developed by GSPC for the Deen Dayal West field to fast-track the development of its neighbouring fields in the Krishna-Godavari basin.

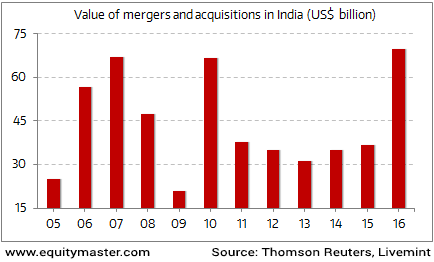

This acquisition adds one more to the growing list of mergers and acquisitions in 2016. The value of M&As that have taken place this year is the highest on record for India.

Indian M&A Activity at an All Time High

The deal is seen as a bailout of GSPC by some, and a bargain acquisition by ONGC by others. It should be noted that the deal would also mean ONGC shouldering most, if not all of GSPC's Rs 19,700 debt.

According to industry experts, ONGC might need another US $1-1.5 billion to develop the Deen Dayal West field further.

It remains to be seen how ONGC leverages this purchase and takes action to make the most of this deal.

At the time of writing, shares of ONGC were trading down by 1.8%

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Stays in the Red; Realty Stocks Witness Maximum Selling Pressure". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!