India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 19, 2016

Sensex Remains Flat; Energy Stocks Witness Buying Interest Mon, 19 Dec 11:30 am

After opening the day on a flat note, the Indian share markets have continued to trade near the dotted line. Sectoral indices are trading on a mixed note with stocks in the energy sector and power sector witnessing maximum buying interest. Realty sector and consumer durable sector stocks are trading in the red.

The BSE Sensex is trading down 59 points (down 0.2%) and the NSE Nifty is trading down 15 points (down 0.2%). The BSE Mid Cap index is trading down by 0.1%, while the BSE Small Cap index is trading flat. The rupee is trading at 67.73 to the US$.

As per a leading financial daily, Finance Minister Arun Jaitley has said that the Goods and Services Tax (GST) can be implemented anytime between April 1 and September 16, 2017. He said that the law will be passed in accordance with the constitutional amendment legislation that allows a national sales tax by subsuming central and state levies.

The above announcement was made amid signs of slippage of the April 1 GST rollout target. In its meeting last week, the GST Council was unable to clear the draft GST law. That made the law not likely to be rolled out from April 1, 2017. The Council is now going to meet on December 22-23 to consider the remaining issues.

Earlier last month, the government finalised the tax rates for GST. The development came as GST Council decided upon a multi-layered tax rate system. The Council finalised a four-tier tax structure, with the tax rate on items of mass consumption at 5%. Other slab rates are 12%, 18%, and 28%. To get a detailed view on the Goods and Services Tax (GST), you can read Vivek Kaul's report, GST & You: What the Media DID NOT TELL YOU about the GST.

One shall note that along with the demonetisation drive, the government is pursuing GST with tenacity in order to make Indians more tax compliant.

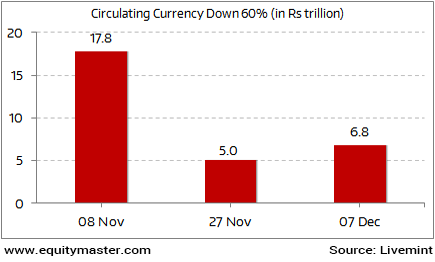

Speaking of demonetisation, numbers released by the Reserve Bank of India (RBI) show that a month after demonetisation, currency in circulation continues to fall. As per the data, currency in circulation as on 9th December stood only a tad more than half of what was in circulation before demonetisation.

After factoring in deposits, withdrawals, and exchange of cash, between 9th November and 7th December, the amount of cash in public hands for carrying out transactions has fallen 60%. This can be seen in the chart below:

Note Ban Impact on Currency

The above effect is a direct result of the withdrawal of the Rs 500 and Rs 1,000 notes. These notes formed 86% of currency in circulation pre-08 November.

The issue is this: the massive stock of money after demonetisation hasn't been re-monetised yet. And this is because the printing (i.e. supply) of the new Rs 2,000 and Rs 500 notes has not kept pace with demand. While the currency in circulation dropped by Rs 14 trillion, the RBI had replenished only Rs 4 trillion.

As Vivek Kaul explained in The Dairy,

- It is worth remembering here that the capacity of the printing presses supplying RBI with notes is around 300 crore notes per month. This, when the presses work 24 hours a day and for the full month.

The total number of 500 rupee notes demonetised stand at 1,716.5 crore. At 300 crore notes a month, it will easily take five to six months to replace the total lot. Even if all the notes are not printed, given the push towards cashless, it will be a while before there is enough cash going around in the economy.

Hence, the point is that people are not hoarding cash. There simply isn't enough cash going around.

The above mess, in our view, will take another 5 to 6 months to get resolved. Economic activity will remain under pressure until then.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Flat; Energy Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!