India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News December 19, 2016

Indian Share Markets Open Marginally Lower; Axis Bank Drags Mon, 19 Dec 09:30 am

Asian stock markets are mostly in red in morning trade following the negative lead from Wall Street. The Shanghai Composite is off 0.25% while the Hang Seng is down 1.06%. The Nikkei 225 is down 0.22%. Stock markets in Europe closed their previous session on a firm note.

Meanwhile, Indian share markets have opened the day on a flat note with a negative bias. The BSE Sensex is trading lower by 71 points while the NSE Nifty is trading lower by 19 points. The BSE Mid Cap index opened up by 0.1% while BSE Small Cap index opened flat. The rupee is trading at 67.78 to the US$.

Barring realty, PSU, oil & gas stocks, all sectoral indices have opened the day in red with auto and banking stocks witnessing maximum selling pressure.

As per an article in The Economic times, Axis Bank announced to cut the marginal cost of lending rate (MCLR) by 0.1-0.15% across tenors with effect from 17 December 2016. Thereby signaling a further downward trend in borrowing costs.

Reportedly, the one year MCLR has been set at 8.90%. The one-month MCLR is at par with the overnight rate of 8.55%, the three-month MCLR is at 8.75%, while the six-month will be 8.85%.

Even as the Reserve Bank of India (RBI) chose to leave the repo rate unchanged at its December 7 monetary policy review, banks continue to pass on the benefit of past cuts and the demonetisation-driven surge in bank deposits to borrowers. The one-year MCLR now stands at 8.9%, at par with that of State Bank of India (SBI), ICICI Bank and HDFC Bank.

On November 8, the government had announced that Rs 500 and Rs 1000 currency notes would cease to be legal tender. Subsequent to the announcement, banks received deposits worth Rs 12.4 trillion as on December 10, according to the RBI even though the government has flagged the possibility of repeat counting of deposits.

Reportedly, the surge in deposits has resulted in a drop in the cost of funds for banks. In an environment of weak credit demand, banks have responded by cutting the deposit rates, which is generally a pre-cursor to a lending rate cut.

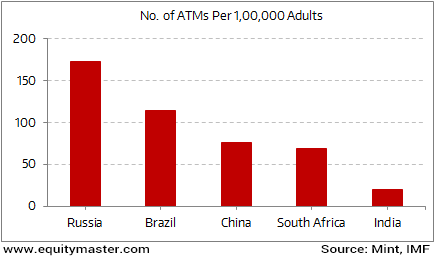

Speaking about demonetisation, the entire country has been facing an acute shortage of liquid cash. This has led to the debate over the country's currency circulation, and whether its banking penetration and ATM reach are enough for its huge population.

Banking Penetration a Major Challenge in India

As you can see in the above chart, during 2015 the penetration of ATMs was quite poor in India when compared to its peers. According to World Bank data, the number of bank branches per 100,000 adults in India was 9 and 13 in 2004 and 2014, respectively. But India has got a long way to go to catch up with many developed countries. Apparently, it is critical that the RBI looks into the penetration of banking services along with financial inclusion.

Axis Bank's share price opened down by 1%.

Moving on to the news from stocks in power sector. NTPC Ltd and National Aluminium Company (NALCO) have jointly agreed to set up a 2,400 MW coal-based power project in Odisha's Dhenkanal district.

To this effect, NTPC has signed an MoU with NALCO to establish a joint venture company for developing a coal based power plant in Gajmara. NALCO will utilize the energy produced at this unit to power its aluminium smelter.

The estimated investment in all these projects will be approximately Rs 360 billion. The move come son the back of rising concern about the pollution being caused by thermal power plants in the region. NTPC has approved a proposal to modernize all power plants older than 25 years within next 5 years. This will be done by replacing them with energy efficient supercritical power plants.

Reportedly, the proposed power plant will comprise three units of 800 megawatts (MW) each. It will source coal from the mines operated by NALCO. Moreover, this JV project will act as a catalyst for industrial growth in the region. This will help create direct and indirect employment for engineers, supervisors and skilled, semi-skilled and unskilled workers.

Further, it will also strive to keep the cost of power generation to a minimum so as to benefit aluminium production for automobile and aerospace industries to improve energy efficiency, the reports noted.

NTPC's share price opened down by 0.3% while NALCO's share price opened the day up by 1.8%.

Keywords: BSE Sensex, BSE, NSE Nifty, NSE, Indian stock markets, Indian share markets, BSE Midcap, BSE Small cap, Rupee Dollar exchange rate, Sensex today, todays share market, share market India, Power & Banking Sector, NALCO Share price, NTPC share price, Axis Bank share price, NALCO, NTPC, Axis Bank, Demonetisation.

GAIL's share price opened the day down by 0.9%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Share Markets Open Marginally Lower; Axis Bank Drags". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!