Investment in securities market are subject to market risks. Read all the related documents carefully before investing

Grab Our Small Cap Recommendation

Service at a 60% Discount

- Home

- Todays Market

- Indian Stock Market News November 12, 2020

Sensex Ends 236 Points Lower; Finance and Banking Stocks Witness Selling Thu, 12 Nov Closing

Indian share markets witnessed selling pressure throughout the day today and ended lower.

Benchmark indices snapped their eight-day winning streak and edged lower even as Finance Minister Nirmala Sitharaman announced 12 measures under 'Atmanirbhar Bharat 3.0'.

At the closing bell, the BSE Sensex stood lower by 236 points. Meanwhile, the NSE Nifty ended down by 58 points.

SBI was the top loser in NSE. Meanwhile, the top gainers in NSE today include HUL and Grasim.

SGX Nifty was trading at 12,734, down by 23 points, at the time of writing.

The BSE Mid Cap index ended up by 0.5%. The BSE Small Cap index ended up by 1.2%.

On the sectoral front, finance stocks and banking stocks witnessed selling pressure. FMCG stocks, on the other hand witnessed buying interest.

Asian stock markets ended on a negative note. As of the most recent closing prices, the Hang Seng ended down by 0.2% and the Shanghai Composite stood lower by 0.1%. The Nikkei ended up by 0.7%.

US stock futures are trading mixed today. Nasdaq Futures are trading up by 70 points (up 0.6%), while Dow Futures are trading down by 151 points (down 0.5%).

The rupee is trading at 74.61 against the US$.

Gold prices are trading up by 0.5% at Rs 50,400 per 10 grams.

Note that gold prices have seen a sharp correction this week, falling about Rs 2,000 per 10 grams.

Speaking of the precious metal, India's #1 trader, Vijay Bhambwani talks about whether you should buy gold now, in his latest video for Fast Profits Daily.

In the video below, Vijay shares what implications the recent fall in gold prices could have for gold as an investment.

So, does the fall in gold prices mean the bull market is over? Or does it mean it is a great opportunity to buy?

Tune in here to find out more:

To know more about gold, you can check out our detailed article on investing in gold here: How to Invest in Gold?

RBI Says India in Historic Recession

In news from the economic space, India's economy probably shrank for a second straight quarter, according to a team of economists including Michael Patra, the central bank's deputy governor in charge of monetary policy, pushing the country into an unprecedented recession.

Gross domestic product (GDP) contracted 8.6% in the quarter ended September, the Reserve Bank of India (RBI) showed in its first ever published 'nowcast,' which is an estimate based on high-frequency data.

The economy had slumped about 24% in April to June.

"India has entered a technical recession in the first half of 2020-21 for the first time in its history," the authors wrote. The government is due to publish official statistics November 27.

RBI's numbers are buoyed by cost cuts at companies, which boosted operating profits even as sales dipped. The team of authors also used a range of indicators from vehicle sales to flush banking liquidity to signal brightening prospects for October.

However, there is a grave risk of generalization of price pressures, unanchoring of inflation expectations feeding into a loss of credibility in policy interventions, the team of economists wrote in RBI's bulletin.

They also highlighted risks to global growth from a Covid second wave.

Stimulus 3.0

Finance Minister Nirmala Sitharaman today announced 12 measures in the next set of stimulus under Atmanirbhar Bharat 3.0 aimed at boosting employment, credit and manufacturing. The stimulus will cost the government Rs 2.65 lakh crore, or 15% of the country's GDP.

The measures include a Rs 650-billion fertilizer subsidy for farmers to ensure adequate availability of fertilisers to farmers.

The government announced relaxations in income tax rules to allow sale of primary residential units of up to Rs 20 million value below the circle rate. Till now, only 10% difference between the circle rate and the agreement value was allowed.

Other measures include:

Subsidy to be given to those establishments that make new hires.

Additional credit of up to 20% of outstanding loans will be given for entities with outstanding credit up to Rs 500 million and annual turnover up to Rs 2.5 billion.

Rs 9 billion grant to the Department of Biotechnology for Covid-19 vaccine research.

Rs 102 billion additional budget outlay will be provided towards capital and industrial expenditure, which covers domestic defence equipment, industrial incentives, industrial infrastructure and green energy.

What effects the above measures have on Indian economy and Indian stock market remains to be seen.

Moving on to stock specific news...

Dewan Housing Finance (DHFL) was among the top buzzing stocks today.

A day after bankrupt mortgage lender DHFL received revised bids from prospective investors, its former promoter Kapil Wadhawan sought a second hearing from lenders to reconsider his resolution proposal submitted last month.

In a letter sent to DHFL administrator R. Subramaniakumar, Wadhawan requested the lenders to let him attend their next meeting via video-conference, and sought one week's time to arrange for the facility.

Kapil and his brother Dheeraj are currently in jail for their alleged involvement in the Yes Bank money laundering case.

Wadhawan said these bids were abysmally low and will result in loss of public money. He also repeated his request to the creditors to consider his proposal to make full repayment to all financial creditors without any haircut.

Wadhawan argued that the offer of Rs 250 billion for the entire company is not justified as the cash on hand, investment and real estate of DHFL alone is above Rs 160 billion, without considering its retail/wholesale portfolio.

He said the value of the retail portfolio, which had stood at Rs 400 billion as of 31 March, would now be close to Rs 300 billion after discounting for further impairment on account of covid-19.

Bids of Rs 150-200 billion are unjustified when DHFL has assets of more than Rs 680 billion, he added.

On Tuesday, it was reported that four bidders for DHFL have submitted their revised offers to the company following lenders' request.

Oaktree Capital has revised its bid price for the entire portfolio to Rs 310 billion from Rs 280 billion earlier.

Piramal Enterprises has revised its bid price for the retail portfolio to Rs 260 billion from Rs 150 billion earlier.

Adani has offered Rs 27 billion for the wholesale and SRA book compared to Rs 22 billion earlier and SC Lowy has upped its bid for the non-SRA book to Rs 23 billion from Rs 15 billion earlier.

We will keep you updated on the latest developments from this space. Stay tuned.

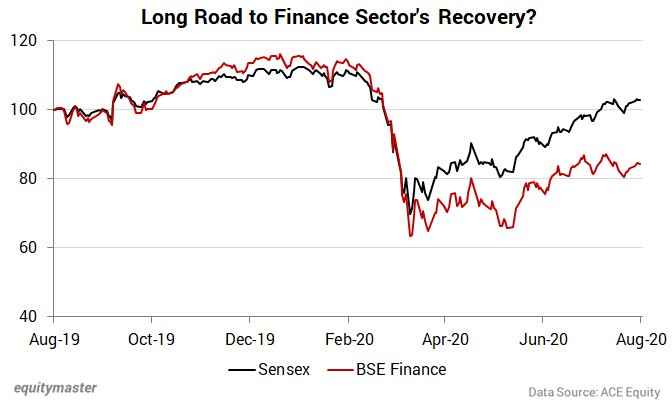

Speaking of the finance sector, note that the market crash impacted all stocks, but finance stocks took the worst hit.

Even as the Sensex made a comeback to pre-Covid levels, the slowdown and asset quality concerns amid the moratorium extension, is an overhang on the financial sector.

Richa Agarwal, lead Smallcap Analyst at Equitymaster, expects a long road to recovery for this sector.

Here's what she wrote about it in one of the editions of the Profit Hunter:

- Just to be sure, being cautious in this sector makes sense to me. However, I believe it would be folly to paint all financial stocks with the same brush.

Financials, especially NBFCs, have gone through multiple disruptions and challenges in the last few years - demonetisation, the IL&FS crisis, and now...coronavirus and moratoriums. This has led to a liquidity squeeze for these players, due to a risk aversion attitude among investors and lenders.

The streak of disruptions will force inefficient and unorganised players in this sector to scale back. I also see a consolidation happening. The survivors and beneficiaries of this shift will be the well capitalised companies with balanced growth and high asset quality.

Investors who identify these stocks now and are willing to be patient with returns, will be rewarded with huge rebound gains.

Richa recently recommended one such stock - a high quality NBFC. Subscribers can read the report here (requires subscription).

And if you are not a Hidden Treasure subscriber, here's where you can sign up.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Ends 236 Points Lower; Finance and Banking Stocks Witness Selling". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!