India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News April 20, 2017

Sensex Trades in Green; Bank Stocks Drag Thu, 20 Apr 01:30 pm

After opening the day on a flat note, share markets in India witnessed volatile trading activity and are currently trading marginally higher. Except for stocks in the banking sector, all sectoral indices are trading in green. Stocks in the realty sector and stocks in the consumer durables sector are leading the gains.

The BSE Sensex is trading up by 76 points (up 0.3%), and the NSE Nifty is trading up by 27 points (up 0.3%). Meanwhile, the BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 1% The rupee is trading at 64.63 to the US$.

In news from stocks in the PSU sector. National Aluminium Company (Nalco) share price is in focus today after the Government announced plans to dilute 10% in the company through the offer-for-sale route.

The Centre fixed the floor price at Rs 67 a share. The offer opened on Wednesday for institutional investors and opened today for retail investors. Through the issue, the government plans to sell 96.6 million shares which make up 5% of the paid-up share capital of the company. The centre said it was considering an additional option to sell up to 5% more.

Allotted retail investors will be getting a discount of 5% to the cut-off price.

The government at present holds 74.6% in the company and the stake sale will fetch it Rs 6.47 billion at the price of Rs 67 per share.

In FY17 Nalco's share price saw an appreciation of 94.6% against a gain for the benchmark Sensex of 17.22%.

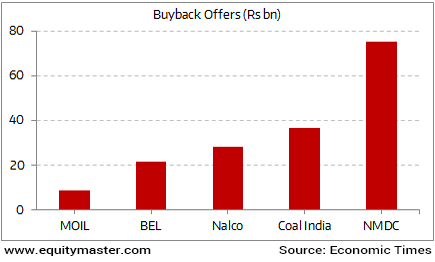

The sale of shares in Nalco via the OFS route follows a buyback by the company of its shares in FY17 for an amount of Rs 28.4 billion to achieve the divestment target for the fiscal. Major PSU companies saw buybacks in the last fiscal in an effort to reach an ambitious target of raising close to Rs 455 billion through divestment.

Buy Buybacks of Public Sector Units

In his Union Budget for FY18 unveiled early February, Finance Minister Arun Jaitley had set the disinvestment target for the year at Rs 725 billion. The government also plans to list three railway sector PSUs during the year.

At the time of writing, Nalco share price was trading up by 1%

We have given our view about Nalco's offer for sale in today's edition of the 5 Minute WrapUp Premium. You can access it here.

In news about the economy. According to an article in The Economic Times, domestic flow of money into the economy beat foreign fund flows in a cumulative two-year cycle in FY16-17 for the first time in seven years.

The total market value of domestic money invested in the BSE-200 at the end of March 2017 was bigger than the value of foreign fund holdings for the first time in two years. It is estimated that the value of Indian non-promoter and non-government holdings was US$ 323 billion compared with $303 billion for foreign funds. This is the first time this has happened in eight quarters.

The cumulative 24-month flow of domestic funds have been greater than the FPI inflow for the first time since October 2010. Domestic funds invested US$ 16 billion in local stocks in the two years compared with US$ 6 billion for FPIs.

After a gap of seven years, domestic investors are once again emerging as a force to reckon with in the Indian equity market as foreign fund flows remain volatile.

A major reason for the growth in the domestic inflows have been SIP (systematic investment plan) investments and rising inflows into National Pension Scheme and the Employee Provident Fund Organisation (EPFO).

The rising share of local funds is important as it reduces market volatility and fluctuation every time FPIs pull out money as part of global risk aversion strategy. This was a major reason for the Indian equity market to hold on its own in the December 2016 quarter even though FPIs sold US$ 4.5 billion worth of equities mostly due to the notebandi saga.

It remains to be seen if the trend continues. Higher domestic inflows would mean a spur in investments and consequently economic growth.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in Green; Bank Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!