India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 8, 2017

Sensex Trades on a Negative Note; Metal Stocks Drag Wed, 8 Mar 01:30 pm

After opening the day on a flat note, share markets in India have witnessed selling and are trading below the dotted line. With the exception of stocks in the pharma sector, all sectoral indices are trading on a negative note with stocks in the metals sector and stocks in the realty sector leading the losses.

The BSE Sensex is trading down by 150 points (down 0.5%), and the NSE Nifty is trading down by 40 points (down 0.4%). Meanwhile, the BSE Mid Cap index is trading down by 0.7%, while the BSE Small Cap index is trading down by 0.4% The rupee is trading at 66.65 to the US$.

In news from stocks in the banking sector. As per a leading financial daily, the government with a view to make public sector banks (PSBs) more accountable and improve performance, plans to introduce stricter recapitalization norms.

Recapitalization essentially is injecting funds to a back to help remedy serious liquidity issues or to steady the ship in case of large Non-Performing Assets (NPAs).

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Hit by NPAs and losses, the Budget 2017 allocated Rs 100 billion to be injected the into PSBs in the next financial year to meet their capital requirements and bail them out from a financial mess.

Government is mulling keeping 50% of the total FY 18 recapitalization budget of Rs 100 billion linked to meeting certain performance criteria such as lowering bad loans, credit growth and the like. In the current fiscal only 25% of the total recapitalization fund was linked to performance.

The government also plans to bring in more disclosure rules and ask the banks to project their profits, income, recovery plans, bad loan ratio and other plans to raise funds from the markets.

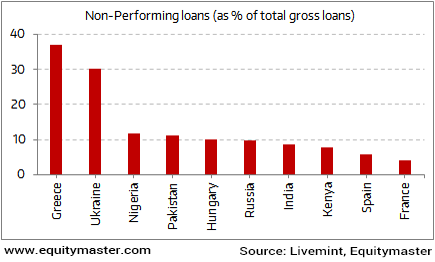

During the April - September, PSBs' gross NPAs stood at over Rs 5,895 billion which is about 11.8% of the bank's gross advances.

India is Near the Bottom of the Global NPA List

Judicious availability of funds may spur the banks to use their funds more cautiously and may help bring down NPAs over the long term.

Under the roadmap announced last year, the government will infuse Rs 250 billion in PSU banks during the current fiscal. The government in July had announced the first round of capital infusion of Rs 229 billion for 13 PSU banks. Of this, 75% has already been released to these banks and would take a final decision on rest of 25 per cent on March 15.

Moving on to IPO news. The IPO market is buzzing ahead of the Rs 18.7 billion initial public offering (IPO) of Avenue Supermarts Ltd, parent of D-Mart which opens for subscription today.

Avenue Supermarts, which runs the D-Mart chain of food and grocery supermarkets, on Tuesday said that it has raised Rs 5.6 billion by selling shares to investors as part of the anchor book allocation, a day ahead of its IPO.

The anchor book is that portion of an IPO that bankers can allot to institutional investors on a discretionary basis. Anchor book subscription opens a day before the launch of an IPO and acts as an indicator of institutional investor interest.

Shares were allotted to anchor investors at Rs 299 apiece, the upper end of the IPO price band of Rs2 95-299 per share.

The issue, worth Rs 18.7 billion, opens for subscription today and closes on 10 March. The company is divesting 10% of its total equity shares.

Avenue plans to use Rs 10.8 billion to repay debt and Rs 3 billion to purchase and build new stores.

The company is one of the most profitable retailers in the country, and posted a Rs 3 billion profit after tax on revenues of Rs 88 billion in fiscal 2017, until December 2016.

D-Mart's is the third IPO this calendar year, following initial share sales of stock exchange BSE Ltd and Radio City FM operator Music Broadcast Ltd. 26 companies together garnered Rs 260 billion through IPOs in 2016.

Rohan Pinto, my colleague, and head of the ValuePro team, has crunched the numbers and put together an exhaustive report on the D-Mart IPO and whether you should subscribe. You can give it a read here (Subscription Required).

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Negative Note; Metal Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!