India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 8, 2017

Sensex Falls 98 Points; Tata Steel Down 1.9% Wed, 8 Mar Closing

Indian share markets continued to trade weak in the afternoon session and finished in red as caution prevailed ahead of UP state elections. At the closing bell, the BSE Sensex stood lower by 98 points, while the NSE Nifty finished down by 23 points. Meanwhile, the S&P BSE Mid Cap finished & the S&P BSE Small Cap finished down by 0.3% and 0.6% respectively. Losses were largely seen in oil & gas stocks, metal stocks & realty stocks.

Tata Steel share price was the top Sensex loser and slipped 1.9% after the company said it will close the British Steel Pension Scheme to future accrual from March 31 and employees will get a new contributory scheme for their retirement savings thereafter.

Kotak Mahindra Bank pared gains and finished up by 0.9% after rising as much 2.69%, following reports of stake sale to Canadian pension fund. According to media reports, Uday Kotak is in discussions for a sale of over 3% stake in the bank to Caisse de Depot et Placement du Quebec

Asian stock markets finished mixed as of the most recent closing prices. The Hang Seng gained 0.43%, while the Nikkei 225 & Shanghai Composite fell 0.47% and 0.05% respectively. European markets too are mixed. The DAX is higher by 0.21%, while the CAC 40 & FTSE 100 are down 0.30% and 0.06% respectively.

The rupee was trading at Rs 66.63 against the US$ in the afternoon session. Oil prices were trading at US$ 52.69 at the time of writing.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Fitch Ratings in its latest report has raised the forecast for India's GDP growth in the current financial year 2016-17 to 7.1% from earlier 6.9%. The projection of growth for this fiscal is in line with the estimates of CSO and global think-tank OECD.

It also said that the economy will grow 7.7% in the next two financial years and estimated retail price inflation to rise to 4.6% in 2017-18 and 5% in 2018-19, from 3.4% in the current year.

Though, the ratings agency expressed surprise at the official Indian statistician's latest projection of 7% GDP growth in the third quarter ended December, saying it contradicted data on real services activity hit by demonetisation. It further said that this number looks somewhat surprising as real activity data released since demonetisation pointed to weak consumption and services activity because these transactions are cash-intensive.

It also said that one reason for this discrepancy could be the inability of the official data to capture the negative effect of demonetisation on the informal sector.

Forecasting robust growth rates for India in the next two fiscal, Fitch said that gradual implementation of the structural reform agenda is expected to contribute to higher growth, as will higher real disposable income, supported by an almost 24% hike in civil servants' wages at the state level.

Moving on to news from stocks in PSU sector. According to an article in The Financial Express, the government is looking to raise close to Rs 90 billion by selling 10% equity stake each in the state-run companies Bharat Heavy Electricals Ltd and Oil India Ltd.

The central government plans to raise funds from its equity stakes in 16 PSUs to meet its ambitious disinvestment target for the next financial year 2017-18.

As per the reports, the government could either sell the shares in the open markets, or might ask the companies to buy back the shares themselves. While 10% stake in the capital goods and engineering major BHEL will fetch the government Rs 52.2 billion, the similar stake in Oil India will earn it Rs 37.7 billion.

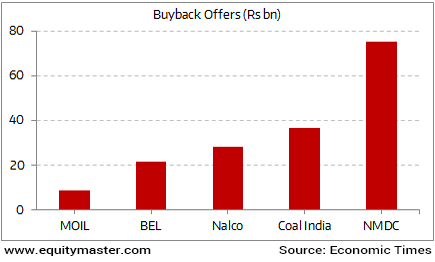

Big Buybacks of the Public Sector Units

Indian government has undertaken strategic sale of stake in profitable PSUs to help boost up state revenue and bridge the fiscal deficit, but has repeatedly fallen short of its disinvestment targets in the past. It has a target to earn Rs 565 billion by divesting its stake in public sector undertakings in the current financial year 2016-17, out of which, it has already earned more than Rs 310 billion.

BHEL share price and Oil India Ltd share price finished the day down by 1.3% and 2.2% respectively.

Meanwhile, Cadila Healthcare share price finished on an encouraging note (up 1.3%) after the company received final approval from the USFDA to market Tizanidine Hydrochloride Capsules. The estimated sale for Tizanidine Hydrochloride Capsules is US$58.6 million, as per IMS Jan 2017.The group now has nearly 110 approvals and has so far filed over 300 ANDAs since the commencement of the filing process in FY 2003-04.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Falls 98 Points; Tata Steel Down 1.9%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!