India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News March 2, 2017

Sensex Trades in Green; Auto Stocks Gain Thu, 2 Mar 11:30 am

After opening the day on a strong note, share markets in India continued to gain the momentum. Sectoral indices are trading on a mixed note with stocks in the auto sector and the metal sector trading in the green, while stocks in the realty sector are leading the losses.

The BSE Sensex is trading up by 150 points (up 0.5%), and the NSE Nifty is trading, up by 43 points (up 0.5%). Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 66.73 to the US$.

Stocks from the banking sector were in the limelight. India's leading banks, Axis Bank, HDFC Bank and ICICI Bank, announced they will charge a minimum of Rs 150 for cash deposits and withdrawals after four free transactions in a month, reviving charges that were put off briefly after the government scrapped high-value notes in November.

The banks will calculate the fee - aimed at reducing cash dealings - at the rate of Rs 5 for every Rs 1,000 transacted or Rs 150, whichever is lower.

The move is seen to discourage cash transactions, and promote the digital payments drive. However, none of the banks have received any directives from the government, and have voluntarily brought back the pre-existing cash withdrawal charges.

The banks claim that these curbs will boost digital economy, but there is no denying that remonetisation is yet to be completed. Many banks are still reeling under cash crunch and this move will discourage cash withdrawals as well

India's major banks are pushing ahead the government's broad agenda to move towards a cashless economy.

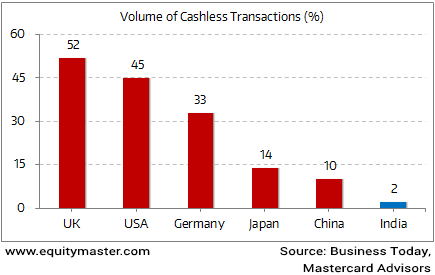

However, this push towards a cashless economy may not have immediate results in a country where nearly 98% of the transactions by volume are undertaken in cash.

Is India ready to go digital?

To go cashless would mean a complete overhaul of how Indians spend their money. Banks and other financial institutions will have to be technologically competent to tackle the security issues associated with the shift towards a digital economy.

All these are major changes, and thus beg the question - Is India ready to go digital?

Moving on to news from stocks in the PSU sector. Coal India share price was in focus for the third consecutive day today as the state run coal major reported a growth in production.

Coal India reported that its coal production grew by 2.3% to 488 million tonnes (mt) during April to February period in the current fiscal as compared to 477.3 mt produced in the corresponding period in the last financial year.

The miner which aimed to produce 535.4 mt in the first 11 months of the current fiscal achieved 91% of the target.

Coal India is the country's largest coal producer and accounts for 84% of the country's coal production.

According to provisional data, production stood at 54.3 mt in February, achieving 96% of the target at 56.8 mt for the month. Production however, was lower as compared to January which stood at 55.9 mt.

Its off-take for February stood at 47.7 mt achieving 94% of the target of 50.6 mt for the month.The PSU reported that its off-take during April-February period was up by a marginal 1.6% at 490.9 mt as against a target of 540.3 mt.

In 2015-16, the state miner produced 538.8 mt of coal against a target of 550 mt and its off-take was at 534.5 mt.

During the current fiscal, the coal production target has been pegged at 598.6 mt and production is expected to be 660.7 mt in 2017-18.

The company envisaged production of 908.1 mt in 2019-20 with a CAGR (Compound Annual Growth Rate) of 12.9% with respect to 2014-15.

At the time of writing, Coal India share price was trading up by 1%

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades in Green; Auto Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!