India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 27, 2017

Sensex Remains Range bound; Banking Stocks Drag Mon, 27 Feb 01:30 pm

After opening the on a flat note, share markets in India have remained range bound and are trading on a flat note. Sectoral indices are trading on a mixed note with stocks in the oil & gas sector and stocks in the IT sector trading in green, while stocks in the banking sector are leading the losses.

The BSE Sensex is trading up by 30 points (up 0.1%), and the NSE Nifty is trading, down by 11 points (down 0.1%). Meanwhile, the BSE Mid Cap index is trading up by 0.3%, while the BSE Small Cap index is trading up by 0.3%. The rupee is trading at 66.77 to the US$.

Coal India share price was in focus today as the world's largest coal producer announced that the board of its subsidiary, Northern Coalfields Limited (NCL) has approved a share buyback plan worth Rs 12.4 billion.

The board of NCL, a wholly owned subsidiary of Coal India, approved the buyback of 76,356 fully paid equity shares of face value of Rs 1,000 each from the members of NCL on a proportionate basis through tender offer.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The equity shares proposed to be bought back by NCL represent 4.3% of its existing paid up share capital. The maximum permissible limit for the same is up to 25% of the company's paid up share capital.

The government remains the biggest stakeholder in Coal India, with a shareholding of almost 80%, and stands to benefit the most from the buyback of its wholly owned subsidiary.

The government is exploring ways at shoring up its revenues and is leaving no stone unturned in exhausting its options through buybacks, steep dividends from PSUs, and other instruments.

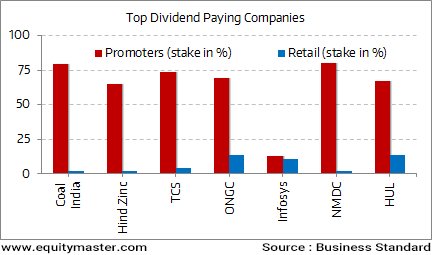

Promoters Get the Major Chunk of the Dividend Pie

Earlier this fiscal, the government had raised about Rs 7.9 billion crore through share buyback of MOIL. The government has so far raised about Rs 300 billion through minority share sale by way of OFS, share buyback and CPSE ETF so far in the current fiscal.

At the time of writing, Coal India share price was trading up by 0.1%.

Moving on to news from stocks in the steel sector. The government is likely to take a final call on strategic disinvestment of three SAIL units by September this year, and due diligence is already on for the same.

While the government had already given an in-principle approval for the strategic divestment of SAIL's Bhadravati, Salem and Durgapur (alloy steel plants), the technicalities are yet to be worked out. The government had earlier said it would not go in for distress sale of the three SAIL subsidiaries and rather look for a management that will turn around the units, while SAIL had earlier said the government will hold auction to identify strategic buyers for SAIL subsidiaries -- Bhadravati, Salem and Durgapur.

In related news, a green panel has recommended environment clearance to state-owned steel major SAIL for construction of a pit head coking coal washery in its Tasra Coal Block in Dhanbad, Jharkhand. An Expert Appraisal Committee (EAC) of the Union Environment Ministry had discussed the SAIL's proposal at earlier meetings and had sought clarifications. The proposal was taken up again recently. As per the proposal, SAIL will source 3.5 MTPA raw coal from its Tasra open cast project.

The company has said it would complete the construction and commissioning of Tasra washery including trial operation and Performance Guarantee Tests in 18 months.

Meanwhile, data from the Joint Plan Committee of the government, shows a three-fold increase in India's steel exports in the month of January this year, as compared to the same month last year.

The massive jump in exports comes amid government providing extensive support to the domestic steel industry by way of various trade remedial measures including anti-dumping.

The country shipped out 5.9 MT in the first 10 months of the ongoing fiscal, registering an increase of 71%. Exports in January, 2017 (0.89 MT) was up 224% over January 2016 (0.27 MT).

During April-January 2016-17, crude steel production was 80.72 MT, registering a growth of 9% over the same period of last fiscal.

Overall crude steel production in January 2017 stood at 8.4 MT which was up by 11.5% over January 2016 but declined by 0.4% over December 2016.

At the time of writing, SAIL share price was trading up by 08%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Range bound; Banking Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!