India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 23, 2017

Sensex Finishes Flat; IT & Realty Stocks Close Strong Thu, 23 Feb Closing

Stock markets in India witnessed selling pressure in final hour of trade to finish flat amid mixed global markets. At the closing bell, the BSE Sensex stood higher by 28 points, while the NSE Nifty finished up by 13 points. Meanwhile, the S&P BSE Mid Cap finished & the S&P BSE Small Cap finished up by 0.2% and 0.1% respectively. Gains were largely seen in IT stocks, realty, and consumer durables' stocks. While energy, PSU, and auto stocks witnessed majority of the selling activity.

Bharti Airtel finished the trading day on an encouraging note (up 1.4%) after it was reported that the company entered into a definitive agreement with Telenor South Asia Investments (Telenor) to acquire Telenor (India) Communications (Telenor India). As part of the agreement, Airtel will acquire Telenor India's running operations in seven circles - Andhra Pradesh, Bihar, Maharashtra, Gujarat, UP (East), UP (West), and Assam.

The proposed acquisition will include transfer of all of Telenor India's assets and customers, further augmenting Airtel's overall customer base and network. It will also enable Airtel to further bolster its strong spectrum foot-print in these seven circles, with the addition of 43.4 MHz spectrum in the 1,800 MHz band.

Asian stock markets finished lower today with shares in Hong Kong leading the region. The Hang Seng was down 0.36% while China's Shanghai Composite was off 0.31%, and Japan's Nikkei 225 was lower by 0.04%. European markets are mixed today. The CAC 40 is up 0.19% while the DAX 30 and the FTSE 100 are trading flat.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The rupee was trading at Rs 66.83 against the US$ in the afternoon session. Oil prices were trading at US$ 54.37 at the time of writing.

According to a leading financial daily, the International Monetary Fund (IMF), in its annual report, has said that India's gross domestic product (GDP) is likely to slow to 6.6% in the financial year 2016-17, then rebound to 7.2% in FY 2017-18, due to transitory disruptions, mainly to private consumption, caused by the government's demonetisation drive.

The report also said that note ban would have only short term impact on the economy and in the next few years it would bounce back to its projected growth of more than 8%. It noted that India's economy grew at 7.6% in 2015-16. The report also pointed that the post-November 8, 2016 cash shortages and payment disruptions caused by the currency exchange initiative taken by government have undermined consumption and business activity, posing a new challenge to sustaining the growth momentum.

It also noted that tailwinds from a favorable monsoon, low oil prices and continued progress in resolving supply-side bottlenecks and robust consumer confidence will support near-term growth as cash shortages ease. Report further said that the country's investment recovery is likely to remain modest and uneven across sectors, as corporate de-leveraging takes place and industrial capacity utilization picks up.

On the external front, IMF said that despite the reduced imbalances and strengthened reserve buffers, the impact from global financial market volatility could be disruptive, including from US monetary policy normalization or weaker-than-expected global growth.

The IMF suggested continued vigilance to potential domestic and external shocks and urged the authorities to further advance economic and structural reforms to address supply bottlenecks, raise potential output, create jobs and ensure inclusive growth.

Moving on to news from stocks in the steel sector, Tata Steel finished the trading day on an optimistic note (up 0.4%) after it was reported that the company's Greenfield steel plant at Kalinganagar achieved a major milestone with hot metal production crossing two million tonne (MT) mark.

The plant has one of the largest operating blast furnaces in the country with a capacity of 4,330 cubic meters. Soon after start of commercial production in May 2016, the state-of-the-art steel plant has crossed a number of operational milestones.

Meanwhile, Tata Steel is now exploring possibility of entering overseas markets like Bangladesh and Myanmar with retail branded steel solution products. This comes on the back of success in the solution business in the retail segment in India. Tata Steel terms consumer products as B2C and has marketed these steel products similar to a FMCG strategy.

In another development, domestic steel production was up to 8.4 mt in January 2017, showing a 12% growth over January 2016 when the country had reported crude steel production of 7.5 MT.

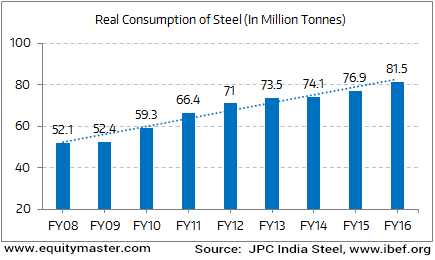

Steel Demand has Outpaced Supply Over the Last 5 Years in the Country

India's growth trend spurred by protectionist measures taken by the government against threat of cheaper imports, was in fact higher than the overall 7% increase in world crude steel production to 136.5 million mt in January 2017 compared to January 2016.

Out of the total global output, China which accounts for more than half of global steel output, saw a 7.4% increase in crude steel production for January 2017 at 67.2 mt, compared to January 2016.

Steel stocks finished the day on a mixed note with Maharashtra Seamless and Jindal Steel & Power leading the gains.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Finishes Flat; IT & Realty Stocks Close Strong". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!