India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 24, 2017

Global Markets Ended on a Mixed Fri, 24 Feb RoundUp

Global stock markets ended the week on a mixed note. Stock markets in Germany and China were the biggest gainers, with gains of 1.7% and 1.6% respectively. Further, Indian stock markets were also up by 1.5%. However, the UK and Brazil share markets were marginally down by 0.6% and 0.5%, respectively. The US markets were up 0.9% for the week gone by.

As per the minutes of the Fed's last policy meeting, the US central bank may not be that keen to hike interest rate in its March policy review.

Many Federal Reserve policymakers said it may be appropriate to raise interest rates again fairly soon should jobs and inflation data come in line with expectations. The minutes showed the depth of uncertainty at the Fed because of a lack of clarity on the new Trump administration's economic program.

Fed policymakers noted both upside and downside risks to the US economy from Trump's policies. As per them, it will take some time for the economic outlook to become clearer and to raise interest rates.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

All eyes are now set on the upcoming Federal Open Market Committee (FOMC) meet which is scheduled on March 14-15. The meeting will decide Fed's stance on interest rates.

We doubt the strength and durability of the US economic recovery since it has been driven mainly by massive doses of money printing and artificial suppression of interest rates. Hence, we also doubt the Fed's capability to further raise interest rates.

Back home, the Indian indices ended their weekly session on a positive note. The BSE Sensex was up 1.5% for the week, while the NSE Nifty was up 1.3%. The market stood strong mainly on the news of consolidation in telecom sector and banking sector. Stock markets are expected to be volatile ahead of the results of the state elections and the outcome of the US Fed rate decision.

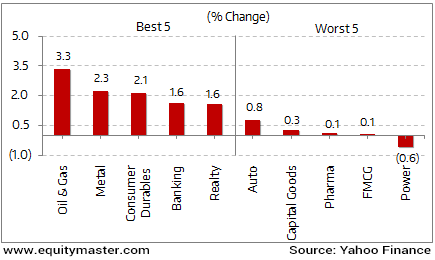

BSE Indices During the Week

On the sectoral indices front, oil & gas sector and metal sector stocks led the gainers this week. However, power stocks were down marginally.

Key World Markets During the Week

Now let us discuss some key economic and industry developments during the week gone by

The International Monetary Fund (IMF) stated India's notebandi drive may have a larger-than-anticipated negative impact on the economy. As per the IMF, the government's notebandi drive is set to bring near-term negative impact through weaker private consumption.

Going by the numbers, the IMF said India's economic growth is expected to slow about 6% in the second-half (October-March) of fiscal 2016-17, before gradually rebounding in the course of 2017-18.

According to a leading financial daily, the International Monetary Fund (IMF), in its annual report, has said that India's gross domestic product (GDP) is likely to slow to 6.6% in the financial year 2016-17, then rebound to 7.2% in FY 2017-18, due to transitory disruptions, mainly to private consumption, caused by the government's demonetisation drive.

In another development, domestic steel production was up to 8.4 mt in January 2017, showing a 12% growth over January 2016 when the country had reported crude steel production of 7.5 MT.

India's growth trend spurred by protectionist measures taken by the government against threat of cheaper imports, was in fact higher than the overall 7% increase in world crude steel production to 136.5 million mt in January 2017 compared to January 2016.

Out of the total global output, China which accounts for more than half of global steel output, saw a 7.4% increase in crude steel production for January 2017 at 67.2 mt, compared to January 2016.

As per an article in the Economic Times, private equity (PE) and venture capital (VC) investments in India touched US$ 1.2 billion in January across 43 transactions. However, this was recorded as 6.3% lower in value terms over the year ago period.

In terms of volume too, the above investments saw a 6.5% decline. This was seen mainly due to a decline in number of growth or expansion funding and high value deals. As per the EY report, more than half of the deals were for less than US$ 10 million each.

The above declining trend in investments could be due to the absence of profitability in many e-commerce businesses that caught the fancy of many venture capitalists and private investors last year.

Presently, most of these e-commerce businesses are mired in losses.

If the above losses keep getting bigger, there will be a point when venture capitalists and private equity funds will further re-assess their investments and start thumbing down valuations of these firms. In fact, a valuation correction is underway in the domestic e-commerce segment right now.

No wonder Vivek Kaul calls these ecommerce companies Ponzi schemes, with individual investors...perhaps you...stuck at the end. And speculators who discount fundamentals will turn out to be the greatest fool in this greater fool theory at work in the Indian e-commerce space.

As per an article in the Economic Times, the yearly SBI Composite Index (YoY) for February 2017 improved to 49.5 compared to last month's index of 47.0. The data indicated some improvement in the manufacturing activity.

However, the index declined sequentially, thereby indicating that full-fledged recovery in output may take some more time. The monthly Index declined marginally to 49.2 in February 2017 from 50.9 in January 2017.

Much of the fall in manufacturing activity is seen on the back of government's notebandi move.

Last week, the Reserve Bank of India (RBI) Governor Urjit Patel stated that India's growth will bounce back after a sharp notebandi-driven slowdown.

However, if one has to go by the ground realities, the economy is still facing troubles from notebandi. The government will continue with its lies and tell us that all is well on the notebandi front, but that doesn't make the situation any better for the common man.

Movers and Shakers During the Week

| Company | 17-Feb-17 | 24-Feb-17 | Change | 52-wk High/Low |

|---|---|---|---|---|

| Top Gainers During the Week (BSE Group A) | ||||

| Jindal Steel & Power | 93 | 117 | 25.9% | 64/33 |

| Jet Airways | 362 | 422 | 16.6% | 94/58 |

| J&K Bank | 69 | 77 | 12.3% | 31/20 |

| Reliance Ind | 1,065 | 1,183 | 11.0% | 195/59 |

| Idea Cellular | 108 | 120 | 11.0% | 79/30 |

| Top Losers During the Week (BSE Group A) | ||||

| SJVN | 35.8 | 33.65 | -6.0% | 673/402 |

| Bayer Cropscience | 4,093.45 | 3,857.8 | -5.8% | 2,095/835 |

| Havells Ind | 431.5 | 409.1 | -5.2% | 607/410 |

| The Ramco Cements | 681.90 | 625.5 | -8.3% | 945/691 |

| Guj. State Petronet | 164.1 | 157.4 | -4.1% | 1,033/788 |

Some of the key corporate developments in the week gone by

As per an article in a leading financial daily, Bharti Airtel has entered into a definitive agreement with Telenor South Asia Investments Pvt Ltd to acquire Telenor India Communications Private Ltd.

As the part of the agreement, Airtel will acquire Telenor India's running operation in seven circles, including Andhra Pradesh, Bihar, Maharashtra, Gujarat, UP East and West and Assam. These circles represent a high population concentration and therefore offer high potential for growth.

Moreover, the acquisition will include the transfer of all Telenor India's assets and customers, which will boost the company's customer case and network. Also, these seven markets will give an additional 43.4 MHz spectrum in the 1800 MHz band to Airtel, the reports noted.

The move comes at a time when new entrant Reliance Jio has acquired 100 million users and the market is awaiting response on a potential Vodafone-Idea merger.

Aurobindo Pharma's US arm announced the recall of 47,040 bottles of Venlafaxine Hydrochloride extended release capsules from the American market.

The drug was manufactured by Aurobindo Pharma Ltd, Hyderabad. The company stated the recall is a voluntary recall. As per the United States Food and Drug Administration (USFDA) the recall is on account of "failed tablet/capsule specifications: some bottles contain punctured, and/or clumped /melted capsules".

The regulator added that the recall was a class II recall which is initiated a situation in which use of or exposure to a violative product may cause temporary or medically reversible adverse health consequences or where the probability of serious adverse health consequences is remote.

NTPC Ltd, India's biggest power producer, announced that it has commissioned 115 MW (megawatt) capacity out of 260 MW of Bhadla Solar Power Project.

With this installation, the installed capacity of NTPC's solar power projects touches 475 MW. The total installed capacity of NTPC on standalone basis has become 41,177 MW and that of NTPC group has become 48,143 MW.

NTPC intends to become a 130 GW company by 2032 with a with diversified fuel mix and 600 billion units' company in terms of generation. The company wants share of renewable energy (including hydro) to be 28%.

On the company's renewable energy plans, NTPC said that it will add 500 MW solar capacity by the end of March 2017. NTPC plans to achieve this target through a 260 MW solar power plant in Rajasthan, and another 250 MW plant in Madhya Pradesh.

In addition to this, the company also plans to set up a 50 MW wind power plant in Gujarat this year.

This is in line with the government's plans to push power capacity addition from renewable energy sources.

As per an article in The Economic Times, Tata Motors and Volkswagen Group are at an advanced stage of finalising a partnership that can have a wide-ranging impact on India and other emerging markets.

Reportedly, the companies are looking at sharing modular platforms for India and emerging markets. It includes the advanced modular platform (AMP) being developed by Tata Motors. While, Volkswagen may offer technical knowhow on producing multiple models based on modular architecture.

The main idea is to share architectures and capacities and bring in quicker returns on investment through economies of scale.

Moreover, Both the companies are stretched financially (Subscription Required), yet they have no way out but to invest for the future, so partnership was the only way out. Further, with large auto makers already investing in these emerging technologies, it is clear that Tata Motors needs to make the move quickly to avoid losing out the race particularly when also technologically assisted driving can soon become a reality.

Tata Consultancy Services Ltd's (TCS) board has approved a share buyback plan of up to Rs 160 billion. The proposed shares represent 2.85% of the total paid up equity share capital at Rs 2850 per equity share.

The announcement comes at a time when some Indian IT companies are caught in controversies.

Earlier this month, Cognizant Technology Solutions Corp, announced that it would do share buybacks worth US$3.4 billion over two years. The announcement came even as Infosys squashed speculations that it was considering a Rs 120 billion share buyback program.

Main reasons behind a clamour for buybacks at the IT companies (Subscription Required) is that these companies have had only single-digit growth recently, leading to low shareholder returns. Shareholders can be rewarded through other means such as a buyback. Cash is idling at Indian IT companies as they are neither making acquisitions nor investing in growth, the reports noted.

According to an article in The Financial Express, Tata Steel is looking at building a distribution network and its brands in the Business to Consumer (B2C) markets in Bangladesh and Myanmar. Bangladesh and Myanmar are the two B2C markets which have a similar profile as India.

According to company's MD, the country's steel industry has been spending less towards research and development (R&D) compared to global standards. Indian steel industry is spending less than 0.5% of the revenue towards R&D.

The Managing Director also mentioned that steel processing facilities in India have not been keeping up with the high-end requirements of steel products in the automobile sector.

And here's an update from our friends at Daily Profit Hunter...

The Nifty 50 Index traded on a positive note for the week. On Monday, it opened its session lower but recovered immediately and closed with 57-point gains. The positive momentum continued throughout the week with the index closing consecutive sessions in the green and ending the weekly session with 1.34% gains. The index is still trading in an uptrend channel with near-term support at 8,850. It's now very close to its all-time high of 9,000. This could be a strong resistance level going forward. You can read the detailed market update here...

Nifty 50 Index near All-Time High

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Global Markets Ended on a Mixed". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!