India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 23, 2017

Indian Indices Continue Momentum; Telecom Stocks Witness Buying Thu, 23 Feb 11:30 am

After opening the day marginally up, stock markets in India have continued their momentum and are presently trading in the green. Sectoral indices are trading on a positive note with stocks in the telecom sector and IT sector witnessing maximum buying interest.

The BSE Sensex is trading up 101 points (up 0.4%) and the NSE Nifty is trading up 34 points (up 0.4%). The BSE Mid Cap index is trading up by 0.5%, while the BSE Small Cap index is trading up by 0.4%. The rupee is trading at 66.83 to the US$.

The International Monetary Fund (IMF) yesterday stated India's notebandi drive may have a larger-than-anticipated negative impact on the economy. As per the IMF, the government's notebandi drive is set to bring near-term negative impact through weaker private consumption.

Going by the numbers, the IMF said India's economic growth is expected to slow about 6% in the second-half (October-March) of fiscal 2016-17, before gradually rebounding in the course of 2017-18.

Private investments and private consumption have witnessed most of the brunt since the Modi government initiated the notebandi move in November. This is seen as re-monetisation has not happened at a fast pace, which had led to lesser demand and falling consumption.

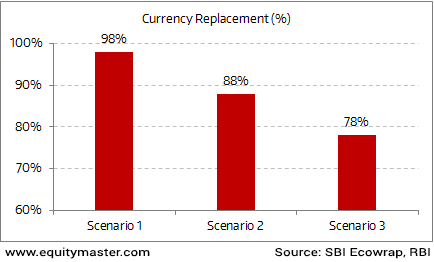

According to an article in the Mint, as of January 2017, the total currency in circulation is 57% of what it was before demonetisation. In fact, as per RBI data, the cash with public is 40% less than what it was one year ago.

Demonetisation: Expected Currency Replacement by Feb 2017

So going by the ground realities, the economy is still facing troubles for the notebandi drive initiated by the government. The government will continue with its lies to tell us that all is well on the notebandi front, but that doesn't make the situation any better for the common man.

Anyway, as analysts, our job is to find silver lining in every dark cloud. And demonetisation is no exception.

Earlier this year, we wrote to you about value migration and how it has benefitted many Indian companies. Simply stated, value migration is defined as a flow of economic and shareholder value away from obsolete business models to new, more effective designs that are better able to satisfy customers' most important priorities.

We believe demonetization will lead to a value migration from unorganised players to organized players. And companies with solid fundamentals and a competitive moat will capture most of this value.

Our Hidden Treasure team is already on the lookout for opportunities in such companies.

In the news from global financial markets, minutes of the Fed's last policy meeting released yesterday suggested that the US central bank may not be that keen to hike interest rate in its March policy review.

As per the minutes, many Federal Reserve policymakers said it may be appropriate to raise interest rates again fairly soon should jobs and inflation data come in line with expectations. The minutes showed the depth of uncertainty at the Fed because of a lack of clarity on the new Trump administration's economic program.

Fed policymakers noted both upside and downside risks to the US economy from Trump's policies. As per them, it will take some time for the economic outlook to become clearer and to raise interest rates.

All eyes are now set on the upcoming Federal Open Market Committee (FOMC) meet which is scheduled on March 14-15. The meeting will decide Fed's stance on interest rates.

We doubt the strength and durability of the US economic recovery since it has been driven mainly by massive doses of money printing and artificial suppression of interest rates. Hence, we also doubt the Fed's capability to further raise interest rates.

As per Asad, the Fed's promise of more interest rate increases will lead to the end of easy money and will create big trends that traders can profit from.

Speaking of trading, our colleague Apurva Sheth of the Profit Hunter team released a detailed report on trading stocks. The special report talks about what he believes could be extremely effective stock trading strategy. Importantly, the strategy could be implemented in four easy steps. HYPERLINK "https://www.dailyprofithunter.com/peak-profit-alert/free-guide/registration.aspx?reg=y&email=%7bemailaddress%7d®src=898" \t "_blank"Get your hands on this report right now.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Continue Momentum; Telecom Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!