India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 14, 2017

Sensex Trades on a Weak Note; PSU Stocks Drag Tue, 14 Feb 01:30 pm

After opening the day on a flat note, the Indian share markets have remained range bound and are currently trading flat with a negative bias. Sectoral indices are trading negative, with stocks in the PSU sector and the metal sector witnessing maximum selling pressure.

The BSE Sensex is trading down by 30 points (down 0.1%) and the NSE Nifty is trading down by 14 points (down 0.2%). Meanwhile, the BSE Mid Cap index is trading down by 0.7%, while the BSE Small Cap index is trading down by 0.5%. The rupee is trading at 66.95 to the US$.

Cash may still reign supreme post-demonetisation in India. According to an article in the Economic Times, cash payments at retail stores are now near pre-note ban levels, as consumers are increasingly opting for cash payments as liquidity improves in the market.

According to the article, retailers Shoppers Stop, Future Group, Lifestyle International, Spencer's and Max said 20-30% of their total sales in January were paid for in cash, a significant jump from a meagre 5-8% cash transactions in November-December when the high denomination notes of 500 and 1000 were demonetised.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Some of these retailers now expect cash transactions to return to pre-demonetisation levels of 40-50% after the cap on cash withdrawn is completely removed on March 13, somewhat negating the government's efforts to push digital payment.

For online fashion retailers Jabong and Myntra, cash transactions, or 'cash on delivery', is already back to normal at 60-70% after falling to about 10% in the aftermath of demonetisation.

India Remains a Cash Based Economy

This shows that Indians prefer cash over any other mode of transaction. In the premium edition of The 5 Minute WrapUp on 11 November, Rahul Shah wrote about the reasons why India is a cash based economy. Trust in online payments, security risks, identity and privacy issues, as well as old habits of paying in cash, are just some of things that he mentioned.

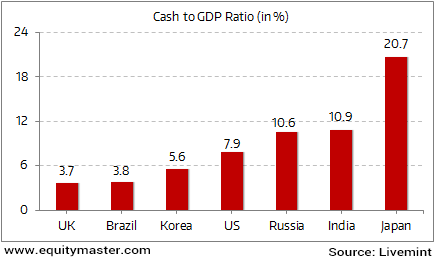

The bottomline is that India still has a long way to go to even come close to a cashless economy. Many nations are way ahead of us. India trails many developing as well as developed economies (except Japan) when it comes to the use of cash.

Moving on to news from the pharma sector. In a move to boost domestic manufacturing of pharmaceuticals and medical devices in India, the government has announced setting up of a pharma and med tech zone in Bengaluru.

The move is set to give a shot in the arm for the Indian pharma sector, which achieved a Compounded Annual Growth Rate (CAGR) of over 15%, would be worth US$ 55 billion by 2020 from the present US$ 32 billion.

India accounts for around 20% of the world's generic medicine supply chain, exporting to over 250 countries globally, and the country's pharma industry provides over 60% of global vaccines.

The sector has received Foreign Direct Investment (FDI) close to US$ 14 billion and has generated employment for over 2.5 million people across India this fiscal.

The recent approval of the Pharma and Med Tech zone in Andhra Pradesh has attracted over 30 investment proposals from domestic and international pharma companies.

The Bengaluru pharma zone will go a long way in helping the Indian pharma industry to recover from its current predicament.

Bhavita Nagrani, our pharma sector analyst has explained the current predicament of Indian pharma companies in one of the premium editions of the 5 Minute WrapUp:

- Over the past few years, risk in the US markets has increased. The US Food and Drug Administration (FDA) has become stricter on products entering US borders. Surprise inspections have increased and companies are being issued warning letters. This has impacted the business and earnings of Indian pharma players, causing major volatility for the sector.

Give it a read to form a better understanding of the current scenario in the Indian pharma sector.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Trades on a Weak Note; PSU Stocks Drag". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!