India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 14, 2017

Sensex Opens Flat; Pharma Stocks Gain Tue, 14 Feb 09:30 am

Asian markets are lower today as Japanese and Hong Kong shares fall. The Nikkei 225 is off 0.16%, while the Hang Seng is down 0.01%. The Shanghai Composite is trading up by 0.33%. Stock markets in the US & Europe ended their previous session on a firm note.

Meanwhile, share markets in India too have opened the trading day on a flat note. The BSE Sensex is trading lower by 3 points while the NSE Nifty is trading lower by 12 points. The BSE Mid Cap index opened down by 0.2%, while BSE Small Cap index opened the day flat.

The rupee is trading at 66.97 to the US$. Sectoral indices have opened the day on a mixed note with auto and realty stocks trading in the red. While consumer durables and healthcare stocks are among the top gainers on the BSE.

Engineering stocks have opened the day on a mixed note with Kalpataru Power and Finolex Cables being the most active stocks in this space. As per an article in a leading financial daily, Larsen & Toubro (L&T) and MBDA, a multinational leader in missile systems, have announced an alliance to develop and supply missiles and missile systems to meet the growing demand of India's armed forces. MBDA is jointly held by Airbus Group, BAE Systems and Leonardo and has expertise in developing all kinds of missile systems.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

The Joint Venture Company, named 'L&T MBDA Missile Systems Ltd', would operate from a dedicated work centre, which will include pyrotechnical integration and final checkout facilities. The JV would focus on business opportunities in the Missiles and Missile Systems domain and target prospects under the Buy (Indian - IDDM), Buy (Indian) and Buy & Make (Indian) categories of defence procurement.

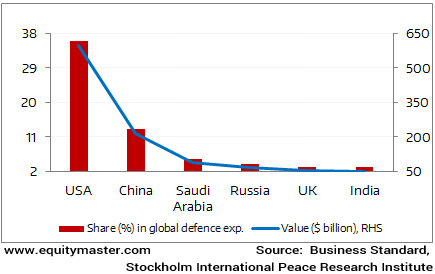

The move to set up a joint venture comes in the wake of the Indian government deciding not to buy missile systems from overseas but source them domestically. The defence sector in India is a sunrise sector. India was among the top ten spenders on military expenditure, ahead of countries such as France, Japan and Germany. However, a significant share of the country's defence requirement is still imported. To encourage domestic production of defence equipment, as part of the initiative to boost manufacturing, the government has implemented a number of measures.

India Among Top Defence Spenders in the World in 2015

Moreover, the Defence Research and Development Organization (DRDO) has signed a technology transfer agreement with a private company, L&T, for the commercial production of Pilotless Target Aircraft.

Reportedly, L&T will own 51% stake in the JV and the rest 49% with the European partner. Moreover, this would not be first time where L&T and MBDA have collaborated. Both the companies together have partnered on co-development and production of major subsystems involving complex technologies and sophisticated weapon systems such as MICA missile launchers and airframe segments including control actuation units for India's defence ministry orders.

To know more about the company's financial performance, subscribers can access to L&T's latest result analysis (Subscription Required) and L&T stock analysis on our website. L&T share price began trading down by 0.3%.

Moving on to the news from stocks in pharma sector. According to an article in leading financial daily, In a major relief to lakhs of heart patients the National Pharmaceutical Pricing Authority (NPPA) reduced prices of stents by about 85%. The price of high grade drug eluting stents (DES) and bioresorbable stents has been capped at Rs 30,000, while that of bare metal stents has been fixed at Rs 7,500.

Reportedly, the cost of a drug eluting stent currently ranges between Rs 24,000 and Rs 1.5 lakh and that of a bio resorbable stent is Rs 1.7 lakh to Rs 2 lakh. Over 95% of stents used in India are drug eluting.

The prices will be effective from notification on Feb 14. This step is a boon for persons with clogged arteries. An estimated 6 lakh stents were used in 2016, the reports noted.

According to the NPPA data, that the hospitals make upto 65% profit on stents. It is because of this many hospitals were opposing price control on stents. Now, the hospitals will have to bill stents separately.

Pharma stocks began the trading day up by 0.1%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat; Pharma Stocks Gain". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!