India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 10, 2023

Sensex Today Sheds 200 Points | Adani Group Stocks Fall up to 5% | LIC Share Price Rises Post Strong Q3 Show Fri, 10 Feb 10:30 am

Asian share markets are down today after US equities fell for a second day and treasury yields climbed as investors began to adjust for the prospect of higher interest rates.

The Nikkei is up 0.3% while the Hang Seng is trading lower by 1.8%. The Shanghai Composite is down by 0.6%.

US stock indices ended lower on Thursday, erasing earlier gains as treasury yields rose after an auction of 30-year bonds went poorly and overshadowed strong earnings from corporate giants like Disney and PepsiCo.

The Dow Jones ended 0.7% lower while the tech heavy Nasdaq Composite ended lower by 1%.

Here's a table showing how US stocks performed on Friday:

| Stock/Index | LTP | Change ($) | Change (%) | Day High | Day Low | 52-Week High | 52-Week Low |

|---|---|---|---|---|---|---|---|

| Alphabet | 95.46 | -4.54 | -4.54% | 100.61 | 93.86 | 144.16 | 83.45 |

| Apple | 150.87 | -1.05 | -0.69% | 154.33 | 150.42 | 179.61 | 124.17 |

| Meta | 177.92 | -5.51 | -3.00% | 186.65 | 177.27 | 236.86 | 88.09 |

| Tesla | 207.32 | 6.03 | 3.00% | 214 | 204.77 | 384.29 | 101.81 |

| Netflix | 362.5 | -4.33 | -1.18% | 373.83 | 361.74 | 411.61 | 162.71 |

| Amazon | 98.24 | -1.81 | -1.81% | 101.78 | 97.57 | 170.83 | 81.43 |

| Microsoft | 263.62 | -3.11 | -1.17% | 273.98 | 262.8 | 315.95 | 213.43 |

| Dow Jones | 33,699.88 | -249.13 | -0.73% | 34,252.57 | 33,607.13 | 35,824.28 | 28,660.94 |

| Nasdaq | 12,381.17 | -114.21 | -0.91% | 12,679.54 | 12,327.44 | 15,265.42 | 10,440.64 |

Back home, Indian share markets are trading on a negative note tracking the trend on SGX Nifty.

At present, the BSE Sensex is trading lower by 210 points. Meanwhile, the NSE Nifty is trading lower by 65 points.

Bajaj Twins and SBI are among the top gainers today.

Tata Steel, and HCL Technologies are among the top losers today.

Broader markets are trading on a mixed note The BSE Mid Cap index is trading flat, while the BSE Small Cap index is up 0.5%.

Sectoral indices are trading on a mixed note. Stocks in the industrials sector, and capital goods sector witness buying.

Meanwhile stocks in the IT sector, and metal sector witness selling.

Shares of Britannia and Blue Star hit their 52 week high today.

The rupee is trading at Rs 82.56 against the US dollar.

In the commodity markets, gold prices trade lower by Rs 326 at Rs 56,526 per 10 grams.

Meanwhile, silver prices are trading lower by 1.1% at Rs 66,296 per 1 kg.

Speaking of stock markets, OpenAI which operates ChatGPT is in talks for a tender offer that could value it at US$29 billion (bn) (about Rs 2,395.6 bn), making it one of the most valued startups.

ChatGPT's valuation is higher than the marketcap of Sensex listed companies such as Nestle, Titan and Wipro.

Could there be a similar opportunity in the making for Indian Artificial Intelligence stocks? Find out in the below video.

Adani groups stock back to falling ways

Index provider MSCI said it has cut the free-float designations of four securities of India's Adani group, a move which analysts have warned could impact their index weightings, as reported by Reuters.

MSCI said that it has reduced the free floats of Adani Enterprises, Adani Total Gas, Adani Transmission and ACC. The remaining companies' free floats will remain the same.

MSCI defines free float as a proportion of shares outstanding that are available to investors for purchase in the public equity markets.

The four companies for which the free float designation change was announced had a combined 0.4% weighting in the MSCI emerging markets index as of 30 January. The changes come into effect on 01 March.

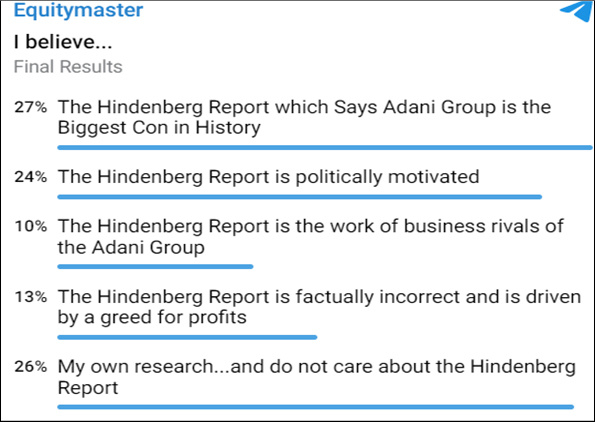

Speaking of Adani group stocks, to know what our readers are thinking about the whole Adani - Hindenburg Saga, we recently conducted a poll on our telegram channel and here are the results:

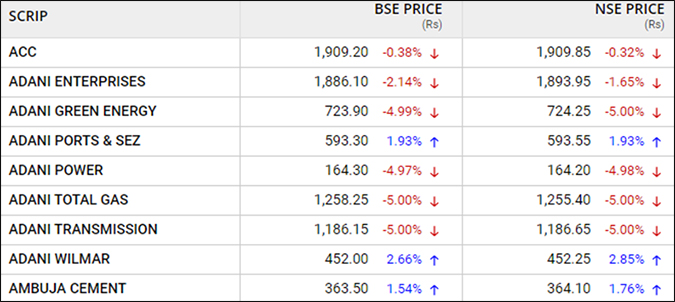

In the past two days, Adani group stocks rallied and saw some respite but today again, they are trading on a negative note.

Take a look at their performance today:

Zomato Q3 results

Moving on, Zomato's consolidated losses widened to Rs 3.5 bn (about Rs 346.6 crore) for the quarter ended December 2022 as against a loss of Rs 630 m in the year-ago period. The online food delivery platform had posted a net loss of Rs 2.5 bn in the previous September quarter.

Revenue from operations rose 75% to Rs 19.5 bn for the December quarter as compared to Rs 11.1 bn in the corresponding period of last year. On a sequential basis, revenue improved by 17% as against Rs 16.6 bn reported in the previous quarter.

The online food delivery giant's adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) loss increased to Rs 2.7 bn in the December quarter. Excluding Blinkit, the operating loss was Rs 380 m compared with Rs 2.7 bn a year ago.

Excluding Blinkit business, Zomato turned positive at the operating level in January even as the food delivery business witnessed a slowdown.

Did you know that Zomato is one of the 5 Indian midcap stocks set to grow dramatically in 2023?

HPCL quarterly business update

PSU oil marketing company, Hindustan Petroleum on Thursday reported a consolidated net profit of Rs 4.4 bn for the December quarter, down 67.2% YoY as against Rs 13.5 bn in the corresponding period of last year.

On a sequential basis, the profit after tax or PAT dropped 82% from Rs 24.8bn in the quarter ending September last year.

The oil and gas refining company has clocked Rs 1.2 tn in revenue as against Rs 1 tn, up 12.3% on-year.

EBITDA came in at Rs 16.8 bn versus Rs 16.6 bn, up 1% YoY.

HPCL is expanding the 8.3 m tonne per annum (MTPA) refinery and building a new one at Barmer in Rajasthan to bridge the gap between the fuel it produces and sells.

LIC Q3 Results

Life Insurance Corp (LIC) of India on Thursday posted multi-fold growth in consolidated net profit at Rs 8,334 crore for the December 2022 quarter, compared with just Rs 211 crore in the corresponding quarter of last year.

Varun Beverages block deal

According to reports, promoters of Varun Beverages will sell their stake worth Rs 8.5 bn through a block deal today.

The shares are likely to be offered at a 5-7% discount to Thursday's close price. On Thursday, the stock ended nearly 3% down at Rs 1,274.95 on the National Stock Exchange.

Looks like promoters are making the most of the rally in Varun Beverages as the company has delivered multibagger gains in the year gone by.

Read this to know what lies ahead for Varun Beverages in 2023.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Sheds 200 Points | Adani Group Stocks Fall up to 5% | LIC Share Price Rises Post Strong Q3 Show". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!