India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 10, 2023

Sensex Today Ends Choppy Session Lower | Paytm, Adani Group Stocks Fall up to 9% | Realty Stocks & Tata Motors Rise Fri, 10 Feb Closing

After opening the day on a negative note, Indian share markets continued their downtrend as the session progressed and ended marginally lower.

Benchmark indices fell tracking a slide in global equities amid fears of a looming US recession, and as sentiment soured after index provider MSCI said it will cut the weightage of four Adani group companies.

At the closing bell, the BSE Sensex stood lower by 124 points (down 0.2%).

Meanwhile, the NSE Nifty closed lower by 37 points (down 0.2%).

Tata Motors, UPL, and Cipla were among the top gainers today.

Adani Enterprises, HCL Tech, and Hindalco on the other hand, were among the top losers today.

The SGX Nifty was trading at 17,856, down by 75 points, at the time of writing.

Broader markets settled on a positive note. The BSE Midcap ended flat while the BSE SmallCap index ended 0.5% higher.

Sectoral indices ended on a mixed note with stocks in the telecom sector, realty sector and capital goods sector witnessing heavy buying.

While stocks in the metal sector, energy sector, and power sector witnessed selling.

Shares of Jindal Saw, Blue Star, and Sonata Software hit their 52-week highs today.

To know about the stocks which moved the markets, check out the stocks to watch today section on our website.

Asian share markets ended the day on a mixed note. The Hang Seng index tanked 2%, while the Shanghai Composite index fell 0.3%. The Nikkei rose 0.3% today.

US stock futures are trading on a negative note. Dow futures are trading lower by 0.1% while Nasdaq futures are trading down by 0.7%.

The rupee is trading at 82.55 against the US$.

Gold prices for the latest contract on MCX are trading lower by 0.2% at Rs 56,715 per 10 grams.

Meanwhile, silver prices for the latest contract on MCX are trading down by 0.3% at Rs 66,849 per kg.

Speaking of stock markets, OpenAI which operates ChatGPT is in talks for a tender offer that could value it at US$29 billion (bn) (about Rs 2,395.6 bn), making it one of the most valued startups.

ChatGPT's valuation is higher than the marketcap of Sensex listed companies such as Nestle, Titan and Wipro.

Could there be a similar opportunity in the making for Indian Artificial Intelligence stocks? Find out in the below video.

Adani Group shares fall amid institutional investors' concern

Adani group shares fell for a second straight day on Friday amid concerns raised by key institutional investors and Life Insurance Corporation (LIC) over the allegations of accounting fraud and share manipulation labelled by the US-based short seller Hindenburg Research.

LIC on Thursday announced that it will soon meet the top management of the Adani Group to seek clarification over the allegation labelled by the US-based Hindenburg Research.

The opposition parties have also criticised LIC's investment in Adani group companies.

The slide continued even as Adani group shares escaped removal from MSCI indexes. Index provider MSCI, however, cut the free-float designations of four securities of the Adani group.

On Friday, to fight back against the Hindenburg report, the Adani-led conglomerate hired defence law firm Wachtell, Lipton, Rosen and Katz in the legal battle.

Wachtell is one of the most expensive law firms in the US.

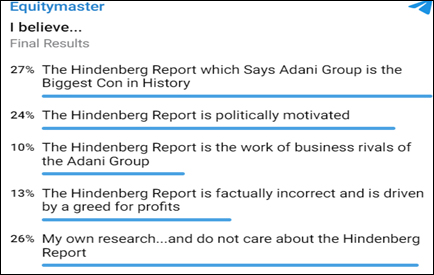

Speaking of Adani group stocks, to know what our readers are thinking about the whole Adani - Hindenburg Saga, we recently conducted a poll on our telegram channel and here are the results:

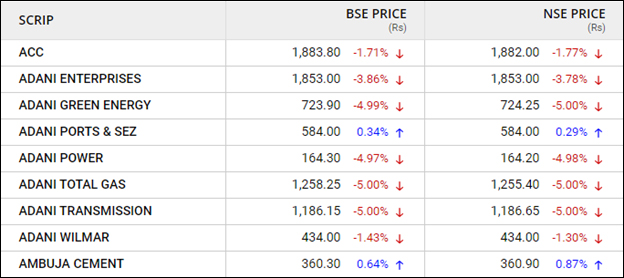

In the past two days, Adani group stocks rallied and saw some respite but today again, they fell.

Take a look at their performance today:

M&M Q3 results

Moving on to news from the automobile sector, share price of M&M fell 0.8% today.

Mahindra and Mahindra on 10 February 2023 reported a 41% YoY (year-on-year) in revenue to Rs 216.5 billion (bn) for December 2022 quarter.

The company's net profit jumped 13.5% YoY to Rs 15.3 bn from Rs 13.3 bn in the same quarter last year.

This profit growth was on the back of the robust performance of its auto division and an increased market share in the farm division.

The company's passenger vehicle sales jumped 59% YoY to 91,135 units. Tractor sales rose 14% YoY to 1,05,765 units.

The open bookings for SUVs stood at over 2,66,000 as of 1 February 2023, reflecting strong demand.

Note that M&M has already announced its commitment of over a billion dollars to aggressively participate in the EV race and it expects a significant 30% of its total sales to come from electric SUVs by 2027.

The electric vehicle (EV) megatrend is a once in a century revolution happening right in front of us.

The revolution has taken the auto sector by storm. All segments of the sector are ripe for disruption, and India's top EV stocks are set to benefit from this shift.

Take a look at the chart below, which shows the massive opportunity in the two-wheeler EVs.

It remains to be seen how the above developments pan out.

Sun Pharma gets USFDA nod to market generic medication

Moving on to news from the pharma sector, shares of Sun Pharma were in focus today.

Sun Pharma's wholly owned subsidiaries, on Friday, received final approval from USFDA for its abbreviated new drug application (ANDA) for generic lenalidomide capsules.

In June 2021, Sun Pharma entered into a settlement with Celgene Corporation (Celgene) to resolve the patent litigation regarding its generic lenalidomide capsules.

Under the terms of this settlement, Celgene granted Sun Pharma a license to patents required to manufacture and sell certain limited quantities of generic lenalidomide capsules in the US, beginning sometime after March 2022

In addition, the license allows Sun Pharma to manufacture and sell an unlimited quantity of generic lenalidomide capsules in the US beginning 31 January 2026.

Sun Pharma is one of the leading players in the chronic therapies segment in India. In the past five years, the stock has gained 84.7%, and is a strong candidate among the 4 pharma stocks to watch out for potential multibagger return.

Increasing demand for chronic conditions and ailments will be the growth driver for Sun Pharma in the future.

If you want to bank on specialty pharma story, Sun Pharma is your best bet.

To know what's moving the Indian stock markets, check out the most recent share market updates here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Today Ends Choppy Session Lower | Paytm, Adani Group Stocks Fall up to 9% | Realty Stocks & Tata Motors Rise". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!