India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 7, 2017

Markets Continue to Remain Weak; ITC Gains on Block Deal Tue, 7 Feb 01:30 pm

After opening the day flat, the Indian share markets have continued to trade on a weak note and are trading marginally below the dotted line. Sectoral indices are trading on a mixed note with stocks in the power sector and oil & gas sector witnessing maximum buying interest. Auto stocks are trading in the red.

The BSE Sensex is trading down 55 points (down 0.2%) and the NSE Nifty is trading down 17 points (down 0.2%). Meanwhile, the BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.5%. The rupee is trading at 67.36 to the US$.

ITC share price rallied over 5% intraday today after the Specified Undertaking of the Unit Trust of India (SUUTI) sold 2% stake in the company via block deals. ITC's shares hit a 52-week high of 291.9 as the divestment news broke.

As per ITC's market capitalization, the 2% stake sale should fetch the government around Rs 67 billion.

With this move, the government now seems closer to achieving the revised Rs 455 billion divestment target for FY17. As of now, the total divestment made via minority stake sale and strategic stake sale stands close to Rs 377 billion.

The government expects to raise another Rs 150 billion in two months and clock the highest ever proceeds from disinvestment at Rs 455 billion at the end of this financial year against the initial target of Rs 565 billion.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

Through SUUTI, the government now holds 9.1% stake in ITC after the sale.

At the time of writing, ITC shares were trading up by 0.7%.

ITC share price has rallied handsomely in the past month and has benefited from a favorable budget and decent quarterly results. However, it too has seen significant downturns during the year, the most recent one being the post-demonetisation slump.

This tells us one thing - stock markets are extremely volatile. A period of upheaval may be followed by an unprecedented downturn. We think the best way to counter this volatility is to have a set process in place for times like that.

Many of you have already tasted the fruits of one of Rahul's processes with his Microcap Millionaires service.

Now, at the Equitymaster Conference 2017, Rahul asked attendees to mark 10 February 2017 on their calendars. The reason? He will send out his first Profit Velocity report to subscribers.

As you may have guessed, Profit Velocity is a system-based strategy.

With Profit Velocity, Rahul believes that the system he has worked upon and developed could help subscribers potentially fetch gains several times those of the benchmark index. In keeping with that, our Founder Member opportunity, which closes at midnight of 10th February, offers a whopping 60% discount on the usual membership fees for Profit Velocity.

So don't miss out. Act now!

Moving on to news about the economy. According to data released by the RBI, digital payment volumes have gown down by in January 2017 as compared to December 2016.

Digital payments were 10.2% lower by volume and 7% lower by value in January 2017 against December 2016.

The number of digital transactions fell from 1,027.7 million in December to 922.9 million in January. In value terms, the number declined from Rs 105.4 lakh crore in December to Rs 98 lakh crore in January. This data included transactions on credit and debit cards, electronic fund transfers, digital wallets and mobile banking transactions.

RBI started releasing representative data on payment systems on a daily basis since December 2, 2016. This comes after the government had announced the note ban on November 8.

Within digital transactions, debit and credit transactions at point-of-sale terminals declined 18.6% month-on-month (MoM) in January, indicating people's preference for cash. Mobile banking transactions declined 7.6% MoM.

After the initial cash crunch the liquidity situation in most parts of the country has eased and people are seen to be going back to their preferred mode of transaction - cash.

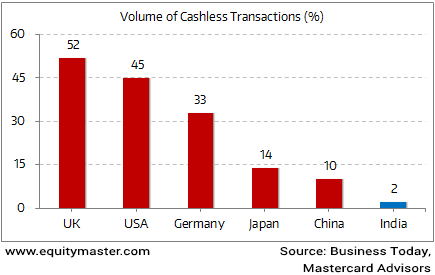

Is India ready to go digital?

There were restrictions on cash withdrawal in January, but the situation was not as bad as in December. According to the RBI Governor, by January 18, the central bank had remonetised 60% of the cash scrapped on November 8.

The cashless dream is not lost however, as there was there was an uptick in other modes of digital payment in January. For example, the Immediate Payment Service (IMPS), used to transfer money in an instant, saw 18% increase in volumes in January.

Similarly, the Unified Payments Interface (UPI) of the National Payments Corporation of India was seen gaining traction. As UPI transactions went from 0.3 million transactions in November to 2 million in December. The corresponding figure in January was 4.2 million.

This may well be positive signs, but to go cashless would mean a complete overhaul of how Indians spend their money. Banks and other financial institutions banks will have to be technologically competent to tackle the security issues associated with the shift towards a digital economy.

It remains to be seen how the financial infrastructure of the country and the government cope with the process of going digital.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Markets Continue to Remain Weak; ITC Gains on Block Deal". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!