India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News February 1, 2017

Sensex Opens Flat Ahead of Budget 2017 Wed, 1 Feb 09:30 am

Asian markets are mixed today. The Hang Seng is lower by 0.91% while the Nikkei 225 is even. European markets finished broadly lower with shares in Germany leading the region. Meanwhile, share markets in India have opened the trading day on a flattish note with a positive bias ahead of the Budget announcement. The BSE Sensex is trading up by 58 points while the NSE Nifty is trading higher by 13 points. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.4% & 0.3% respectively.

The rupee is trading at 67.81 to the US$. Barring information technology stocks, all sectoral indices have opened the day in green. Realty and consumer durables stocks are among the top gainers on the BSE.

Power stocks have opened the day on a mixed note. Jaiprakash Power and KSK Energy are the most active stocks in this space. According to an article in The Economic Times, Rural Electrification Corp (REC) has signed a loan agreement with Tamil Nadu's power generation and transmission utilities for financial assistance of Rs 68.9 billion.

Reportedly, the pact has been signed with Tangedco and Tantransco in Chennai for implementation of 800 Megawatt supercritical thermal power plant, renovation and modernisation of existing thermal power plants and establishment of new 765 KiloVolt, 400 KV substations in and around Chennai.

Further, it will also support in other renewable energy, energy conservation, smart grid and automation power projects in Tamil Nadu.

In the meanwhile, REC has also inked three pacts to extend financial assistance of around Rs 600 billion to Andhra Pradesh recently. The financial assistance comprises Rs 400 billion to Andhra Pradesh Power Generation Corp, Rs 100 billion to Transmission Corporation of Andhra Pradesh and Rs 100 billion to AP DISCOMSs.

Apart from financial assistance, power utilities have agreed for availing Consultancy and Management Services from wholly owned subsidiaries of REC for their various projects for next 5 years, the reports noted. To know more about the company's financial performance, subscribers can access to REC's latest result analysis (subscription required) and REC stock analysis on our website.

Moving on to the news from stocks in steel sector, National Aluminium Company Limited (Nalco) and Neelachal Ispat Nigam Limited (NINL) have signed a memorandum of understanding (MoU) to set up a joint venture company for producing coal tar pitch in Odisha.

Under the JV, the coal tar distillation plant that is proposed to be set up. The plant will use the coal tar generated from NINL's coke oven plant at its 1.1 million tonne per annum integrated iron and steel plant at Kalinga Nagar in Duburi. Meanwhile, NINL will be preparing a techno-economic feasibility report for the JV project.

The agreement comes on the back of Nalco's new business plan to ensure backward integration and sustain the plans for forward integration.

Speaking of the aluminum industry, aluminium demand in India has been growing at a decent rate. This is on the back of increased usage of aluminium and its alloys in the automobile sector. However, the aluminium industry has been plagued by a massive oversupply that has put pressure on prices.

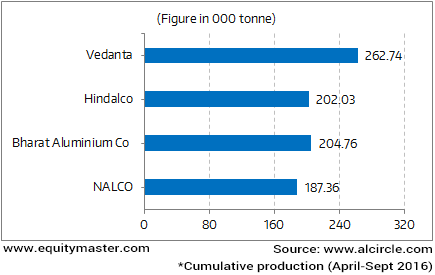

Production of Aluminium during September 2016

Reportedly, India's aluminium consumption is rising steadily and is estimated to reach eight million tonnes per annum over the next ten years driven by growth in automobile, electricity, building & construction and packaging sectors. The aluminium that is produced here has to meet the costs and environment challenges.

NALCO share price opened the day down by 1.3%.

Union Budget for 2017-18 will be tabled in the parliament today. You can read about the key takeaways and some important updates in our today's 5 Minute WrapUp. Stay tuned.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Flat Ahead of Budget 2017". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!