India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 31, 2017

Sensex Closes in Red; Economic Survey Fails to Cheer Market Tue, 31 Jan Closing

Share markets in India finished the day on a negative note as Finance Minister Arun Jaitley tabled Economic Survey for 2016-17. The Survey has projected the growth rate for the current fiscal at 6.5%, lower than 7.1% projected by Central Statistics Office earlier this month. It outlined three main downside risks to the FY18 GDP growth forecast adding that demonetisation, rise in oil prices and global trade tensions will affect the growth forecast.

At the closing bell, the BSE Sensex closed lower by 194 points, whereas the NSE Nifty finished lower by 71 points. The S&P BSE Midcap and the S&P BSE Small Cap both finished down by 1.1% & 1% respectively. Barring FMCG stocks, all sectoral indices ended the day in red with Information technology and energy stocks witnessing maximum brunt.

Asian markets that were open for business during the Lunar New Year holiday extended their declines Tuesday, tracking overnight losses in Wall Street. Japanese markets fell 1.69% as Japan's central bank keeps monetary policy unchanged. European markets are higher today with shares in London leading the region. The FTSE 100 is up 0.54% while France's CAC 40 is up 0.44% and Germany's DAX is up 0.37%. The rupee was trading at Rs 67.81 against the US$ in the afternoon session. Oil prices were trading at US$ 52.43 at the time of writing.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

IT stocks ended the day down by 3%. TCS and Info Edge were among the top losers in the IT space. According to an article in The Economic Times, Wipro has teamed with and invested in supply chain finance platform Tradeshift to offer a cloud-based source-to-pay (S2P) business-process-as-a-service (BPaaS) solution. Headquartered in San Francisco, Tradeshift offers a business commerce platform to digitally connect companies through cloud-based, collaborative accounts payable and procurement automation.

The partnership aims to help customers accelerate digitalization and automation in their procurement, finance and accounting functions. Along with Tradeshift's capabilities, Wipro will be able to standardise and continually expand its business process as a service (BPaaS) offerings, the reports noted.

After acquiring Appirio, a US$500 million buy to strengthen cloud-based services, this the second investment for cloud-based service delivery.

Meanwhile, a legislation has been introduced in the US House of Representatives which doubles the minimum salary of H-1B visa holders to US$ 130,000. Following the tabling of the Bill, the BSE IT index fell by 4%. The shares of HCL Technologies fell 3.7%. TCS saw its stock price tumble 4.6%. And Wipro went down by 4.1% on the bourses.

Reportedly, Indian IT professionals largely use these visas to go to the US. The Bill introduced seeks to double the salaries for IT firms to US$130,000 per annum, which is more than double of the current H-1B minimum wage of US$60,000, which has remained so since 1989. The bill, if passed, would require employers in the US to first offer a vacant position to an equally or better qualified American worker before seeking an H-1B or L-1 visa holder.

This move could affect technology companies that depend on the programme to hire tens of thousands of employees each year, the reports noted.

Subscribers can access Wipro's latest result analysis and Wipro stock analysis on our website (subscription required).

Moving on to the news from stocks in pharma sector. It was reported that, the Centre has moved the Supreme Court seeking to enforce a ban on 344 fixed dose combination (FDC) drugs, challenging a Delhi HC order which had last month overturned a government notification on the issue. A FDC drug combines two or more active pharmaceutical ingredients.

The notification which imposed ban on 344 FDC drugs including popular cough syrups based on codine like Phensedyl and Corex, the ministry had prohibited manufacturing and sale of these medicines in March last year. They were allegedly found to be without any therapeutic efficacy or use. Also, there were concerns about misuse of such medicines considered unsafe for mass consumption.

The ban had impacted several popular brands including Corex, Phensedyl, Saridon, D'Cold Total and Vicks Action 500 Extra. The government's ban had impacted about 6,000 brands.

The government aims to organize India's healthcare system. As it weeds out irregularities from the healthcare sector, pharma companies are likely to face such challenges in this process. Bhavita Nagrani, our Research analyst has spoken about how the ban will impact pharma companies that form a considerable part of FDC drugs falling into the category (Subscription Required) in one of our premium editions of The 5 Minute Wrapup. Here's an excerpt from the article:

- "According to the Central drugs standard control organization (CDSCO) website, DCGI (Drug Controller General of India) has approved (last updated Nov 2014) 1,193 FDC drugs. Apart from this, number of FDCs approved from various state governments are more than 4,000. This means the current ban captures only a small part of the list. Given the flouts in this category of drugs; we won't be surprised if more drugs are added in the banned list".

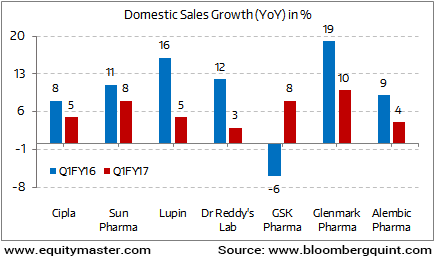

Impact of Price Curbs on Domestic Growth of Pharma Companies

Market research organisation AIOCD AWACS had estimated the overall annual sales impact of the ban on the pharmaceutical market to be around Rs 30-35 billion of the Indian clinical drug market, after the ban came into effect. However, domestic sales in India had recovered in Q2FY17.

S&P BSE Healthcare index finished the day down by 1.38%.

And here's a note from Profit Hunter:

In today session, the entire IT sector was hit hard on back of H1B visa issues making the IT sector the top loser for the day.

Let us look at what the charts has to say.

The Nifty IT index was amongst the worst performers in 2016. It hit a low, as did the Nifty-50 index, in February 2016. From these lows, the Nifty-50 index returned just over 22%. The Nifty IT index on the other hand returned a negative 4%.

Looking from a longer term perspective, the Nifty IT index is trading in a descending channel, with its resistance placed at 10, 650 levels.

The RSI indicator, which measures the strength of the trend, is refraining to go into its overbought territory. This indicates lack of strength in the price trend.

Although there are many other factors to be considered, purely based on the above, the Nifty IT index does not appear to be well positioned at the moment.

Until and unless we see a sustained break through the resistance levels and RSI indicators gaining some strength, the Nifty IT index might remain under pressure.

Nifty-IT Index under Pressure

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Closes in Red; Economic Survey Fails to Cheer Market". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!