India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 25, 2017

Sensex Opens Marginally Up; Kotak Mahindra Gains 0.7% Wed, 25 Jan 09:30 am

Asian markets are higher today as Japanese and Hong Kong shares show gains. The Nikkei 225 is up 1.10% while the Hang Seng is up 0.21%. The Shanghai Composite is trading up by 0.25%. Stock markets in the US ended their previous session on a firm note.

Meanwhile, Indian share markets have opened the trading day marginally higher. The BSE Sensex is trading higher by 88 points while the NSE Nifty is trading higher by 26 points. The BSE Mid Cap index and BSE Small Cap index have opened the day up by 0.3% & 0.5% respectively. The rupee is trading at 68.16 to the US$. All sectoral indices have opened the day on a positive note with consumer durables, realty and banking stocks witnessing maximum buying interest.

Banking stocks have opened the day in green with only Dhanlaxmi Bank, City Union bank witnessing selling pressure. According to an article in The Economic Times, Kotak Mahindra International divested 2.1% stake in private sector lender South Indian Bank for an estimated over Rs 600 million through an open market transaction.

According to bulk deal data available with the BSE, Kotak Mahindra International sold a total of 28.5 million shares, amounting to 2.11% stake, in South Indian Bank. Further, the shares were purchased by Lavender Investments Ltd.

Kotak Mahindra International held a 2.11% holding in South Indian Bank, while Lavender Investments owned 2.82% stake in the private sector lender as of December quarter.

In another development, it was reported that, with a number of small finance banks (SFBs) already operational, customers are being offering interest rates up to 150-200 basis points higher than the market rate.

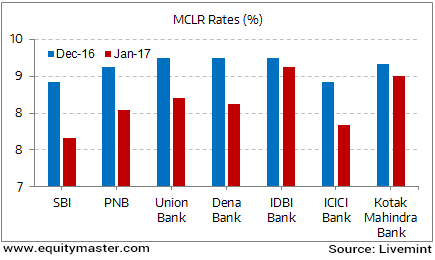

Interest Rates Finally Headed Down South?

This comes at a time when banks are flush with funds after demonetisation and are cutting interest rates on deposits to keep pace with slow credit offtake. As microfinance institutions, the cost of funds for most SFBs was around 11% or more. But after converting into banks, even with interest rates higher than the market, their cost of funds will come down. Also, SFBs are initially expected to continue to focus on microlending rather than full-fledged retail banking. Hence, most of the proposed banks have kept MCLR high. For example, the MCLR for Suryoday is 17%, the reports noted.

According to Reserve Bank of India (RBI) norms, small finance banks are to start operations by April 2017. In September 2015, RBI granted licences for 10 small finance banks. Earlier, the RBI granted licenses for 11 payments banks.

Moving on to the news from stocks in pharma sector, Lupin Pharmaceuticals has launched a generic version of contraceptives Ortho-Cyclen tablets after approval from the US health regulator.

Reportedly, Lupin has launched its Norgestimate and Ethinyl Estradiol Tablets USP, 0.25 mg/0.035 mg. In this regard, it has received approval from the United States Food and Drug Administration (USFDA) earlier to market a generic version of Janssen Pharmaceutical Inc.'s Ortho-Cyclen 28 Tablets. The tablets had sales of US$ 204 million as per IMS MAT September 2016.

Meanwhile, it was reported that, the Indian pharmaceutical industry is on the threshold of becoming a major global market by 2020 with revenues close to Rs 1,652 billion (FY 2014-15), and is expected to grow at a 15-20% CAGR. Exports clocked revenues close to Rs 942.75 billion in FY 2014-15.

In light of such anticipated growth rates, it is imperative that the pharma sector gets the necessary fillip on the income-tax front in the eagerly awaited union budget 2017.

Recently, in one of our editions of The 5 Minute WrapUp, we wrote about the USFDA crackdowns faced by the Indian Pharma in the recent times and how they have been constantly investing towards R&D. We believe pharma companies that are upgrading and keeping facilities compliant, and have niche product pipelines in place will see sustained revenue growth.

Indian pharma sector has had its fair share of challenges, be it the ban (though, now struck down) of many FDC (fixed dose combination) drugs or the constant encounters faced by it in relation to IP protection. Thus, going forward, whether the union budget 2017 presents some tax sops to all the stakeholders of this sector will be the prominent thing to watch out for.

HYPERLINK "https://www.equitymaster.com/result.asp?symbol=LUPL&name=LUPIN-LTD-Stock-Quote-Chart" Lupin share price opened the day up by 0.5%.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Opens Marginally Up; Kotak Mahindra Gains 0.7%". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!