India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 25, 2017

Indian Indices Continue to Trade in the Green; Realty Stocks Witness Buying Wed, 25 Jan 01:30 pm

After opening the day marginally higher, the Indian share markets have continued their momentum and are presently trading in the green. Sectoral indices are trading on a positive note with stocks in the realty sector and consumer durables sector witnessing maximum buying interest.

The BSE Sensex is trading up 193 points (up 0.7%) and the NSE Nifty is trading up 71 points (up 0.8%). The BSE Mid Cap index is trading up by 0.6%, while the BSE Small Cap index is trading up by 0.8%. The rupee is trading at 68.14 to the US$.

As per an article in the Economic Times, a high-level committee on digital payments has suggested a tax to discourage cash transactions. As per the news, the committee has suggested a banking cash transaction tax on transactions of Rs 50,000 and above.

Moreover, it has also suggested abolition of charges on card payments to incentivise digital transactions.

It is also said some of the above recommendations could find a mention in the upcoming Union Budget which is scheduled for February 1.

Just Released: Multibagger Stocks Guide

(2017 Edition)

In this report, we reveal four proven strategies to picking multibagger stocks.

Well over a million copies of this report have already been claimed over the years.

Go ahead, grab your copy today. It's Free.

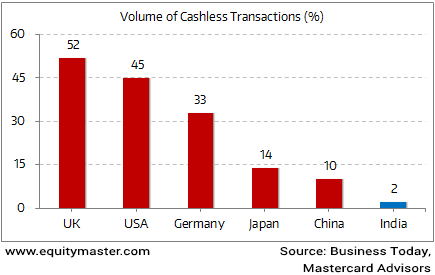

The aim here is to give a boost digital transactions and make them attractive than cash transactions. The government expect India to move in the direction of becoming a cashless economy.

However, we must question: Will it be in India's best interest to move towards a cashless society?

We don't think so.

The fact is that India is not ready to go digital. A few days ago we pointed out some challenges to India's digitisation. Only 15% of India's one billion wireless subscribers have a broadband connection. Around six lakh villages do not have adequate mobile or internet connectivity. India has only around 15.1 lakh point of sales machines. So unless these issues are sorted out, the road towards a cashless economy will remain a long one.

Is India Ready to Go Digital?

We don't know how the above trends will play out. The move towards a cashless society could mean a positive development for India. It will lower costs, improve transparency in transactions, save time, and open up opportunities for some companies. However, we must pause to consider the other side of the coin, and be ready to deal with challenges.

In other news from the IPO space, BSE's initial public offering (IPO) has garnered good response so far. The issue got oversubscribed 1.55 times on the second-day of the bidding process.

The IPO, which opened on Monday, closes for subscription on Wednesday, January 25, 2017.

The IPO is an offer-for-sale of up to 15.43 million equity shares of face value of Rs 2 each in a price band of Rs 805-806 an equity share. The objects of the issue are to achieve the benefits of listing the equity shares on NSE and for the sale of equity shares by the selling shareholders.

As far as IPOs are concerned, listing gains and over subscription of the issues have caught the eye of market participants. In our view, one should not get swayed away by the buoyancy surrounding IPOs. Instead, what one should look for in IPOs is the fundamentals of the business and the attractiveness of valuations.

The bottomline: One needs to evaluate each IPO on its merits by considering its fundamentals and most importantly the valuations, particularly when the hype and mania surrounding an IPO is at its peak.

One of our editions of The 5 Minute WrapUp offers two ways to think about IPOs and explains how to profit from them. Further, in case you wish to run IPOs through a handy checklist, we have something for you. Download our Handbook of IPOs to be able to pick only the right ones for you.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Indian Indices Continue to Trade in the Green; Realty Stocks Witness Buying". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!