India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Todays Market

- Indian Stock Market News January 2, 2017

Sensex Remains Negative; Realty Stocks Witness Buying Interest Mon, 2 Jan 01:30 pm

After opening the day on negative note, the Indian share markets have continue to trade below the dotted line. Sectoral indices are trading on a mixed note with stocks in the Realty sector and the Metal sector witnessing maximum buying interest. Stocks in the Banking sector are trading in the red.

The BSE Sensex is trading down by 85 points (down 0.3%) and the NSE Nifty is trading down 22 points (down 0.3%). Meanwhile, the BSE Mid Cap index is trading up by 0.4%, while the BSE Small Cap index is trading up by 0.8%. The rupee is trading at 68.01 to the US$.

According to an article in a leading financial daily, foreign portfolio investors (FPIs) have withdrawn a massive US $4 billion (Rs 272billion) from the Indian capital market in the month of December alone. This withdrawal comes on the heels of the interest rate hike by the US Federal Reserve.

This was the third consecutive month of outflows by overseas investors and most of the outflows have been witnessed in the debt market during the period under review.

The latest FPI outflow took place following a withdrawal of Rs 497 billion on a net basis from the capital market in both equity and debt during the months of October and November. Prior to that, FPIs had poured in Rs 460 billion in the capital market in preceding three months from July to September.

The FPI withdrawals started in October 2016 with uncertainties over the US election results.

While demonetisation may have impacted the short term sentiment. The withdrawal was further aggravated due to several factors including uncertainty over US ties after Donald Trump's victory, interest rate hike by the federal reserve, and a surge in oil prices.

Net withdrawal by FPIs from equities stood at Rs 82 billion in December, while from the debt market was Rs 189 billion, translating into a total outflow of Rs 271 billion (US $3.98 billion).

As of December, equities still remain positive on inflows for the 2016 calendar year. It was the debt market that was witness to large amounts of FPI outflows in December. The net outflows in the month of November and December alone accounted for 92% of the outflows in the debt market.

Moving on the news from the auto sector, shares of

The company said in a statement that it sold 225,529 vehicles as against 289,003 in the corresponding period a year ago. Sales of motorcycles were down 18%, while those of commercial vehicles plunged 46% on a year-on-year basis.

The decline in sales can strongly attributed to the demonetisation move, especially in the rural areas, where the demand has fallen by 20%.

Demonetisation has had a telling effect on India's prolific two-wheeler industry, with new dispatches from factories to dealers and sub-dealers reducing drastically in December. A big chunk of two-wheeler sales happens in rural India, with a large number of the transactions in cash. With demonetisation causing a cash crunch, potential buyers either scrapped or postponed their decision, hurting demand

Car manufacturers too face a similar predicament. India's largest car manufacturer Maruti Suzuki has reported a decline of 4.4% in domestic sales for the month of December 2016 as compared to the corresponding period last year.

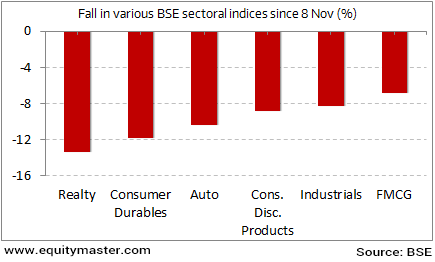

Auto stocks have taken a beating post demonetisation. Stocks from the automobile sector have fallen about 10% since the demonetisation scheme was announced on 8 November, 2016.

The Biggest Losers of Demonetisation

However, as my colleague Kunal Thanvi points out in a recent edition of the 5 Minute WrapUp, the current slump due to demonetisation is only a temporary setback.

Here's Kunal...

- Even if sales take a big blow this year, the auto growth story won't break down. Individuals and businesses will buy cars, two-wheelers, and trucks irrespective of demonetisation. A one-year hit to profitability won't change the long-term earnings power of fundamentally strong auto firms.If anything, the recent correction in auto stocks is bringing valuations down to reasonable levels. The only thing a long-term investor has to do is wait for the market to finish 'voting'. Buying good auto stocks at the right price will likely result in healthy returns a few years later when the market begins 'weighing' them.

Capitalizing on the correction in auto stocks, our Hidden Treasure team has recommended a stock from the auto ancillary sector.

But is it a buy? Find out here.

For information on how to pick stocks that have the potential to deliver big returns, download our special report now!

Read the latest Market Commentary

Equitymaster requests your view! Post a comment on "Sensex Remains Negative; Realty Stocks Witness Buying Interest". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!