India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Top Metal Stocks in India

Top Metal Stocks in India

India is seated on the golden throne when it comes to the metal and mining industry. The country is a dominant producer of most metals and minerals in the world.

India is -

- The second largest producer of crude steel in the world,

- The fourth largest producer of iron ore and chromium,

- The fifth largest producer of bauxite, graphite and zinc,

- The seventh largest producer of lead and sulphur,

- The eleventh largest producer of titanium and uranium in the world.

The Indian metal sector is divided into four groups. These are the steel industry, copper industry, zinc industry, and aluminum industry.

The growth for this sector is expected to be fueled by an increase in automotive and infrastructural construction. Further, expansion of the power and cement sector give more reasons to cheer for the metal industry.

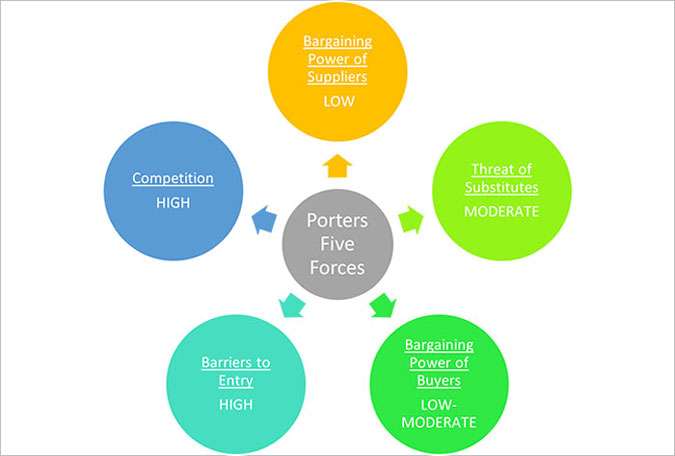

Porter’s Five Forces Analysis of the Metal Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the metal sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the metal sector, barriers to entry are high, as exploration and development of mines requires large capital investment.

#2 Bargaining Power of Suppliers

The bargaining power of customers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

This is low in the metal industry, as it is a highly regulated industry.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the metal sector, the bargaining power of customers is low to moderate. Demand/ supply imbalance determines the price of commodities. Major customers typically negotiate prices based on current market levels.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the metal industry is high to identify commodity reserves leading to more market share.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is moderate for the metal sector, as customers are switching to lighter materials because of the weight.

Porters Five Forces Analysis of the Metal Sector in India

How and When to Invest in Metal Stocks

Metal stocks are usually risker as their fortunes are prone to economic booms and busts. For this reason, they are called cyclical stocks.

Cyclical stocks do well when the economy is doing well and vice versa.

However, before selecting a stock, one must check whether the industry is due for revival or not.

So how do you play the cycle?

Let us analyze how you could have timed your entry and exit in steel stocks during the 2019-2022 period.

Steel Sector Over the Past 3 Years

| Steel Sector | Demand | Debt | Steel Prices | Valuation | Action to be taken |

|---|---|---|---|---|---|

| 2019 | Moderate | High | Moderate | Moderate | Equal Weight |

| 1H2020 | Weak | High | Low | Very Low | Time to buy |

| 2H2020 | Moderate | Moderate | High | Moderate | Time to increase weightage |

| 2021 | Strong | Low | High | High | Equal Weight |

| 2022 | Moderate | Low | High | Very High | Time to cut exposure |

2019 - The steel sector was in a steady scenario with moderate demand and steady prices. These were high debt companies.

1H2020 - The pandemic led to a crash in commodity prices. Post this, demand vanished, and stock prices halved. This was the time to buy.

2H2020 - The global economy started to recover due to free money doled out by central banks. Consequently, steel demand and prices started firming up. Container shortages and supply constraints from China too pushed up prices.

As cash flows improved, steel companies started repaying loans. This was the time to further add to positions.

2021 - Steel prices kept rising on the back of strong demand and supply constraints. Output from China declined leading to supply challenges.

As a result, Indian steel companies saw their revenues spike. Companies used these cashflows to further repay debt. Stocks prices soared.

2022 - Demand started to moderate as interest rates went up. Steel prices corrected 20-25% from the peak (after 3x rise from the bottom). Stock prices started falling.

Key Points to Keep in Mind While Investing in Metal Stocks

Here are some key points to take note of before you invest in metal stocks:

#1 Cyclicality of the sector

This is the most important factor one must keep in mind while investing in metal stocks.

Since metal stocks are cyclical, the best time to buy them is at the start of an economic expansion. The best time to sell them is just before the economy begins to slow down.

Investing in a metal stock at the peak of an economic cycle could result in a huge chunk of the investment being wiped it. Nevertheless, identifying the bottom of the cycle is not an easy task.

#2 Profitability of the company

Metal companies with a larger presence in contract sales and value-added products are insulated to a great extent from the cycle and have healthier profit margins.

Before you compare the performance of two metal companies, say for instance, Tata Steel vs JSW Steel, do factor in the operating performance.

Here’s a list of top metal companies in India based on their consolidated net profit.

| Company | Net Sales (Rs m) | Operating Profit (Rs m) | Consolidated Net Profit (Rs m) |

|---|---|---|---|

| Tata Steel Ltd. | 2,439,592 | 642,748 | 401,539 |

| JSW Steel Ltd. | 1,463,710 | 405,380 | 206,650 |

| Vedanta Ltd. | 1,327,320 | 474,240 | 188,020 |

| Hindalco Industries Ltd. | 1,950,590 | 294,830 | 137,300 |

| Hindustan Zinc Ltd. | 294,400 | 174,410 | 96,290 |

| ISMT Ltd. | 21,606 | 823 | 23,742 |

| Welspun Corp Ltd. | 65,051 | 10,229 | 4,388 |

| Ratnamani Metals & Tubes Ltd. | 31,388 | 5,325 | 3,226 |

| Usha Martin Ltd. | 26,881 | 4,189 | 2,913 |

| Kalyani Steels Ltd. | 17,060 | 3,900 | 2,441 |

Data as of March 2022

#3 Exports as a percentage of revenue

Metal companies that earn a large share of their revenue from exports have better margins as international prices tend to be higher than domestic prices.

#4 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here’s a list of top metal companies in India with low debt to equity ratio.

| Company | Debt to Equity (x) |

|---|---|

| JSW Steel Ltd. | 0.80 |

| Tata Steel Ltd. | 0.26 |

| Hindustan Zinc Ltd. | 0.09 |

| Vedanta Ltd. | 0.59 |

| Hindalco Industries Ltd. | 0.39 |

| Ratnamani Metals & Tubes Ltd. | 0.07 |

| Lloyds Metals & Energy Ltd. | 0.20 |

| Welspun Corp Ltd. | 0.43 |

| Usha Martin Ltd. | 0.18 |

| Tinplate Company Of India Ltd. | 0.00 |

Data as of March 2022

#5 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here’s a list of top metal companies in India with more than 15% in ROCE.

| Company | ROCE (%) |

|---|---|

| Tinplate Company Of India Ltd. | 47.5 |

| Hindustan Zinc Ltd. | 37.4 |

| Tata Steel Ltd. | 33.0 |

| Usha Martin Ltd. | 27.1 |

| JSW Steel Ltd. | 26.9 |

| Tata Metaliks Ltd. | 25.7 |

| Lloyds Metals & Energy Ltd. | 22.7 |

| Ratnamani Metals & Tubes Ltd. | 19.7 |

| Vedanta Ltd. | 19.1 |

| Welspun Corp Ltd. | 17.7 |

Data as of March 2022

#6 Valuations

Two commonly used financial ratios used in the valuation of metal stocks are -

Price to Earnings Ratio (P/E) - It compares the company’s stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

#7 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

Here’s a list of top metal companies in India that score well on dividend yield and dividend payout.

| Company | Dividend Yield (eoy) | Dividend Payout (%) |

|---|---|---|

| Vedanta Ltd. | 11.2 | 89.0 |

| Hindustan Zinc Ltd. | 5.8 | 79.0 |

| Welspun Corp Ltd. | 3.0 | 29.7 |

| Usha Martin Ltd. | 1.5 | 20.9 |

| Ratnamani Metals & Tubes Ltd. | 0.5 | 20.3 |

| JSW Steel Ltd. | 2.4 | 20.2 |

Data as of March 2022

For more details, check out the top stocks offering high dividend yields.

Top Metal Stocks in India

The metal sector is in its growth phase. The top metal stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top metal stocks in India which score well on crucial parameters.

| Company | RoE (Latest, %) | D/E (Curr FY, x) | Sales CAGR (3 yrs,%) | Profit CAGR (3 yrs,%) | P/E (x) |

|---|---|---|---|---|---|

| TATA STEEL | 42.60% | 0.7 | 16% | 67% | 3.4 |

| JSW STEEL | 37.60% | 1.1 | 20.00% | 40% | 10 |

| VEDANTA | 30% | 0.8 | 13% | 40% | 5.1 |

| NALCO | 25.40% | 0.01 | 7% | 19% | 4.6 |

| SAIL | 25.10% | 0.3 | 16% | 68% | 3.6 |

| JINDAL STEEL & POWER | 17.80% | 0.4 | 3% | NM | 5.2 |

For more details on metal stocks such as steel stocks, check out Equitymaster’s Powerful stock screener for filtering the best steel stocks in India.

List of Metal Stocks in India

The details of listed metal companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of metal stocks.

You can also check out the latest mining sector results.

Best Sources for Information on the Metal Sector

Indian Brand Equity Foundation Metals and Mining Sector Report - https://www.ibef.org/industry/metals-and-mining

Ministry of Mines - https://mines.gov.in

World Steel Association - https://worldsteel.org/

Ministry of Steel - https://steel.gov.in/overview-steel-sector

So, there you go. Equitymaster's detailed guide on the top steel stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the metal sector and top metal stocks in India. This is a great starting point for anyone who is looking to explore more about metal stocks and the metal sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() From Vedanta to NALCO: Why Metals Stocks Are Rising

From Vedanta to NALCO: Why Metals Stocks Are Rising

Sep 25, 2024

Here's why all metal stocks are on an upward trajectory.

![]() Best Metal Stock: JSW Steel vs Tata Steel vs Hindalco

Best Metal Stock: JSW Steel vs Tata Steel vs Hindalco

Apr 11, 2024

All major government policies, including Make in India, smart cities, and rural electrification, are driving the demand for metals in India, and these three metals companies are leading the way.

![]() Why Hindalco Share Price is Falling

Why Hindalco Share Price is Falling

Feb 13, 2024

Share price of Hindalco slips 2% after Q4 results. Here's what's worrying the street.

![]() Why the Metal Index May Outperform Nifty 500

Why the Metal Index May Outperform Nifty 500

Jul 11, 2023

A lot of technical indicators point towards a comeback rally in metal stocks. Watch this video till the end to find out which companies to track now...

![]() Rakesh Jhunjhunwala & Associates Enter this Multibagger Stock in Q4. More Details Inside...

Rakesh Jhunjhunwala & Associates Enter this Multibagger Stock in Q4. More Details Inside...

Apr 17, 2023

Rekha Jhunjhunwala now holds 5% stake in this metal company. Do you own it?

![]() Why Hindalco Share is Falling

Why Hindalco Share is Falling

Feb 25, 2023

Technically, Hindalco on the chart has turned bearish as highlighted by multiple patterns.

![]() Hind Copper vs Hind Zinc - The Best Metal Stock of 2023?

Hind Copper vs Hind Zinc - The Best Metal Stock of 2023?

Dec 22, 2022

Which is the best metal stock to trade? Find out in this video.

![]() Adani Enterprises vs Tata Steel vs Vedanta

Adani Enterprises vs Tata Steel vs Vedanta

Nov 11, 2022

Metal stocks are looking good on the charts, but which one should you buy?

![]() Vedanta or NALCO - Which is the Better Dividend Stock?

Vedanta or NALCO - Which is the Better Dividend Stock?

Sep 5, 2022

Investing in high dividend paying stocks becomes more relevant in the current environment where uncertainty is ruling the stock market.

![]() Why Did Rakesh Jhunjhunwala Sell Stake in this Undervalued PSU Stock?

Why Did Rakesh Jhunjhunwala Sell Stake in this Undervalued PSU Stock?

Jul 20, 2022

Ace investor Rakesh Jhunjhunwala is not as bullish as he was a year ago in this metal stock.

![]() Why SAIL Share Price is Rising

Why SAIL Share Price is Rising

Apr 25, 2024

Investors are fancying SAIL over peers Tata Steel and JSW owing to cheaper valuations. There's more to the story though...

![]() Why Hindustan Copper Share Price is Rising

Why Hindustan Copper Share Price is Rising

Apr 1, 2024

Shares of the company rose 11% to hit their 52-week high today. Here's why.

![]() Why Hindalco Share Price is Rising

Why Hindalco Share Price is Rising

Dec 28, 2023

The aluminium major's stock price touched its 52-week high today. Here's what is driving the rally.

![]() Why Tata Steel Share Price is Falling

Why Tata Steel Share Price is Falling

May 18, 2023

The Tata Group company faced another setback yesterday. Continue reading to know more...

![]() Why Metal Stocks are Falling

Why Metal Stocks are Falling

Mar 17, 2023

Metal stocks are under pressure since the beginning of 2023. Find out why...

![]() Why Metal Stocks Are Rising

Why Metal Stocks Are Rising

Jan 3, 2023

Metal stocks were under pressure throughout 2022, but they have seen a sharp rally moving in to the new year. Find out factors responsible for the rise.

![]() Nifty Metal Index Signals a Breakout. Watch Out for Outperforming Stocks

Nifty Metal Index Signals a Breakout. Watch Out for Outperforming Stocks

Nov 30, 2022

The metal index is breaking out and the momentum is likely to head northwards. The outperforming stocks could head higher.

![]() Why Tata Steel Share Price is Falling

Why Tata Steel Share Price is Falling

Sep 20, 2022

Here's why Tata Steel share price fell over 12% today.

![]() Tata Steel Stock Split and Q1 Results. 5 Key Takeaways

Tata Steel Stock Split and Q1 Results. 5 Key Takeaways

Jul 26, 2022

The steel major's performance during the quarter was impacted by decline in volumes due to the imposition of export duty as well as increase in coking coal costs.

![]() Can JSW Steel Take the Metal Index Higher?

Can JSW Steel Take the Metal Index Higher?

Jul 13, 2022

JSW Steel has outperformed the metal index since June 2022 and the bullish momentum still prolongs. Here's why...