India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Best Sugar Stocks in India

Best Sugar Stocks in India

The Indian sugar industry is the world's second-largest producer of sugar after Brazil, with an annual production capacity of about 35 million metric tonnes (MMT).

It is the second-largest agro-based industry after cotton and is essential to the economic growth of the country since it creates significant amounts of direct and indirect employment.

The sugar industry in India has witnessed growth in recent years on account of rising sugar demand by consumers as well as the institutional sector.

It is set to further grow on the back of the government's Ethanol Blended Petrol Programme (EBP) and sugar export policy.

To tackle the problem of surplus production of sugarcane, the Government of India has introduced the Ethanol Blended Petrol Programme (EBP) to achieve blending of ethanol with motor sprit, enabling sugar mills to clear cane price arrears of farmers.

This is expected to increase timely payments to farmers, reduce pollution and increase value addition in the sugar industry.

In order to support the EBP, the government has set aside in the Union Budget for providing financial assistance to sugar mills for the enhancement and augmentation of ethanol production capacity.

It has also decided to levy an additional differential excise charge on unblended petrol beginning October 2022. The fuel also has to be categorized as blended fuel (with ethanol/ methanol) to meet specifications.

Besides this, the government has also lifted the cap on the export of sugar. This is expected to help in maintaining domestic sugar prices, which in turn will boost the liquidity position of mills, enabling them to pay sugarcane farmers on time.

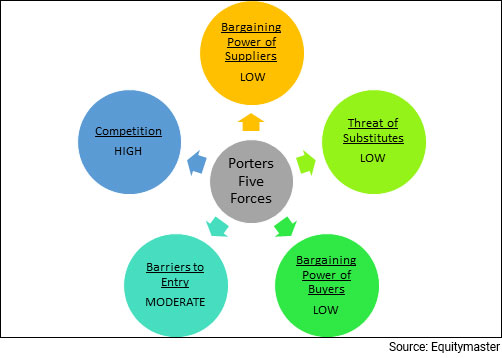

Porter's Five Forces Analysis of the Sugar Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the sugar sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

The sugar industry in India is characterized with moderate entry and exit barriers. Integrated business model and increasing capital requirement in the industry restrict new entrants.

The Government earlier used to give incentives to set up new plants by granting higher free sales quota for the first five to eight years of operations that had led to mushrooming of small units. This incentive has been withdrawn and the new sugar units are required to comply with the levy quota regulation from first year of operations.

#2 Bargaining Power of Suppliers

The bargaining power of customers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

This is low in the sugar industry. Allocation of the area from where the sugarcane can be procured is allocated by the government. Sugar mills have no choice but to purchase all the cane sold to them, even if it exceeds their requirement.

Though recent sugar de-control is likely to give higher pricing power to the mills, the government still can influence the prices.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the sugar sector, the bargaining power of customers is low, as the Indian sugar market is highly regulated by the Govt. influencing the distribution, purchase price of levy sugar and the free sale quota releases for sugar.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the sugar industry is high, due to a large influence of the unorganized sector in the industry. With around 500 units engaged in production of sugar, the industry is highly fragmented.

Private Individual players do not have big market share. Cooperatives are relatively high as they account for more than 50% of the industry's production.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

Being an essential commodity the demand for sugar is not elastic. Alternate sweeteners to refined sugar in India are gur (jaggery) and khandsari.

But with increased per capita income and easy availability of sugar at competitive rates, use of gur and khandsari is seeing a downward trend and is mostly confined to rural areas. Hence, threat of substitute is low in the industry.

Porters Five Forces Analysis of the Sugar Sector in India

When to Invest in Sugar Stocks

The best time to buy stocks from this sector is when companies that have strong fundamentals are trading at attractive valuations.

Key Points to Keep in Mind While Investing in Sugar Stocks

Here are some key points to take note of before you invest in sugar stocks.

#1 Weather Risk

Weather is the biggest risk as far as sugar stocks are concerned.

Of the total annual crop losses in the sector, many are due to direct weather and climatic effects such as drought, flash floods, untimely rains, frost, hail, and storms.

Bad weather also interrupts business processes, supply chains and consumer movements, among other things. This can impact yield which in turn can impact the performance of the business and the stock price.

#2 Crude Oil Prices

While high crude oil prices impact most business by impacting their margins, they have an opposite effect on the sugar industry.

When oil prices are high, mills tend to divert cane for making ethanol (alcohol of 99%-plus purity) to be blended with petrol. But with oil prices falling, mills may not find it attractive to divert cane for ethanol.

#3 Investment in Technology

Experts believe the technological revolution in agriculture sector might be the biggest revolution after the green revolution.

The sugar industry, being a part of the agriculture sector is also witnessing huge investments in technology especially with respect to ethanol.

Therefore, when investing in sugar stocks, look for companies that are investing heavily in technology.

#4 Profitability of the company

Profitability is the primary goal of all business ventures. Without profitability the business will not survive in the long run. So, measuring current and past profitability and projecting future profitability is very important.

Here's a list of top sugar companies in India based on their consolidated net profit.

| Company | Net Profit (in Rs m) | Net Profit Margin (%) |

|---|---|---|

| E.I.D. - Parry (India) Ltd. | 15,730 | 6.7 |

| Balrampur Chini Mills Ltd. | 4,527 | 9.3 |

| Triveni Engineering & Industries Ltd. | 3,649 | 7.8 |

| Dalmia Bharat Sugar and Industries Ltd. | 2,973 | 9.8 |

| Dhampur Sugar Mills Ltd. | 1,440 | 6.7 |

| Dhampur Bio Organics Ltd. | 1,019 | 6.6 |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here's a list of top sugar companies in India with a low debt to equity ratio.

| Company | Debt to Equity Ratio |

|---|---|

| Prudential Sugar Corporation Ltd. | 0 |

| Dhampure Speciality Sugars Ltd. | 0 |

| E.I.D. - Parry (India) Ltd. | 0.15 |

| Dalmia Bharat Sugar And Industries Ltd. | 0.35 |

| Balrampur Chini Mills Ltd. | 0.44 |

| K.C.P. Sugar And Industries Corporation Ltd. | 0.6 |

| Piccadily Agro Industries Ltd. | 0.65 |

| DCM Shriram Industries Ltd. | 0.82 |

| Triveni Engineering & Industries Ltd. | 0.82 |

| Dhampur Bio Organics Ltd. | 0.94 |

| Dhampur Sugar Mills Ltd. | 0.99 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here's a list of top sugar companies in India with more than 15% in ROCE.

| Company | RoCE |

|---|---|

| E.I.D. - Parry (India) Ltd. | 39.56 |

| Triveni Engineering & Industries Ltd. | 18.97 |

| Piccadily Agro Industries Ltd. | 17 |

| Balrampur Chini Mills Ltd. | 15.76 |

| Dalmia Bharat Sugar And Industries Ltd. | 13.28 |

| DCM Shriram Industries Ltd. | 11.41 |

| Dhampur Sugar Mills Ltd. | 11.31 |

Data as of March 2022

#7 Valuations

Investing in stocks requires careful analysis of financial data to find out a company's true worth. However, an easier way to find out about a company's performance is to look at its financial ratios.

The commonly used financial ratios used in the valuation of sugar stocks are -

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

Price to Earnings Ratio (P/E) - It compares the company's stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

#8 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

For more details, check out our list of top sugar stocks offering high dividend yields.

Top Sugar Stocks in India

The top sugar stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top stocks in India which score well on crucial parameters.

#2 Triveni Engineering & Industries

Best Sources for Information on the Sugar Sector

Indian Sugar Mills Association

Department of Food and Public Distribution

So there you go. Equitymaster's detailed guide on the best sugar stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the sugar sector and top sugar stocks in India. This is a great starting point for anyone who is looking to explore more about sugar stocks and the sugar sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Best Sugar Stock: Dwarikesh Sugar Industries vs Shree Renuka Sugars

Best Sugar Stock: Dwarikesh Sugar Industries vs Shree Renuka Sugars

Oct 6, 2024

Rising demand for sugar and the government's ethanol blending program are helping this sugar company rise to the top.

![]() Which Companies Make Ethanol in India?

Which Companies Make Ethanol in India?

Jun 22, 2024

What are the best ethanol stocks in India? Find out...

![]() Why Renuka Sugars Share Price is Rising

Why Renuka Sugars Share Price is Rising

Apr 10, 2024

Sugar stocks rise on speculative reports that the Indian government may divert more sugar to produce ethanol.

![]() Why Balrampur Chini Share Price is Falling

Why Balrampur Chini Share Price is Falling

Dec 11, 2023

Despite reporting a strong Q2, shares of Balrampur Chini continue to fall with over 15% drawdown in a week. Here's why.

![]() Top 5 Sugar Stocks Under Rs 100 to Add to Your Watchlist

Top 5 Sugar Stocks Under Rs 100 to Add to Your Watchlist

Oct 31, 2023

India is one of the largest producers, consumers, and exporters of sugar in the world. Despite this, the Indian sugar industry is battling many challenges.

![]() 3 Reasons why Dolly Khanna Bought this Ethanol Penny Stock in Q2

3 Reasons why Dolly Khanna Bought this Ethanol Penny Stock in Q2

Oct 13, 2023

Dalal Street has recently been obsessed with ethanol stocks and even top investing gurus are taking big bets on the ethanol story.

![]() Why this Stock Deserves to be on Your Green Energy Watchlist

Why this Stock Deserves to be on Your Green Energy Watchlist

Oct 3, 2023

India recently flew its first biofuel charged flight. Here's the details of the company behind it.

![]() Dolly Khanna Trims Stake in this Smallcap Stock in Q4. Do You Own?

Dolly Khanna Trims Stake in this Smallcap Stock in Q4. Do You Own?

Apr 11, 2023

Known for picking undervalued stocks from the midcap and smallcap space, Dolly Khanna recently trimmed her stake in this company.

![]() Why Sugar Stocks are Rising

Why Sugar Stocks are Rising

Mar 9, 2023

Sugar stocks shine, with most frontline stocks up 10%. Find out why.

![]() Top 5 Sugar Companies in India by Growth

Top 5 Sugar Companies in India by Growth

Dec 31, 2022

These five sugar companies have shown consistent growth in the past. Keep an eye on them as the ethanol megatrend comes into play.

![]() Why Shree Renuka Sugars Share Price is Rising

Why Shree Renuka Sugars Share Price is Rising

Aug 30, 2024

Find out why sugar stocks rallied after a government announcement.

![]() Why Trident Share Price is Rising

Why Trident Share Price is Rising

Jun 13, 2024

Find out why Trident share price rallied 8% in just one day.

![]() Ethanol 100: Top 5 Stocks to Add to Your Watchlist

Ethanol 100: Top 5 Stocks to Add to Your Watchlist

Mar 24, 2024

A recent government push for E100 has sent shockwaves driving stock prices in sugar and ethanol industry. Discover the top players in this arena.

![]() Sugar Stocks are no Longer Sweet. Here's why Sugar Stocks are Falling...

Sugar Stocks are no Longer Sweet. Here's why Sugar Stocks are Falling...

Dec 7, 2023

Here's why sugar stocks saw a sharp decline in recent days.

![]() Why Bajaj Hindusthan Sugar Share Price is Rising

Why Bajaj Hindusthan Sugar Share Price is Rising

Oct 27, 2023

The current rally is attributed to NCLT dismissing a petition. But there are several factors that could keep the stock in good stead going forward.

![]() Is this the Best Biofuel Stock in the Market?

Is this the Best Biofuel Stock in the Market?

Oct 10, 2023

This green energy stock deserves to be on your watchlist.

![]() Top 5 Sugar Stocks to Watch as Supply Crunch Drives Prices Higher

Top 5 Sugar Stocks to Watch as Supply Crunch Drives Prices Higher

Sep 9, 2023

These five sugar stocks could benefit the most if there's a supply crunch. Take a look...

![]() Nemish Shah Portfolio: Top 5 Stocks

Nemish Shah Portfolio: Top 5 Stocks

Mar 26, 2023

Over 95% of Nemish Shah's portfolio is concentrated in these five stocks. Check them out.

![]() Sugar Rush on Dalal Street

Sugar Rush on Dalal Street

Mar 9, 2023

Should you trade sugar stocks now? Find out...

![]() Why Sugar Stocks Are Like Diwali Soanpapdi

Why Sugar Stocks Are Like Diwali Soanpapdi

Oct 31, 2022

Soanpapdi is the best sweet to gift. I believe the sugar sector is in soanpapdi mode - gift it but don't consume.