India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Best Power Stocks in India

Best Power Stocks in India

Power is one of the most critical components of infrastructure, crucial for the economic growth and welfare of nations.

India is the world's third-largest producer as well as the third-largest consumer of power (electricity).

The country's power sector has made significant inroads over the last decade, doubling its installed capacity from 200 gigawatts (GW) in the financial year 2012 to 403 GW in the financial year 2022.

This comes on the back of strong reforms from the Ministry of Power. They have turned the country from one with a power shortage to one with a surplus by establishing a single national grid, fortifying the distribution network, and achieving universal household electrification.

Despite the significant increase in the power generation capacity, India still faces challenges in meeting the growing demand for power as reliable supply remains low in the country.

Electricity demand is on the rise. This is attributable to the growing population, rising levels of electrification in villages and smaller towns and a robust per-capita usage. The per capita consumption is less than a third of the global average highlighting the opportunity for growth. The demand for power in India is expected to grow threefold between 2018 and 2040.

India's power sector is one of the most diversified in the world. Sources of power generation range from conventional sources such as coal, lignite, natural gas, oil, hydro and nuclear power, to viable non-conventional sources such as wind, solar, agricultural and domestic waste.

However, we are still largely dependent on conventional sources such as coal. Coal-fired (including lignite) thermal power plants account for more than 50% of the total installed capacity.

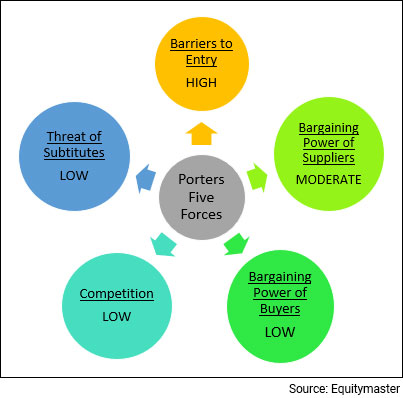

Porter's Five Forces Analysis of the Power Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the power sector:

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the power sector, barriers to entry are high. Moreso in in the transmission and distribution segments, which are largely state monopolies. The primary reasons are high fixed costs, fuel linkages and payment guarantees from state governments that buy power and retail distribution license.

#2 Bargaining Power of Suppliers

The bargaining power of suppliers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

The bargaining power of suppliers in the power sector is moderate since the tariff structure is mainly regulated.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the power sector, the bargaining power of customers is low. Despite low switching costs and the fact that electricity is an undifferentiated product, customers don't tend to change their source of electricity often.

#4 Competition

For most industries, understanding the competition is vital to successfully marketing or selling a product.

The competition in the power industry is low, as new entrants are dissuaded by a shortage of inputs such as natural gas and regulatory hurdles.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

The threat of substitutes for the power sector is low as there is no alternative to power. Whereas within the sector, the threat of substitutes is moderate as the cost of switching to substitutes like solar, wind energy etc. is still high.

However, as the industry is still transforming and once the substitute sources become viable, the threat of substitutes can rise over the long term.

Porters Five Forces Analysis of the Power Sector in India

When to Invest in Power Stocks

The demand for power is closely linked to the economic growth which makes it a highly cyclical industry. This means that for some reason the economy and by extension the stock market flounders, so will power stocks.

Since economic cycles affect the earnings prospects, the best time to buy power stocks is at the start of an economic expansion. And the best time to sell is just before the economy begins to slow down.

So, if you invest in an power stock at the peak of an economic cycle there is good chance you will lose a huge chunk of the investment. Nevertheless, identifying the bottom of the cycle is not an easy task.

In the past decade, the power sector has provided investors healthy returns but overall, the performance of the sector has been underwhelming. However, with the advent of the renewable power in the country, this is likely to change.

Companies producing power with conventional sources have pivoted their businesses to focus on developing cleaner sources of energy. So, a good time to look at power stocks would be now, when companies are ramping up their clean energy sources.

The demand for power should continue to increase. With a rising urban population, the need for clean and infallible power supply gives immense scope for growth in the power sector.

Key Points to Keep in Mind While Investing in Power Stocks

Here are some key points to take note of before you invest in power stocks:

#1 Cyclicality of the sector

This is the most important factor one must keep in mind while investing in power stocks.

The power sector, being cyclical, is dependent on business cycles and economic conditions. As the demand for power is closely linked to the economy, power stocks are usually riskier - their fortunes are prone to economic booms and busts.

Usually, cyclical stocks can be used to generate high returns when the economy is doing well and vice versa.

#2 The shift towards cleaner sources of power (energy)

From EPC projects to energy generation and transmission, power companies are deep diving into every facet of the renewable segment. This renewed focus makes renewable power a noteworthy sector for the long-term.

As the world looks for alternative fuel sources, this sector has garnered a lot of attention of late.

Companies with coal-based power plants are also pivoting their businesses to focus on renewable energy sources. This monumental transition towards cleaner sources presents a huge money-making opportunity for investors.

#3 Competitive landscape

The monumental transition towards cleaner sources and strong growth prospects of the country has attracted several companies to invest in the renewables sector.

They are pivoting their business and operating in the market either through joint ventures with local partners or via independently owned operations.

This is bound to change the competitive landscape and is already churning of market shares amongst the top players.

While this is likely to continue for some time, the incumbent players should end up with a lion's share over the next decade.

#4 Profitability of the company

The sector has a low bargaining power and a fixed tariff structure set by the regulators. Therefore the sector operates on thin margins.

Here's a list of top power companies in India based on their consolidated net operating profit.

| Company | Net Sales (Rs m) | Operating Profit (Rs m) | Consolidated Net Profit (Rs m) |

|---|---|---|---|

| NTPC Ltd. | 11,48,575 | 3,91,867 | 1,61,114 |

| Power Grid Corporation Of India Ltd. | 3,99,281 | 3,73,295 | 1,70,938 |

| NHPC Ltd. | 83,538 | 44,683 | 35,377 |

| Torrent Power Ltd. | 1,37,157 | 36,297 | 4,097 |

| Sembcorp Energy India Ltd. | 76,891 | 22,130 | 1,424 |

| SJVN Ltd. | 24,220 | 19,527 | 9,775 |

| CESC Ltd. | 72,939 | 14,092 | 8,158 |

| Jaiprakash Power Ventures Ltd. | 46,246 | 13,479 | 1,085 |

| JSW Energy Ltd. | 36,427 | 12,728 | 5,698 |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

Therefore, one must look for a debt-to-equity ratio of one or less than one.

Here's a list of top power companies in India with low debt to equity ratio.

| Company | Debt to Equity (x) |

|---|---|

| Inox Wind Energy Ltd. | 0.04 |

| JSW Energy Ltd. | 0.09 |

| PTC India Ltd. | 0.26 |

| Reliance Infrastructure Ltd. | 0.38 |

| SJVN Ltd. | 0.42 |

| Jaiprakash Power Ventures Ltd. | 0.47 |

| Reliance Power Ltd. | 0.69 |

| Adani Power Ltd. | 0.72 |

| Sembcorp Energy India Ltd. | 0.77 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

A ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Power companies operate on a fixed tariff regime, which hampers their return ratios. Hence most of them operate on a ROCE of 14% or lower.

Here's a list of top power companies in India with ROCE of more than 10%.

| Company | ROCE (%) |

|---|---|

| Power Grid Corporation Of India Ltd. | 14.2 |

| PTC India Ltd. | 13.3 |

| Inox Wind Energy Ltd. | 10.3 |

Data as of March 2022

#7 Valuations

Two commonly used financial ratios used in the valuation of power stocks are -

Price to Earnings Ratio (P/E) - It compares the company's stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check our list of stocks according to their P/E Ratios.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check our list of stocks according to their P/BV Ratios.

#8 Dividend yields

The power sector has a consistent trend of dividend yields. However, it varies depending on the owner's discretion.

Here's a list of top power companies in India that score well on dividend yield and dividend payout.

| Company | Dividend Yield (eoy) | Dividend Payout (%) |

|---|---|---|

| PTC India Ltd. | 9.6 | 75 |

| Power Grid Corporation Of India Ltd. | 6.8 | 147.5 |

| NHPC Ltd. | 6.5 | 18.1 |

| SJVN Ltd. | 6.2 | 17 |

| CESC Ltd. | 5.9 | 450 |

| NTPC Ltd. | 5.2 | 70 |

Data as of March 2022

For more details, check out the top stocks offering high dividend yields.

Top Power Stocks in India

The power sector is transforming. The top power stocks in India can immensely benefit with a variety of factors positively affecting the industry.

Here are the top power stocks in India which score well on crucial parameters.

| Company | RoE (Latest, %) | D/E (Curr FY, x) | Sales CAGR (3 yrs, %) | Profit CAGR (3 yrs, %) |

|---|---|---|---|---|

| NTPC Ltd. | 13.24 | 1.35 | 5.30% | 6.40% |

| Power Grid Corporation Of India Ltd. | 29.33 | 2.18 | 4.40% | 19.90% |

| PTC India Ltd. | 11.37 | 0.26 | -4.80% | 35.50% |

| Torrent Power Ltd. | 4.05 | 0.79 | 1.40% | -23.20% |

| Adani Green Energy Ltd. | -3.58 | 7.62 | 73.10% | NA |

| NHPC Ltd. | 14.09 | 1 | -2.40% | 7.70% |

| Sembcorp Energy India Ltd. | 1.29 | 0.77 | NA | NA |

| CESC Ltd. | 8.19 | 0.84 | -11.90% | -10.30% |

| Jaiprakash Power Ventures Ltd. | 1.58 | 0.47 | 5.90% | NA |

| JSW Energy Ltd. | 4.55 | 0.09 | -26.40% | -4.40% |

List of Power Stocks in India

The details of listed power companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of power stocks.

Best Sources for Information on the Power Sector

Indian Brand Equity Foundation Powers and Mining Sector Report - https://www.ibef.org/industry/power

Ministry of Power - https://powermin.gov.in/

Ministry of New & Renewable Energy - https://mnre.gov.in/

So, there you go. Equitymaster's detailed guide on the top power stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

You can also checkout our playlist on Power Stocks on Equitymaster's YouTube channel.

Here's a list of articles and videos on the power sector and top power stocks in India. This is a great starting point for anyone who is looking to explore more about power stocks and the power sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Is Innovation Already Priced into Siemens India's PE Ratio of 100?

Is Innovation Already Priced into Siemens India's PE Ratio of 100?

Nov 20, 2024

Siemens India's 100x PE an indicator of economic buoyancy or market froth?

![]() Which Companies Make Nuclear Power in India?

Which Companies Make Nuclear Power in India?

Nov 9, 2024

With India ramping up its nuclear energy capacity to address rising demand and a commitment to net-zero emissions, here are the leading nuclear power stocks to keep an eye on.

![]() Top 5 Switchgear Stocks to Add to Your Watchlist

Top 5 Switchgear Stocks to Add to Your Watchlist

Oct 5, 2024

Here are the top companies contributing to the growth value chain of switchgear sector.

![]() Can NTPC Lead India's Clean Energy Drive with its Nuclear Power Ambitions?

Can NTPC Lead India's Clean Energy Drive with its Nuclear Power Ambitions?

Sep 19, 2024

NTPC plans to go big on nuclear expansion. Here's everything you need to know about its ambitious nuclear power plans.

![]() Rs 700 to Rs 7,450: Power Mech Projects Announces First Ever Bonus Issue

Rs 700 to Rs 7,450: Power Mech Projects Announces First Ever Bonus Issue

Aug 26, 2024

The increasing capex budget to build India's energy security is working wonders for this company as it builds turbines and generators for power projects.

![]() Top 5 Microcap Nuclear Power Stocks to Watch Out in 2024

Top 5 Microcap Nuclear Power Stocks to Watch Out in 2024

Jul 10, 2024

The government is inviting private investment worth Rs 2.2 trillion to grow its nuclear energy sector, and these five microcaps could benefit.

![]() 5 Best Power Sector Penny Stocks in India

5 Best Power Sector Penny Stocks in India

May 20, 2024

While penny stocks in power sector may not promise the stability of bluechips, they offer an entry point into a sector on the cusp of transformation.

![]() Meet the Nifty Next 50 Stocks that Had a Better Year than Tata Motors

Meet the Nifty Next 50 Stocks that Had a Better Year than Tata Motors

Mar 31, 2024

Nifty Next 50 is a map to India's future. These 5 dynamic companies outperforming the market are poised for success.

![]() Transformers are the New Gold. Here are Top 5 Stocks in this Booming Market

Transformers are the New Gold. Here are Top 5 Stocks in this Booming Market

Mar 26, 2024

Government initiatives aimed at grid upgrades and the incorporation of cutting-edge technology are pivotal factors propelling the power transformer industry.

![]() Top 5 Nuclear Power Stocks to Watch Out in 2024

Top 5 Nuclear Power Stocks to Watch Out in 2024

Mar 21, 2024

The government is inviting private investment worth Rs 2.2 trillion to grow its nuclear energy sector, and these five companies could benefit.

![]() Stocks that Could Deliver an Electrifying Performance

Stocks that Could Deliver an Electrifying Performance

Nov 14, 2024

India's power sector IPO's could be an indicator of economic buoyancy.

![]() Top 10 Value Stocks in India with Long Term Potential

Top 10 Value Stocks in India with Long Term Potential

Nov 3, 2024

These stocks provide a cushion against market fluctuations, thanks to their stable earnings, established market positions, and potential for consistent dividends.

![]() Rural Electrification (REC) Share Price: Rs 6 Trillion Nuclear Power Push to Fuel its Next Leg of Growth

Rural Electrification (REC) Share Price: Rs 6 Trillion Nuclear Power Push to Fuel its Next Leg of Growth

Oct 1, 2024

REC targets Rs 6 trillion investment in nuclear and green energy by 2030.

![]() Top 4 Power Stocks by Growth to Add to Your watchlist

Top 4 Power Stocks by Growth to Add to Your watchlist

Aug 29, 2024

Keep an eye on these top four power stocks, each showcasing robust growth potential and strong fundamentals.

![]() Top Solar Cell & Solar Module Manufacturing Stocks to Watch Out for Ahead of Budget 2024

Top Solar Cell & Solar Module Manufacturing Stocks to Watch Out for Ahead of Budget 2024

Jul 12, 2024

These solar cell and solar module manufacturing stocks could come into play in budget 2024.

![]() Top Transformer Stocks in India Ranked by Order Book

Top Transformer Stocks in India Ranked by Order Book

Jul 3, 2024

Government initiatives aimed at grid upgrades and the incorporation of cutting-edge technology are pivotal factors propelling the power transformer industry.

![]() Top Wind Energy Shares in India 2024: Wind Energy Companies to Add to Your Watchlist

Top Wind Energy Shares in India 2024: Wind Energy Companies to Add to Your Watchlist

Apr 5, 2024

India's wind energy market is experiencing explosive growth, more than doubling in just three years.

![]() Multibagger Alert! 5 Stocks that Rallied Over 1,000% in Financial Year 2024

Multibagger Alert! 5 Stocks that Rallied Over 1,000% in Financial Year 2024

Mar 30, 2024

These 5 stocks made headlines by skyrocketing in the financial year 2023-24. More gains ahead or a possible downturn?

![]() Top 5 Penny Stocks to Watch Out for in India's Booming Power Sector

Top 5 Penny Stocks to Watch Out for in India's Booming Power Sector

Mar 26, 2024

Power stocks have found favour after a long wait. Here's what lies ahead for them and how you can invest in the best power companies.

![]() Why JP Associates Share Price is Falling

Why JP Associates Share Price is Falling

Mar 8, 2024

Post the proposed divestment of its cement business, the company's borrowing is expected to come down to almost nil.

FAQs

Which are the Top Power Companies In India right now?

As per Equitymaster's Indian stock screener, here is the list of the top power stocks in India right now...

- #1 NTPC

- #2 POWER GRID

- #3 ADANI POWER

- #4 ADANI GREEN ENERGY

- #5 TATA POWER

These companies are investing in the renewable power segment and keeping themselves ahead of the competition.

Note that, there are various other parameters you should take into account before investing in any company such as promoter holding etc. Sustained research must not be compromised despite the positive odds.

Which are the power stocks with the best shareholder returns?

Power Grid and NTPC were the top performers over the last 5 years in terms of sales and profit growth.

Power Grid's growth was led by its leadership status in the company and support from the Government considering it is a PSU.

NTPC, also a PSU, is India's largest power-generation utility has the done well in the domestic power sector on account of its leadership status and well-established relations with the state distribution companies.

To know which other companies performed well over the last 5 years, check out our entire list of top performers.

What kind of dividend yields do power stocks offer?

The power sector has a consistent trend of dividend yields. However, it varies depending on the owner's discretion.

At present, Power Grid, JSW Energy, Tata Power and NTPC offer attractive dividend yields to their shareholders.

For more, check out the top dividend yield stocks on Equitymaster's Indian stock screener.

Which are the top gainers and top losers within the power sector today?

Within the Power sector, the top gainers were NLC INDIA (up 7.8%) and TD POWER (up 4.1%). On the other hand, ADANI ENERGY SOLUTIONS (down 20.0%) and ADANI GREEN ENERGY (down 18.9%) were among the top losers.

For more, please visit the BSE power index live chart and also check out our power sector report.