Our Big Prediction

This Could be One of the Exciting Opportunities for Investors

- Home

- Outlook Arena

- Best Infrastructure Stocks in India

Best Infrastructure Stocks in India

The infrastructure sector in India is an important driver of the country's economic growth.

Given that roads, railways, metros, etc. are an integral part of enhancing the productivity and operations of businesses, robust infrastructure is a must.

However, despite being one of the fastest-growing economies in the world, India is lagging behind the rest of the world with respect to infrastructure development.

To change this, the government of India has been taking various measures in recent years.

Resultantly, the tide has turned after a long time for infrastructure stocks. There's massive capex lined up backed by government's announcements on the production linked incentive (PLI) schemes.

An important thing here is that the benefits of the capex cycle will not be limited to infra sector. Think of the additional cement and steel required to build roads, highways, hospitals, and buildings.

A push to the infra sector directly lifts the gross domestic product (GDP) growth because infrastructure investment has a multiplier effect.

With a steadily rising population, the economy needs a massive amount of spending on constructing new infrastructure and rebuilding the aging assets to meet the needs.

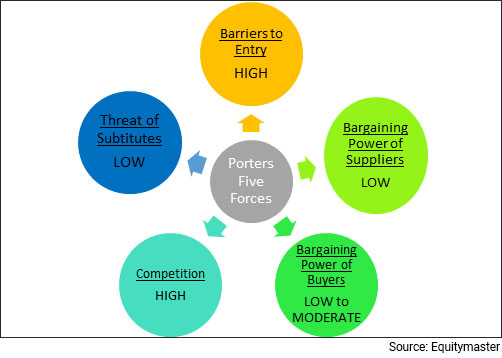

Porter's Five Forces Analysis of the Infrastructure Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the infrastructure sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the infrastructure sector, barriers to entry are high, considering the capital intensive nature of the industry and reputation attached to the existing players.

#2 Bargaining Power of Suppliers

The bargaining power of customers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

This is low in the infrastructure industry, because of intense competition amongst them. However, in technology driven high-end segments, suppliers have the upper hand.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

This is low in technology oriented segments. However, fierce competition in power generation and transmission equipment has increased bargaining power of customers.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in infrastructure sector is intense among major players. Companies compete on pricing, experience in a particular field, product quality, and capability of handling projects.

However, small companies are trying to revamp their scale and size.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is low in the infra sector due to the nature of the industry. If a buyer wants to revamp or renovate its existing stock, it is likely to go to the same players.

Porters Five Forces Analysis of the Infrastructure Sector in India

When to Invest in Infrastructure Stocks

Infrastructure stocks are usually risker as their fortunes are prone to economic booms and busts and for this reason, they are often called cyclical stocks.

Generally considered an offensive tactic in investing, cyclical stocks can be used to generate high returns when the economy is doing well.

Therefore, the best time to buy such stocks is at the start of an economic expansion and the best time to sell them is just before the economy begins to slow down. However, before selecting a stock, one must check whether the industry is due for revival or not.

Key Points to Keep in Mind While Investing in Infrastructure Stocks

Here are some key points to take note of before you invest in infra stocks.

#1 Cyclicality risk

An industry cycle is characterized by an upturn as well as downturn. Cyclical businesses do well during an industry upturn and vice versa.

On the other hand, there are some businesses that are not very cyclical. These businesses are immune to changes in industry cycles in the sector and have less risk. In short, if the business is cyclical, higher is the risk.

Infra companies' operations are linked to spending by the government on infrastructure and the expansion plan a company undertakes.

As a result, during times of distress in the Indian economy, government can cut down on investments in infrastructure spending. This can have an adverse impact on infra companies' operations.

To mitigate this risk at certain extent, you could look at companies who have decent export revenues.

#2 Order book

You know it's a good time to invest in infra stocks when all infrastructure-focused firms experience strong order inflows. This could be due to government's big push or any other particular reason.

If the order book position of infra players is adequate, it provides near term revenue visibility.

Along with order book, also check the company's history of execution capabilities and whether it is able to execute at higher pace than others.

#3 Interest rates

For any infra company, interest rate is a big lever for earnings growth because in most cases, they are dependent on borrowed funds.

Infra companies will be able to grow their earnings at a faster pace when there's a reduction in interest rates.

#4 Profitability of the company

Profitability is the primary goal of all business ventures. Without profitability the business will not survive in the long run. So, measuring current and past profitability and projecting future profitability is very important.

Here's a list of top infrastructure companies in India based on their consolidated net profit.

| Rs m, consolidated | Profit After Tax | PAT Margin (%) |

|---|---|---|

| Larsen & Toubro Ltd. | 78,795 | 8% |

| Rail Vikas Nigam Ltd. | 10,872 | 6% |

| GR Infraprojects Ltd. | 7,608 | 10% |

| Ircon International Ltd. | 5,443 | 8% |

| Kalpataru Power Transmission Ltd. | 5,154 | 7% |

| NCC Ltd. | 4,901 | 5% |

| PNC Infratech Ltd. | 4,478 | 7% |

| KEC International Ltd. | 4,344 | 3% |

| KNR Constructions Ltd. | 3,818 | 12% |

| H.G. Infra Engineering Ltd. | 3,388 | 9% |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

One must look for a debt to equity ratio of one or less than one.

Here's a list of top infrastructure companies in India with a low debt to equity ratio.

| Rs m, consolidated | Debt to Equity (x) | Interest Coverage (x) |

|---|---|---|

| Ircon International Ltd. | 0.00 | 4.21 |

| KNR Constructions Ltd. | 0.00 | 19.99 |

| Likhitha Infrastructure Ltd. | 0.00 | 110.66 |

| PNC Infratech Ltd. | 0.06 | 8.88 |

| NCC Ltd. | 0.20 | 2.32 |

| J Kumar Infraprojects Ltd. | 0.21 | 3.83 |

| Nelco Ltd. | 0.21 | 5.96 |

| H.G. Infra Engineering Ltd. | 0.23 | 9.60 |

| GR Infraprojects Ltd. | 0.25 | 8.72 |

| Larsen & Toubro Ltd. | 0.30 | 5.66 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, a one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

An ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here's a list of top infrastructure companies in India with more than 15% in ROCE. We have also provided their return on equity (ROE) and return on assets (ROA).

| ROCE (%) | |

|---|---|

| Likhitha Infrastructure Ltd. | 35.3 |

| H.G. Infra Engineering Ltd. | 33.8 |

| KNR Constructions Ltd. | 29.6 |

| GR Infraprojects Ltd. | 21.7 |

| Techno Electric & Engineering Company Ltd. | 19.1 |

| Salasar Exteriors & Contour Ltd. | 17.6 |

| Rail Vikas Nigam Ltd. | 17.0 |

| KEC International Ltd. | 16.8 |

| Kalpataru Power Transmission Ltd. | 16.2 |

| Nelco Ltd. | 16.2 |

Data as of March 2022

#7 Valuations

Investing in stocks requires careful analysis of financial data to find out a company's true worth. However, an easier way to find out about a company's performance is to look at its financial ratios.

Being an asset heavy and cyclical business, the commonly used financial ratios used in the valuation of infrastructure stocks are -

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

Price to Earnings Ratio (P/E) - It compares the company's stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

#8 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

Here's a list of top infrastructure companies in India making healthy dividend payouts.

| Dividend per share (Rs) | Dividend Payout (%) | |

|---|---|---|

| Nirlon Ltd. | 26 | 211.5 |

| Ircon International Ltd. | 2.5 | 43.2 |

| Rail Vikas Nigam Ltd. | 1.8 | 35.1 |

| NCC Ltd. | 2 | 24.9 |

| J Kumar Infraprojects Ltd. | 3 | 11 |

| Kalpataru Power Transmission Ltd. | 6.5 | 18.8 |

| Larsen & Toubro Ltd. | 22 | 39.2 |

| Man InfraConstruction Ltd. | 1.3 | 44.3 |

| Indian Hume Pipe Company Ltd. | 2 | 16.8 |

| KEC International Ltd. | 4 | 23.7 |

Data as of March 2022

For more details, check out the top stocks offering high dividend yields.

Top Infrastructure Stocks in India

Here are the top infrastructure stocks in India which score well on crucial parameters.

#1 L&T

#2 Siemens

#3 ABB India

#4 Tube Investments of India

#5 BHEL

For more details on infra stocks, check out Equitymaster's Powerful stock screener for filtering the best infra stocks in India.

List of Infrastructure Stocks in India

The details of listed infra companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of infra stocks.

Best Sources for Information on the Infrastructure Sector

India Brand Equity Foundation (IBEF) Infra sector report - https://www.ibef.org/industry/infrastructure-sector-india

National Infrastructure Pipeline - https://indiainvestmentgrid.gov.in/national-infrastructure-pipeline

So, there you go. Equitymaster's detailed guide on the top infra stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the infra sector and top infra stocks in India. This is a great starting point for anyone who is looking to explore more about infra stocks and the infra sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() These Stocks have Topped Q2 Guidance, Boost Forecast

These Stocks have Topped Q2 Guidance, Boost Forecast

Nov 15, 2024

A look at the top stocks that have exceeded their Q2 guidance and raised forecasts.

![]() Smallcap to Ride Transmission Capex SuperCycle

Smallcap to Ride Transmission Capex SuperCycle

Nov 4, 2024

Smallcap opportunities to keep an eye on to ride growing power transmission infrastructure.

![]() Ashish Kacholia's Latest Pick is this Multibagger Data Center Stock That's Up 650%

Ashish Kacholia's Latest Pick is this Multibagger Data Center Stock That's Up 650%

Oct 23, 2024

This company is a hyperscaler from India. It focuses on advanced Cloud GPU (graphic processing unit) infrastructure.

![]() Smallcap Multibagger Stock Bajel Projects Takes a Big Leap for Data Centre Expansion

Smallcap Multibagger Stock Bajel Projects Takes a Big Leap for Data Centre Expansion

Oct 1, 2024

Bajel Projects has officially forayed into the data center space, landing its first contract with an emerging service provider. More details inside.

![]() This PSU Stock Under Rs 250 is Sitting on a Rs 114 Billion Order Book

This PSU Stock Under Rs 250 is Sitting on a Rs 114 Billion Order Book

Sep 16, 2024

This PSU has a strong foothold in the petrochemical and infrastructure sector. Take a look...

![]() Top 10 Telecom Players Fuelling India's Digital Revolution

Top 10 Telecom Players Fuelling India's Digital Revolution

Sep 6, 2024

With the telecom sector on a bullish trajectory, here are the top stocks to keep an eye on.

![]() Which Companies Make Roads and Highways in India?

Which Companies Make Roads and Highways in India?

Sep 2, 2024

As India gears up for a major highway revolution as new expressways transform how we travel, these companies are leading from the front.

![]() 2 Proxy Smallcap Stocks Riding a Long Term Megatrend

2 Proxy Smallcap Stocks Riding a Long Term Megatrend

Aug 30, 2024

Proxy small-cap stocks can create huge wealth in the smart meter megatrend.

![]() 2 Smallcap Proxies for Smart Meter Theme

2 Smallcap Proxies for Smart Meter Theme

Aug 8, 2024

Lesser known pick and shovel suppliers to the national smart meter theme.

![]() New Winners in the Cement Sector in India

New Winners in the Cement Sector in India

Aug 4, 2024

Which are the top cement manufacturing companies in India? Find out...

![]() Which Companies Make Nuclear Power in India?

Which Companies Make Nuclear Power in India?

Nov 9, 2024

With India ramping up its nuclear energy capacity to address rising demand and a commitment to net-zero emissions, here are the leading nuclear power stocks to keep an eye on.

![]() Afcons Infrastructure IPO Opens Today. Is This the Next L&T in the Making?

Afcons Infrastructure IPO Opens Today. Is This the Next L&T in the Making?

Oct 25, 2024

With a six-decade legacy of delivering complex infrastructure projects, Afcons Infrastructure's IPO opens today. Here's a closer look at whether it's worth considering.

![]() Top 5 Leading PSU Banks to Keep an Eye on in 2025

Top 5 Leading PSU Banks to Keep an Eye on in 2025

Oct 7, 2024

These government-owned banks are crucial in financing large-scale infrastructure projects, supporting the rural economy, and driving national development.

![]() Top 5 Companies that Could Benefit from India's Doubling Container Capacity

Top 5 Companies that Could Benefit from India's Doubling Container Capacity

Sep 29, 2024

Five stocks poised to benefit from India's container handling capacity doubling in five years.

![]() Which Companies Manufacture 5G Telecom Equipment in India?

Which Companies Manufacture 5G Telecom Equipment in India?

Sep 11, 2024

As India advances towards a 5G future, these players are crucial for manufacturing the equipment needed for this transformative shift.

![]() Top 5 Real Estate Proxy Stocks to Watch Out for

Top 5 Real Estate Proxy Stocks to Watch Out for

Sep 6, 2024

As real estate and infrastructure development accelerate, companies involved in supplying essential construction materials can present attractive investment opportunities.

![]() Top 10 Infra Stocks in India Ranked by Order Book Value

Top 10 Infra Stocks in India Ranked by Order Book Value

Sep 1, 2024

As India races towards becoming the world's third largest economy, these infra companies are expected to play a pivotal role.

![]() 4 Recycling Industry Stocks that had a Blockbuster Q1. What Next?

4 Recycling Industry Stocks that had a Blockbuster Q1. What Next?

Aug 18, 2024

The recycling industry is growing rapidly as more and more people become aware of the importance of sustainability. These 4 stocks are well-positioned to capitalise on this trend.

![]() 2 Smallcap Proxy Stocks in the National Smart Meter Theme

2 Smallcap Proxy Stocks in the National Smart Meter Theme

Aug 7, 2024

These are the lesser known pick and shovel suppliers in the national smart meter theme.

![]() Top 5 Digital Infrastructure Stocks to Watch Out in 2024

Top 5 Digital Infrastructure Stocks to Watch Out in 2024

Aug 2, 2024

As India accelerates its digital journey, these five digital infrastructure stocks are set to be the front-runners.

FAQs

Which are the best infrastructure stocks in India?

As per Equitymaster's Indian stock screener, these are the top infrastructure stocks in India which score well on crucial parameters.

- #1 L&T

- #2 SIEMENS

- #3 ABB INDIA

- #4 TATA POWER

- #5 CUMMINS INDIA

Is infra a good investment?

After a long time, the tide has turned for infrastructure stocks. There's massive capex lined up backed by government's announcements on the production linked incentive (PLI) schemes.

Given that facilities such as roads, railways, metros, etc. are an integral part of enhancing the productivity and operations of businesses, robust infrastructure is a must.

With a steadily rising population, the economy needs a massive amount of spending on constructing new infrastructure and rebuilding the aging assets to meet the needs.

So yes, investing in the infra sector for the long term can turn out to be a good investment.

What factors should you consider before investing in infrastructure stocks?

You need to keep these points in mind before you invest in infra stocks:

- #1 Cyclicality of the sector

- #2 Interest rates

- #3 Order book of the company

- #4 Profitability of the company

- #5 Debt to Equity ratio

- #6 Return on Capital Employed (ROCE)

Which are the top gainers and top losers within the infrastructure sector today?

Within the Infrastructure sector, the top gainers were H.G.INFRA ENGINEERING (up 5.7%) and PSP PROJECTS (up 4.7%). On the other hand, THERMAX (down 4.9%) and CUMMINS INDIA (down 1.6%) were among the top losers.

For more, please visit the Nifty infra index live chart and also check out our infra sector report.