India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Top Energy Stocks in India

Top Energy Stocks in India

India's economic growth is linked directly to its energy demand. So, over the long term, the need for energy (oil and gas) will increase at the same level the economy develops.

India is the third-largest consumer of oil in the world, after the US and China as of 2022. At present, the country imports 82.8% of its oil and half of its gas needs.

According to the India Energy Outlook 2021, energy demand in India should nearly double to 1,123 million (m) tonnes of oil equivalent as the gross domestic product (GDP) goes up to US$8.6 trillion (tn) by 2040.

The Indian energy industry constitutes three different segments. There is exploration and production, storage and transportation, refining, processing and marketing.

The global automotive industry is shifting towards cleaner modes of transport such as electric vehicles (EVs). The imminent transition to EVs signals a bumpy road ahead for the energy sector, specifically crude oil. According to the International Monetary Fund, more than 90% of all passenger vehicles in the US, Canada, Europe, and other rich countries could switch to EVs by 2040.

The gradual shift towards electric vehicles and other environmental conscious source of energy poses a big question to the demand for oil and its by-products over the long-term.

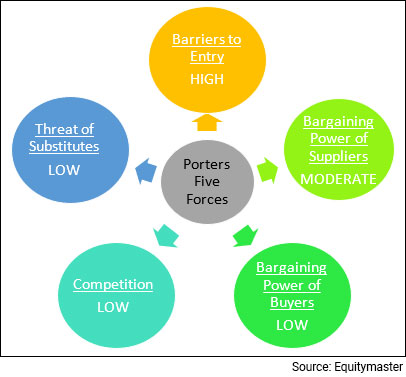

Porter's Five Forces Analysis of the Energy Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining energy of suppliers, bargaining energy of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the energy sector:

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the energy sector, barriers to entry are high. The primary reasons are capital intensive nature of the industry and economies of scale. Apart from this, players in the exploration and production segment need government permission to operate.

#2 Bargaining Power of Suppliers

The bargaining power of suppliers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

Crude oil prices are a function of global events. They are highly susceptible to economic growth, geopolitical events and global policies. Apart from that, they are susceptible to bets.

A large amount of crude oil in the world is produced by OPEC. Their leadership gives them a significant influence over the demand-supply scenario. Therefore, the bargaining power of suppliers is moderate in the crude oil segment of energy.

However, for petroleum products, the surplus capacity in the country drastically reduces their bargaining power.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the energy sector, the customers are price-takers with little to no bargaining power.

#4 Competition

For most industries, understanding the competition is vital to successfully marketing or selling a product.

The competition in the energy industry is low in all the segments. This is because only a few players operate in the Upstream, Midstream and Downstream segment.

However, with new reforms announced in energy sector, more private players are likely to enter the sector thus increasing the competition.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

At present, the threat of substitutes is low in the energy industry. Although, with India's ambitious plans for alternative sources of energy such as solar, wind energy,coal and hydroelectric, the scenario may change in the future.

Porters Five Forces Analysis of the Energy Sector in India

When to Invest in Energy Stocks

The demand for energy is closely linked to the economic growth which makes it a highly cyclical industry. This means that for some reason the economy and by extension the stock market flounders, so will the energy stocks.

Since economic cycles affect the earnings prospects, the best time to buy energy stocks is at the start of an economic expansion. And the best time to sell is just before the economy begins to slow down.

So, if you invest in an energy stock at the peak of an economic cycle there is good chance you will lose a huge chunk of the investment. Nevertheless, identifying the bottom of the cycle is not an easy task.

The Indian economy has been growing consistently, led by robust domestic demand. With the world's largest youth population and increasing urbanization in tow, this is likely to continue going forward. Therefore, it is safe to assume that India's demand for energy will also remain strong over the long term.

The crude oil consumption is expected to grow at a CAGR of 5.1% to 500 m tonnes by the financial year 2040 from 202.7 m tonnes in the financial year 2022.

Key Points to Keep in Mind While Investing in Energy Stocks

Here are some key points to take note of before you invest in energy stocks:

#1 Cyclicality of the sector

This is the most important factor one must keep in mind while investing in energy stocks.

The energy sector, being consumer cyclical, is dependent on business cycles and economic conditions. As the demand for energy is closely linked to the economy, energy stocks are usually riskier - their fortunes are prone to economic booms and busts.

Usually, cyclical stocks can be used to generate high returns when the economy is doing well.

#2 The shift towards cleaner sources of energy

The substitute product in the energy segment is the alternative source of fuel used to run a vehicle.

The Indian automobile industry is gradually shifting its focus to electric vehicles (EV). With an aim to reduce emissions, the industry is charging forward in this direction with increased localised production. And now, with the cost and affordability of EVs dropping in the coming years, we are not far from when most vehicles will be electric.

This can pose a serious threat to the demand for energy in the coming years. However, it is still a few years away.

So, look for companies which are investing in the renewable energy space to keep up with competition.

#3 Competitive landscape

The competitive landscape in all segments of the energy sector is weak. However, with the advent of new reforms in the sector, private players are likely to crowd the market thereby, increasing the competition.

Apart from the new entrants in the existing market, alternative sources of energy can also give stiff competition to the sector. While the market is still nascent, the government's ambitious plans can change the landscape.

#4 Profitability of the company

With moderate bargaining power, the sector operates on thin margins. But what they lack in margins, they make up for in high volume.

Here's a list of top energy companies in India based on their consolidated operating profit.

| Company | Net Sales(Rs m) | Operating Profit (Rs m) | Consolidated Net Profit (Rs m) |

|---|---|---|---|

| Indian Oil Corporation Ltd. | 59,81,638 | 4,75,956 | 2,41,841 |

| Reliance Industries Ltd. | 42,37,030 | 6,61,850 | 3,90,840 |

| Bharat Petroleum Corporation Ltd. | 36,22,768 | 1,86,053 | 87,887 |

| Hindustan Petroleum Corporation Ltd. | 34,96,829 | 1,31,455 | 63,826 |

| Oil & Natural Gas Corporation Ltd. | 11,03,189 | 6,09,455 | 4,03,057 |

| GAIL (India) Ltd. | 9,16,265 | 1,58,869 | 1,03,640 |

| Mangalore Refinery And Petrochemicals Ltd. | 6,97,271 | 50,381 | 29,553 |

| Chennai Petroleum Corporation Ltd. | 4,33,754 | 27,487 | 13,424 |

| Petronet LNG Ltd. | 4,31,686 | 55,596 | 33,524 |

| Gujarat Gas Ltd. | 1,64,562 | 21,919 | 12,856 |

Data as of March 2022

#5 Debt to equity (D/E) ratio

A company uses both equity and debt to run a business. However, the amount of debt it uses indicates its fixed obligations. Higher the leverage, higher will be the fixed charges such as interest expense which will lower the profitability.

Therefore, one must look for a debt-to-equity ratio of one or less than one.

Here's a list of top energy companies in India with low debt to equity ratio.

| Company | Debt to Equity (x) |

|---|---|

| Indian Oil Corporation Ltd. | 0.84 |

| Reliance Industries Ltd. | 0.41 |

| Bharat Petroleum Corporation Ltd. | 0.5 |

| Hindustan Petroleum Corporation Ltd. | 1.12 |

| Oil & Natural Gas Corporation Ltd. | 0.03 |

| GAIL (India) Ltd. | 0.11 |

| Mangalore Refinery And Petrochemicals Ltd. | 2.93 |

| Chennai Petroleum Corporation Ltd. | 3.35 |

| Petronet LNG Ltd. | 0.00 |

Data as of March 2022

#6 Return on Capital Employed (ROCE) ratio

Along with a low debt to equity ratio, one must look for a high return on capital employed (ROCE).

Return on capital employed measures how much profits the company is generating through its capital. The higher the ratio, the better.

A ROCE of above 15% is considered decent for companies that are in an expansionary phase.

Here's a list of top energy companies in India with more than 15% in ROCE.

| Company | ROCE (%) |

|---|---|

| Indian Oil Corporation Ltd. | 38.08 |

| Reliance Industries Ltd. | 31.42 |

| Bharat Petroleum Corporation Ltd. | 24.05 |

| Hindustan Petroleum Corporation Ltd. | 19.94 |

| Oil & Natural Gas Corporation Ltd. | 18.74 |

| GAIL (India) Ltd. | 17.72 |

| Mangalore Refinery And Petrochemicals Ltd. | 16.37 |

Data as of March 2022

#7 Valuations

A commonly used financial ratio used in the valuation of energy stocks is-

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out list of stocks according to their P/BV Ratios.

#8 Dividend yields

There is no consistent trend of dividends across the industry, with different companies having different dividend policies.

Here's a list of top energy companies in India that score well on dividend yield and dividend pay-out.

| Company | Dividend Yield (eoy) | Dividend Payout (%) |

|---|---|---|

| Indian Oil Corporation Ltd. | 10.59 | 47.83 |

| GAIL (India) Ltd. | 6.42 | 42.84 |

| Oil & Natural Gas Corporation Ltd. | 6.41 | 32.77 |

| Oil India Ltd. | 5.98 | 39.75 |

| Petronet LNG Ltd. | 5.94 | 51.46 |

| Hindustan Petroleum Corporation Ltd. | 5.2 | 31.12 |

| Bharat Petroleum Corporation Ltd. | 4.45 | 38.77 |

| Chennai Petroleum Corporation Ltd. | 1.57 | 2.22 |

Data as of March 2022

For more details, check out the top stocks offering high dividend yields.

Top Energy Stocks in India

The energy sector is in its growth phase. The top energy stocks in India can immensely benefit with so many factors positively affecting the industry.

Here are the top energy stocks in India which score well on crucial parameters.

| Company | RoE (Latest, %) | D/E (Curr FY, x) | Sales CAGR (3 yrs, %) | Profit CAGR (3 yrs, %) |

|---|---|---|---|---|

| Petronet LNG Ltd. | 26.74 | 0 | 4.00% | 15.80% |

| Gujarat Gas Ltd. | 25.59 | 0.09 | 28.80% | 45.60% |

| GAIL (India) Ltd. | 20.28 | 0.11 | 6.80% | 22.20% |

| Indian Oil Corporation Ltd. | 20 | 0.84 | 0.00% | 15.50% |

| Oil & Natural Gas Corporation Ltd. | 18.25 | 0.03 | 5.00% | 16.20% |

| Bharat Petroleum Corporation Ltd. | 17.01 | 0.5 | 0.70% | 10.20% |

For more details on energy stocks, check out Equitymaster's powerful stock screener for filtering the best energy stocks in India.

List of Energy Stocks in India

The details of listed energy companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of energy stocks.

Best Sources for Information on the Energy Sector

Indian Brand Equity Foundation Energy Sector Report - https://www.ibef.org/industry/energys-and-mining

So, there you go. Equitymaster's detailed guide on the top energy stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the energy sector and top energy stocks in India. This is a great starting point for anyone who is looking to explore more about energy stocks and the energy sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

![]() Why IOC Share Price is Falling

Why IOC Share Price is Falling

Nov 5, 2024

Here's why the company's stock price has been sliding.

![]() Why 2025 Could be the Best Time to Invest in India's Top Green Energy Finance Stocks

Why 2025 Could be the Best Time to Invest in India's Top Green Energy Finance Stocks

Oct 8, 2024

With India witnessing a surge in solar and wind energy projects, green financing is the hot new trend.

![]() Top 5 Energy Stocks by Growth

Top 5 Energy Stocks by Growth

Sep 4, 2024

Let's look at the top 5 stocks in the energy sector by their growth.

![]() Rs 200 to Rs 10,000: The Road Ahead for Inox Wind Energy Post 5,000%+ Gains in 3 Years

Rs 200 to Rs 10,000: The Road Ahead for Inox Wind Energy Post 5,000%+ Gains in 3 Years

Aug 16, 2024

Inox Wind Energy's performance this week was one of the best in recent memory as the company added Rs 27 billion to its marketcap.

![]() Pros and Cons of Investing in the Stock of Suzlon Right Now

Pros and Cons of Investing in the Stock of Suzlon Right Now

Aug 1, 2024

The stock of Suzlon Energy is on fire. Should you consider investing in it. Find out...

![]() Why SJVN Share Price is Rising

Why SJVN Share Price is Rising

Jul 26, 2024

Find out why this PSU's share price rallied 9% today.

![]() Top 5 Energy Storage Stocks to Add to Your Watchlist

Top 5 Energy Storage Stocks to Add to Your Watchlist

Jun 27, 2024

With impending investments of over Rs 20 billion at the India Energy Storage week later this month, companies operating in this niche industry are expected to grow leaps and bounds.

![]() Why You Need to Have Green Energy Stocks on Your Watchlist

Why You Need to Have Green Energy Stocks on Your Watchlist

Jun 7, 2024

This megatrend will create multibaggers in the stock market.

![]() Dividend of Rs 12.3, Dividend Yield Above 4%: This PSU Stock Gives Strong Q4 Update

Dividend of Rs 12.3, Dividend Yield Above 4%: This PSU Stock Gives Strong Q4 Update

May 22, 2024

During the quarter under review, this energy player's operating profit margin improved 1,030 basis points to 45.9%.

![]() Top Solar Power Shares in India 2024: Solar Power Companies to Add to Your Watchlist

Top Solar Power Shares in India 2024: Solar Power Companies to Add to Your Watchlist

Apr 27, 2024

As India's solar race heats up, these companies are well-poised to capitalise on the major investment megatrend of this decade.

![]() Top 10 Value Stocks in India with Long Term Potential

Top 10 Value Stocks in India with Long Term Potential

Nov 3, 2024

These stocks provide a cushion against market fluctuations, thanks to their stable earnings, established market positions, and potential for consistent dividends.

![]() Can NTPC Lead India's Clean Energy Drive with its Nuclear Power Ambitions?

Can NTPC Lead India's Clean Energy Drive with its Nuclear Power Ambitions?

Sep 19, 2024

NTPC plans to go big on nuclear expansion. Here's everything you need to know about its ambitious nuclear power plans.

![]() IREDA: Leading the Charge in India's Green Energy Revolution

IREDA: Leading the Charge in India's Green Energy Revolution

Aug 22, 2024

This state-owned company is capitalising on India's transition to a low-carbon economy. Take a look.

![]() Beyond Lubricants: Castrol India Expands into Data Centre Cooling

Beyond Lubricants: Castrol India Expands into Data Centre Cooling

Aug 2, 2024

Is Castrol India's Data Centre Investment the Right Move for Future Growth?

![]() Top 4 Nuclear Energy Stocks in India

Top 4 Nuclear Energy Stocks in India

Jul 28, 2024

Which are the top companies working in the nuclear energy space in India? Find out...

![]() Top Green Energy Shares in India 2024: Green Energy Companies to Add to Your Watchlist

Top Green Energy Shares in India 2024: Green Energy Companies to Add to Your Watchlist

Jul 20, 2024

As India's renewable energy sector becomes a dominant force, these companies are well-poised to capitalise on the major investment megatrend of this decade.

![]() Why Suzlon Energy is the Current Favourite Stock of Indian Mutual Funds

Why Suzlon Energy is the Current Favourite Stock of Indian Mutual Funds

Jun 19, 2024

With renewable energy gaining momentum, a poster boy of this sector, Suzlon Energy, has grabbed eyeballs off late.

![]() Why Inox Wind Share Price is Falling

Why Inox Wind Share Price is Falling

May 28, 2024

Shares of the company are locked in a lower circuit today after hitting their 52 week high yesterday.

![]() This Green Energy Stock has Soared 1,000% in Eight Months. Can it Maintain the Momentum?

This Green Energy Stock has Soared 1,000% in Eight Months. Can it Maintain the Momentum?

May 7, 2024

This stock has skyrocketed from Rs 118 to Rs 1,939 in just eight months. Here's What Comes Next...

![]() Top 3 Penny Stocks to Watch Out for in India's Booming Energy Sector

Top 3 Penny Stocks to Watch Out for in India's Booming Energy Sector

Apr 15, 2024

The increasing adoption of EVs, the expanding renewable energy market, and the development of cleaner technologies is creating a big opportunity for energy players.

FAQs

Which are the Top Energy Companies In India right now?

As per Equitymaster's Indian stock screener, here is the list of the best energy stocks in India right now...

- #1 RELIANCE IND.

- #2 ONGC

- #3 IOC

- #4 BPCL

- #5 GAIL

These companies are investing in the renewable energy segment and keeping themselves ahead of the competition.

Note that, there are various other parameters you should take into account before investing in any company such as promoter holding etc. Sustained research must not be compromised despite the positive odds.

Which are the energy stocks with the best shareholder returns?

Indraprastha Gas and HPCL were the top performers over the last 5 years in terms of sales and profit growth.

Indraprastha Gas growth can be attributed to it being the pioneer in city gas distribution (CGD) and enjoying an exclusive position in the business, besides the strong parentage of GAIL and Bharat Petroleum Corporation (BPCL).

HPCL has also done well in the domestic energy sector on account of its strong parentage (Oil and Natural Gas Corporation (ONGC), its established brand name and its leading position in the domestic oil marketing business.

To know which other companies performed well over the last 5 years, check out our entire list of top performers.

What kind of dividend yields do energy stocks offer?

The energy sector has a consistent trend of dividend yields. Different companies have different dividend policies which vary depending on the owners discretion.

At present, IOC, GAIL, ONGC and Oil India offer attractive dividend yields.

For more, check out the top dividend yield stocks on Equitymaster's Indian stock screener.