India's Third Giant Leap

This Could be One of the Biggest Opportunities for Investors

- Home

- Outlook Arena

- Top Pharma Stocks in India

Top Pharma Stocks in India

The year was 2005. The innovators, also called 'Big Pharma', started losing patents on most of their blockbuster drugs.

The World Trade Organization's (WTO) agreement on trade-related aspects (TRIPS) came into force in 2005, effectively handing big pharma exclusive patents in all markets.

Ever since then, the Indian pharma industry has seen a major breakthrough and broke the pharmaceutical monopoly.

Growth opportunities exploded in 2005 as when it comes to producing generics for off patent drugs, Indian companies have little competition.

The Indian pharma industry eventually became the world's third-largest pharma market by volume and fourteenth by value.

For over a decade, India has been hailed as the ‘Pharmacy of the World’.

India is the largest generic medicine provider, with 20% share in global supply. Indian pharmaceutical sector supplies over 50% of global demand for various vaccines, 40% of generic demand in the US, and 25% of all medicines in the UK.

Globally, India has the lowest manufacturing costs. This ability to manufacture high quality and low-priced medicines, presents a huge business opportunity for the domestic industry. India’s cost of production is approximately 33% lower than that of the US. This puts the top pharma companies in India in a sweet spot.

Over the years, domestic pharma manufacturers have experienced a significant increase in R&D spending to be competitive in the world market.

The pandemic may as well turn out to be a blessing in disguise for pharma companies as it pushed them to expedite focus on various pharma segments.

Further, pharma companies' efforts have been supplemented by the government's production-linked incentive (PLI) scheme.

The department of pharmaceuticals has initiated a PLI scheme to promote domestic manufacturing by setting up greenfield plants with a cumulative outlay of Rs 69.4 bn from financial year 2020-21 to financial year 2030-31.

With low-cost trained labour and a well-established manufacturing base, India is poised to play an even larger role in global drug security.

India will remain one of the world's most popular pharmaceutical markets in the coming years.

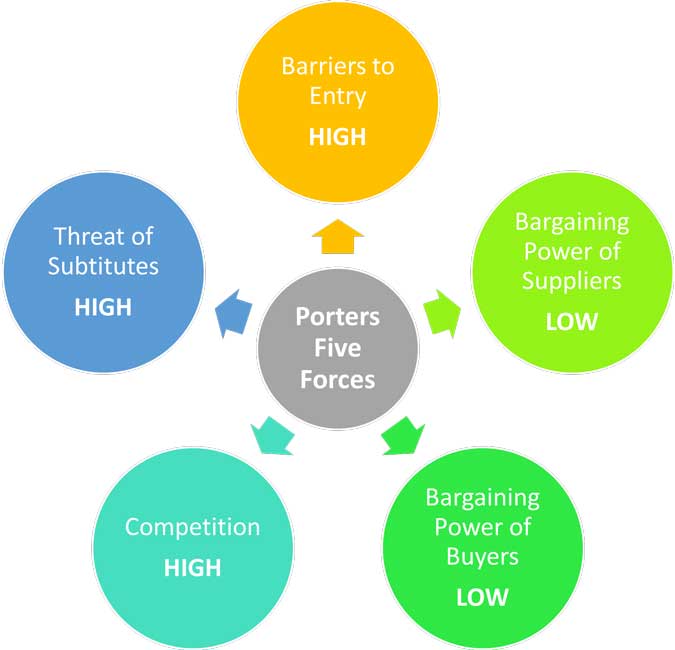

Porter's Five Forces Analysis of the Pharma Sector in India

Porter's Five Forces is a model that identifies and analyzes five competitive forces that shape every industry.

These are barriers to entry, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competition within the industry.

A change in any of the forces normally requires a company to re-assess the marketplace.

Let us have a look at how these five forces shape the pharma sector -

#1 Barriers to Entry

The most attractive segment is one in which barriers to entry are high as they restrict the threat of new entrants.

Conversely if the barriers are low, the risk of new companies venturing into a given market is high.

In the pharma sector, barriers to entry are high. This is due to economies of scale in manufacturing, R&D, marketing, distribution and capital requirements.

Existing companies have a huge advantage in terms of the costs involved in launching new drugs and formulations.

#2 Bargaining Power of Suppliers

The bargaining power of suppliers is the ability of suppliers to put the firm under pressure. Suppliers may refuse to work with the firm or charge excessively high prices for unique resources.

For the pharma sector, the bargaining power of suppliers is low. The fragmented nature of the industry prevents the suppliers (organic chemical industries and labor force) from having much bargaining power over the manufacturers as the switching cost is low for the manufacturers.

#3 Bargaining Power of Customers

The bargaining power of customers is the ability of customers to put the firm under pressure. It is high if buyers have many alternatives and low if they have few choices.

In the pharma sector, the bargaining power of customers is low, because of the presence of an influencing element, in this case, i.e., the doctor.

However, due to the extremely fragmented nature of the industry and the presence of government policies like Drug Price Control Order (DPCO), 1970 under which the power to control prices is with the National Pharmaceutical Pricing Authority (NPPA), the low power of the buyers does not have much effect on the manufacturers.

Also, except in generic and OTC medicines, the buyer does not normally switch medicines easily.

#4 Competition

For most industries, having an understanding of the competition is vital to successfully marketing a product.

The competition in the pharma industry is high. The pharma sector is extremely fragmented with around 250-300 manufacturing and formulation units in the organized sector which contribute to only 70% of the market share of total sales in the country.

Also, quicker drug approvals have impacted the sector. The US Food and Drug Administration (USFDA) has expedited the pace of approvals, specifically for generics. This has led to a large number of players getting approvals, leading to increased competition.

#5 Threat of Substitutes

A substitute product uses a different technology to try to solve the same economic need.

This is high for the pharma sector. In a developing country like India, traditional medicine plays a major substituting role.

According to industry estimates, around 70% of the Indian population supplements and at times even replaces pharmaceutical medicines with traditional medicines.

Porters Five Forces Analysis of the Pharma Sector in India

When to Invest in Pharma Stocks

In the last decade, the pharma sector has been relatively stable through various periods of peaks and troughs compared to the rest of the stock market. It has been a consistent performer.

As there is a constant demand for pharma products, stocks from the pharma sector provide stable earnings regardless of the state of the overall stock market. For this reason, they are often called defensive stocks and can protect your portfolio during bad times.

However, in a sustained bull run, these stocks will underperform the market.

The defensive sector can also get defenseless against headwinds in export markets. In the export markets, price erosion can impact the sector. There has been a consolidation at the buyer level in the US. This has given them increased bargaining power against Indian drug manufacturers, leading to price erosion.

Therefore, the best time to buy pharma stocks is when there is a gloomy picture on the economic front. Since defensive sectors are less prone to the above mentioned risks, they offer lot of value in uncertain times.

Key Points to Keep in Mind While Investing in Pharma Stocks

Here are a few things to keep in mind before investing in pharma stocks.

#1 R&D spends as a percentage of revenues

It’s always a good hypothesis to check the pharma company’s R&D spends as a percentage of revenues.

For a brighter future, pharma companies must embrace the right opportunities and spend as more as possible on R&D.

The ones investing heavily will stay ahead of the curve and enable the company to have a strong presence in complex products segment.

Here are the top Indian pharma companies spending heavily on R&D.

| (Rs m) | R&D Expense | % of Sales |

|---|---|---|

| Suven Life Sciences Ltd. | 245.3 | 207% |

| Natco Pharma Ltd. | 2,090.0 | 12% |

| Shilpa Medicare Ltd. | 347.0 | 10% |

| Zydus Lifesciences Ltd. | 7,594.0 | 10% |

| Indoco Remedies Ltd. | 1,027.3 | 7% |

Data as of March 2022

#2 Drug pipeline

A robust drug pipeline is what separates a good pharma stock from an average one. Having a strong pipeline, offsets any decrease in existing revenue streams.

A pharma company needs to constantly take new development projects if it wants to have a consistent and growing income source.

If you study the annual reports of top Indian pharma companies like Sun Pharma or Biocon, you’ll see that they have a pipeline of products in the work and they have been constantly developing a portfolio of niche and complex molecules.

Take a look at the company’s new drug applications (NDAs) and abbreviated new drug applications (ANDA).

ANDA contains data which is submitted to the US regulator for review and potential approval of a generic drug product whereas an NDA is the application through which sponsors formally propose the approval of a new pharmaceutical drug.

However, there are chances that the drug candidates may not clear the regulatory approvals. Which brings us to another important factor to look at.

#3 USFDA approvals

Since 2007, the USFDA has transformed itself into a regulator that is nimble and unpredictable. The quality checks on the premises of Indian pharma companies have become more frequent.

There have been instances where USFDA did quality checks on premises and Indian pharma companies saw their plants shutting down for years. This led to them losing big chunk of revenues.

So, there is no risk bigger than the regulatory risk for Indian pharma companies today. Their inability to come clean on the USFDA checks has had a huge impact on their growth certainty. And this has led to the sector becoming one of the most hated amongst investors.

That is why, before investing in a pharma company, see its track record of getting USFDA approvals. A company camouflaged by regulatory challenges is always the first priority for investors.

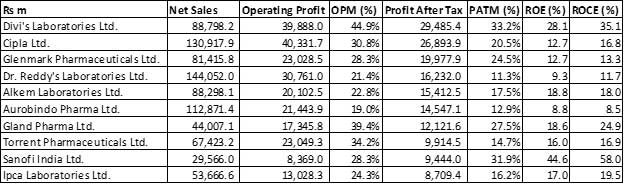

#4 Profitability of the company

If you are looking for attractive pharma stocks, sales and profit growth is what you look for.

You also need to see the return on capital employed (ROCE) and operating margins. This will help you analyze how much the company is spending to generate sales.

Before you compare the performance of two pharma companies, say for instance, Sun Pharma vs Dr Reddy’s Lab, do factor in the operating margins.

Here's a list of top pharma companies in India based on their consolidated net profit.

Data as of March 2022

#5 Valuations

Two commonly used financial ratios used in the valuation of stocks are -

Price to Earnings Ratio (P/E) - It compares the company's stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of stocks according to their P/E Ratios.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of stocks according to their P/BV Ratios.

#6 Dividend yields

There is no consistent trend of dividends across the pharma industry, with different companies having different dividend policies.

Here's a list of top pharma companies in India that score well on dividend yield and dividend payout.

| Company Name | Dividend (%) | Dividend yield (%) | Dividend payout (%) |

|---|---|---|---|

| Sanofi India Ltd. | 4,900.0 | 6.2 | 119.3 |

| Glaxosmithkline Pharmaceuticals Ltd. | 900.0 | 5.4 | 404.9 |

| Glenmark Life Sciences Ltd. | 1,050.0 | 4.6 | 61.4 |

| Gujarat Themis Biosyn Ltd. | 220.0 | 2.7 | 36.6 |

| BDH Industries Ltd. | 36.0 | 2.7 | 28.7 |

| Alembic Ltd. | 90.0 | 2.5 | 53.9 |

| Denis Chem Lab Ltd. | 15.0 | 2.2 | 33.2 |

| Jenburkt Pharmaceuticals Ltd. | 120.0 | 2.1 | 24.7 |

| Anuh Pharma Ltd. | 35.0 | 2.0 | 28.7 |

| Torrent Pharmaceuticals Ltd. | 960.0 | 1.7 | 81.9 |

| RPG Life Sciences Ltd. | 120.0 | 1.7 | 30.8 |

Top Pharma Stocks in India

Here are the top pharma stocks in India which score well on crucial parameters.

| Company | RoE (Latest, %) | D/E (Curr FY, x) | Sales CAGR (3 yrs, %) | Profit CAGR (3 yrs, %) |

|---|---|---|---|---|

| SUN PHARMA | 7.1% | 0.00 | 10.0% | 2.0% |

| DIVIS LABORATORIES | 25.2% | 0.00 | 21.9% | 29.8% |

| CIPLA | 12.3% | 0.00 | 10.0% | 19.2% |

| DR. REDDYS LAB | 11.1% | 0.20 | 11.7% | 3.5% |

| TORRENT PHARMA | 13.1% | 0.70 | 3.5% | 21.2% |

| CADILA HEALTHCARE | 13.7% | 0.20 | 5.1% | 7.9% |

| BIOCON | 11.9% | 0.60 | 14.1% | NM |

For more details, check out Equitymaster's Powerful Indian stock screener for filtering the best pharma stocks in India.

List of Pharma Stocks in India

The details of listed pharma companies can be found on the NSE and BSE website. However, the overload of financial information on these websites can be overwhelming.

For a more direct and concise view of this information, you can check out our list of pharma stocks which has Indian pharma stocks and MNC pharma stocks.

You can also read our pharma sector report and check the latest pharma sector results.

Best Sources for Information on the Pharma Sector

Indian Brand Equity Foundation Pharma Sector Report - https://www.ibef.org/industry/pharmaceutical-india

Pharmaceuticals Export Promotion Council - https://pharmexcil.com/

Press Information Bureau (PIB) - https://www.pib.gov.in/indexd.aspx

So there you go. Equitymaster's detailed guide on the best pharma stocks in India is simple and easy to understand. At the same time, it offers detailed analysis of both the sector and the top stocks in the sector.

Here's a list of articles and videos on the pharma sector and top pharma stocks in India. This is a great starting point for anyone who is looking to explore more about pharma stocks and the pharma sector.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

You can also checkout our playlist on Pharma Stocks on Equitymaster's YouTube channel.

![]() Why Syncom Formulations Share Price is Rising

Why Syncom Formulations Share Price is Rising

Aug 28, 2024

Find out what factors are driving the rally in Indian pharma stocks

![]() Top 5 Pharma Stocks in India by Growth

Top 5 Pharma Stocks in India by Growth

Aug 21, 2024

Explore the top 5 pharma stocks that have demonstrated significant growth over the past 5 years.

![]() Why Indian Pharma Stocks Should be on Your Watchlist

Why Indian Pharma Stocks Should be on Your Watchlist

Aug 9, 2024

A major megatrend is playing out in the pharma sector.

![]() Top 5 Indian Pharma Stocks Set to Shine in the Post-Biosecure Act Era

Top 5 Indian Pharma Stocks Set to Shine in the Post-Biosecure Act Era

Jul 30, 2024

These 5 CDMOs are ready to seize the Biosecure Act opportunity.

![]() Why Wockhardt Share Price is Rising

Why Wockhardt Share Price is Rising

Jul 1, 2024

Wockhardt recently got success in a cancer treatment drug, and it plans to introduce the drug in India at a significant discount of 85-90%.

![]() 3 Indian Pharma Stocks Soaring Amid US Drug Shortage and Election Jitters

3 Indian Pharma Stocks Soaring Amid US Drug Shortage and Election Jitters

Jun 5, 2024

The recent drug shortage in US is accelerating exports and sales of these pharma companies.

![]() A Rare Opportunity to Profit from Pharma Stocks

A Rare Opportunity to Profit from Pharma Stocks

Apr 25, 2024

This opportunity can create a lot of wealth. Keep an eye on it.

![]() Beyond Pharma: Top 10 Medical Equipment Stocks to Add to Your Watchlist

Beyond Pharma: Top 10 Medical Equipment Stocks to Add to Your Watchlist

Mar 11, 2024

Pharma companies won't be the only ones to benefit as the sector grows. Medical equipment stocks could also come into play.

![]() Why Natco Pharma Share Price is Rising

Why Natco Pharma Share Price is Rising

Feb 20, 2024

Natco Pharma zooms 21% in 5 days, hits 52-week high. What's driving the rally?

![]() Ace Investor Ashish Kacholia's New Investment in a Multibagger Pharma Stock

Ace Investor Ashish Kacholia's New Investment in a Multibagger Pharma Stock

Dec 27, 2023

Find out why the seasoned investor turned bullish on this multibagger stock that has soared over 300% in 2023 so far.

![]() MNC Pharma Stocks: The Right Dose for Investors?

MNC Pharma Stocks: The Right Dose for Investors?

Aug 28, 2024

MNC pharma companies are focused on the fast growing domestic market and face virtually no regulatory risk from the US FDA.

![]() The Big Opportunity to Make Profits in Pharma Stocks

The Big Opportunity to Make Profits in Pharma Stocks

Aug 13, 2024

A rare patent opportunity in pharma stocks could be a great investment opportunity.

![]() BioSecurity Act: A Potential Shot in the Arm for Pharma Stocks

BioSecurity Act: A Potential Shot in the Arm for Pharma Stocks

Jul 31, 2024

A new dimension to China plus one for India Pharma companies.

![]() This Act Could be a Potent Growth Pill for Indian Pharma Stocks

This Act Could be a Potent Growth Pill for Indian Pharma Stocks

Jul 26, 2024

A new act in the making could be a big boost for Indian Pharma industry.

![]() Orchid Pharma's Most Important Medical Advance in 32 Years

Orchid Pharma's Most Important Medical Advance in 32 Years

Jun 20, 2024

Here's how Orchid Pharma's new antibiotic approval could transform the company.

![]() Pharma Stocks Watchlist to Profit from Patent Cliff

Pharma Stocks Watchlist to Profit from Patent Cliff

May 12, 2024

The last time such a cliff occurred during 2011-15 and offered substantial upside in pharma stocks.

![]() Will Biocon Lead Indian Pharma's Rare 'Patent Cliff' Opportunity

Will Biocon Lead Indian Pharma's Rare 'Patent Cliff' Opportunity

Apr 12, 2024

The last time such a cliff occurred during 2011-15 and offered substantial upside in pharma stocks.

![]() These 5 Healthcare Stocks are the Medicine You Need

These 5 Healthcare Stocks are the Medicine You Need

Mar 5, 2024

As India's healthcare sector soars, a new breed of pioneers is emerging. Here are 5 stocks that are redefining the pharma landscape.

![]() Why Biocon Share Price is Rising

Why Biocon Share Price is Rising

Jan 4, 2024

Biocon zooms 13% in five days, hits 52-week high. What's driving the rally?

![]() Why Sigachi Industries Share Price is Rising

Why Sigachi Industries Share Price is Rising

Nov 16, 2023

Shares of the company hit a new 52-week high after it reported Q2 results. Find out other reasons driving the rally.

FAQs

Which are the top pharma companies in India right now?

As per Equitymaster's Stock Screener, here is a list of the top pharma companies in India right now...

These companies have been ranked as per their market capitalization. The higher the market cap, the higher the total value of the company.

Of course, there are other parameters you should take into account before forming a hard opinion on the stock valuation.

When should you invest in the pharma sector?

As there is a constant demand for pharma products, stocks from the pharma sector provide stable earnings regardless of the state of the overall stock market. For this reason, they are often called defensive stocks and can protect your portfolio during bad times.

However, in a sustained bull run, these stocks will underperform the market.

The defensive sector can also get defenseless against headwinds in export markets. In the export markets, price erosion can impact the sector.

Therefore, the best time to buy pharma stocks is when there is a gloomy picture on the economic front.

Where can I find a list of pharma stocks?

The details of listed pharma companies can be found on the NSE and BSE website.

For a more curated list, you can check out our list of pharma stocks which has Indian pharma stocks and MNC pharma stocks.

How should you value pharma companies?

Investing in stocks requires careful analysis of financial data to find out a company's true worth. However, an easier way to find out about a company's performance is to look at its financial ratios.

Two commonly used financial ratios used in the valuation of stocks are -

Price to Earnings Ratio (P/E) - It compares the company's stock price with its earnings per share. The higher the P/E ratio, the more expensive the stock.

To find stocks with favorable P/E Ratios, check out our list of pharma stocks according to their P/E Ratios.

Price to Book Value Ratio (P/BV) - It compares a firm's market capitalization to its book value. A high P/BV indicates markets believe the company's assets to be undervalued and vice versa.

To find stocks with favorable P/BV Ratios, check out our list of pharma stocks according to their P/BV Ratios.